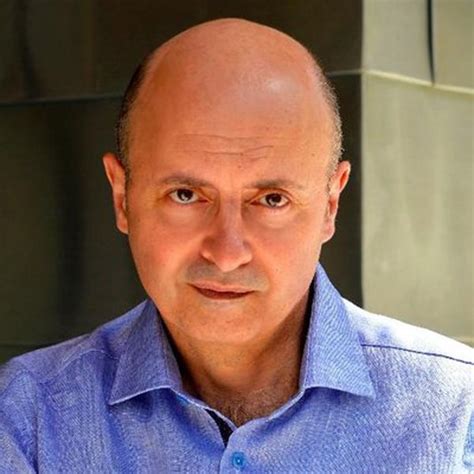

A Quote by William Mougayar

The blockchain is custom-made for decentralizing trust and exchanging assets without central intermediaries. With the decentralization of trust, we will be able to exchange anything we own and challenge existing trusted authorities and custodians that typically held the keys to accessing our assets or verifying their authenticity.

Related Quotes

Giving users easy access to many different kinds of digital assets on the blockchain and, particularly, tokens that are linked to assets in the real world, is crucial to seeing blockchain adoption reach the next level, and I applaud Digix Global's initiative in being the first of many such projects to successfully launch.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

If economic catastrophe does come, will it be a time that draws Christians together to share every resource we have, or will it drive us apart to hide in our own basements or mountain retreats, guarding at gunpoint our private stores from others? If we faithfully use our assets for his kingdom now, rather than hoarding them, can't we trust our faithful God to provide for us then?

Trust is perhaps the most critical single building block underlying effectiveness. Without trust leaders do not have followers. Without trust, leaders are impotent despite great rhetoric or splendid ideas. Trust rests on the belief among followers that the leader is transparent: What you see is what there is. Trust means followers believe there is no duplicity; no manipulation just to satisfy the leader's ego. Very simply: The effective leader is transparent; that's why that person is trusted.

If God was the owner, I was the manager. I needed to adopt a steward's mentality toward the assets He had entrusted - not given - to me. A steward manages assets for the owner's benefit. The steward carries no sense of entitlement to the assets he manages. It's his job to find out what the owner wants done with his assets, then carry out his will.