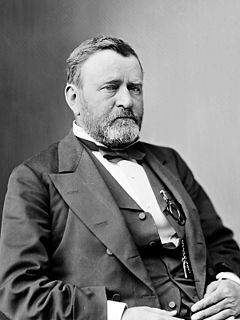

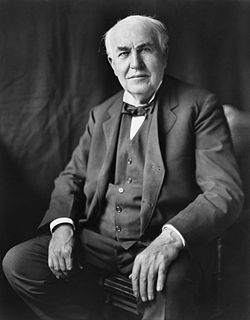

Цитата Улисса С. Гранта

Столь обширная сумма, получающая всю защиту и льготы правительства, не неся на свою долю бремени и расходов того же самого, не будет безропотно смотреть на тех, кто должен платить налоги. . . . Я бы предложил налогообложение всего имущества одинаково.

Связанные цитаты

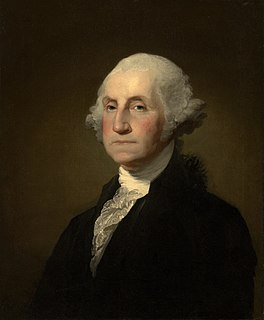

По-моему, в 1850 году церковная собственность в Соединенных Штатах, которая не платила налогов, составляла 87 миллионов долларов. В 1900 году можно с уверенностью сказать, что без проверки это имущество достигнет суммы, превышающей 3 миллиарда долларов. Я бы предложил налогообложение всего имущества одинаково.

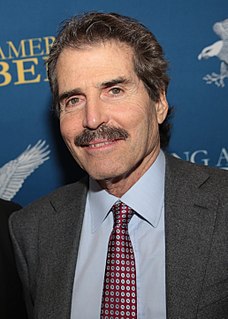

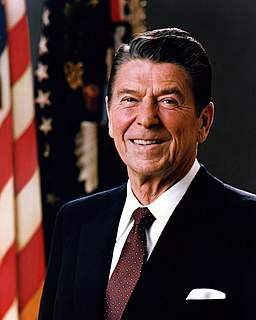

Теория правительства, которой меня учили, гласит, что правительство обеспечивает преимущества, в первую очередь безопасность, всему населению. Взамен мы платим налоги. Но в последнее время правительство стало распределителем особых привилегий, отбирая деньги у одних и отдавая другим. Америка сейчас примерно поровну разделена между теми, кто платит подоходный налог, и теми, кто их потребляет.

Все налоги, кроме «паушального налога», вносят искажения в экономику. Но ни одно правительство не может ввести паушальный налог — одинаковую сумму для всех, независимо от их доходов или расходов, — потому что он тяжелее всего ляжет на тех, у кого меньше доходов, и он будет истощать бедняков, которые могут быть вообще не в состоянии его платить. .

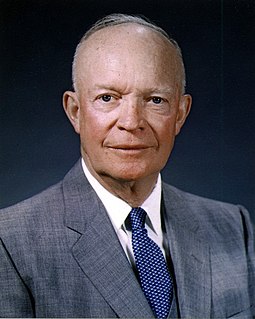

Вы не могли бы поддерживать текущий уровень государственного налогообложения, не скрывая налоги, а они скрываются двумя совершенно разными способами. Их скрывают через удержание, но скрывают и через навязывание бизнесу, якобы бизнесу, когда на самом деле, конечно, бизнес не может платить налоги, только люди могут платить налоги.

Именно люди составляют основу кредита правительства. Почему же тогда люди не могут получить выгоду от своего собственного кредита с золотым краем, получая беспроцентную валюту, вместо того, чтобы банкиры получали выгоду от народного кредита в процентных облигациях. Если правительство Соединенных Штатов примет эту политику увеличения своего национального богатства, не внося вклада в сборщик процентов — ибо весь государственный долг состоит из процентов, — тогда вы увидите эру прогресса и процветания в этой стране, каких никогда не было. пришли иначе.

Истинным принципом налогообложения является принцип выгоды: те, кто получает выгоду от государственной услуги, должны за нее платить. Он также известен как принцип «платит пользователь». Следует приложить все усилия, чтобы увязать уплату налогов или сборов с расходами, связанными с государственной службой.

Правительство: Если вы откажетесь платить несправедливые налоги, ваша собственность будет конфискована. Если вы попытаетесь защитить свою собственность, вас арестуют. Если вы будете сопротивляться аресту, вас избивают дубинками. Если вы будете защищаться от избиения дубинкой, вас застрелят. Эти процедуры известны как верховенство закона.

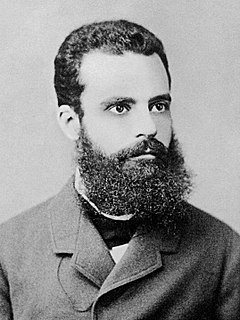

Налог на стоимость земли есть самый справедливый и равный из всех налогов. Оно падает только на тех, кто получает от общества особую и ценную пользу, и на них пропорционально той пользе, которую они получают. Это применение общей собственности для общего использования. Когда вся рента будет собираться в виде налогов для нужд общества, тогда будет достигнуто равенство, установленное природой.