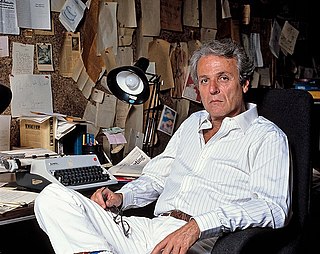

A Quote by Will Rogers

We owe more money than any Nation in the World, and we are LOWERING TAXES. When is the time to pay off a debt if it is not when you are doing well? You let a Politician return home from Washington and announce, 'Boys we lowered your taxes. We had to borrow the money to do it, but we did it.' Say, they would elect him for life.

Related Quotes

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

Taxes, well laid and well spent, insure domestic tranquility, provide for the common defense, and promote the general welfare. Taxes protect property and the environment; taxes make business possible. Taxes pay for roads and schools and bridges and police and teachers. Taxes pay for doctors and nursing homes and medicine.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

Remember that all tax revenue is the result of holding a gun to somebody's head. Not paying taxes is against the law. If you don't pay your taxes, you'll be fined. If you don't pay the fine, you'll be jailed. If you try to escape from jail, you'll be shot. ... Therefore, every time the government spends money on anything, you have to ask yourself, 'Would I kill my kindly, gray-haired mother for this?'

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

When you pay social security taxes, you are in no way making provision for your own retirement. You are paying the pensions of those who are already retired. Once you understand this, you see that whether you will get the benefits you are counting on when you retire depends on whether Congress will levy enough taxes, borrow enough, or print enough money.