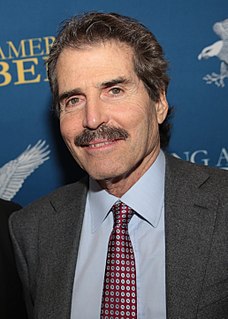

A Quote by Walter E. Williams

It is not wise for us to permit a few people on the Federal Reserve Board to have life and death power over our economy. My recommendation for reducing some of that power is to repeal legal tender laws and eliminate all taxes on gold, silver and platinum transactions. That way there would be money substitutes and the government money monopoly would be reduced and hence the ability to tax - some people would say steal from - us through inflation.

Quote Topics

Ability

Board

Death

Economy

Eliminate

Federal

Federal Reserve

Few

Few People

Gold

Government

Hence

Inflation

Laws

Legal

Life

Life And Death

Money

Monopoly

Our

Over

People

Permit

Platinum

Power

Recommendation

Reduced

Reducing

Repeal

Reserve

Say

Silver

Some

Some People

Steal

Substitutes

Tax

Taxes

Tender

Through

Transactions

Us

Way

Wise

Would

Would Be

Related Quotes

If I were a candidate for running, I'd say, "Look at what the economy has done." It's strong. We've created a lot of jobs. I'd be telling people that the Democrats will raise your taxes. I'd be reminding people that tax cuts have worked in terms of stimulating the economy. I'd be reminding people there's a philosophical difference between those who want to raise taxes and have the government spend the money, and those of us who say, "You get to spend the money the way you want to see fit. It's your money."

There is no reason products and services could not be swapped directly by consumers and producers through a system of direct exchange – essentially a massive barter economy. All it requires is some commonly used unit of account and adequate computing power to make sure all transactions could be settled immediately. People would pay each other electronically, without the payment being routed through anything that we would currently recognize as a bank. Central banks in their present form would no longer exist – nor would money.

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

Any money the government spends must be taxed, borrowed or conjured out of thin air by the Federal Reserve, and that will reduce sound private investment. Obama has no real wealth to inject into the economy. He can only move around existing money while inflation robs us of purchasing power. Meanwhile, private investors who might have produced a better engine, battery, computer, cancer treatment or other wealth-creating and life-enhancing innovations hold back for fear that big government will undermine productive efforts.

The Founding Fathers realized that "the power to tax is the power to destroy," which is why they did not give the Federal government the power to impose an income tax. Needless to say, the Founders would be horrified to know that Americans today give more than a third of their income to the Federal government.

Strictly speaking, it probably is not “necessary” for the federal government to tax anyone directly; it could simply print the money it needs. However, that would be too bold a stroke, for it would then be obvious to all what kind of counterfeiting operation the government is running. The present system combining taxation and inflation is akin to watering the milk; too much water and the people catch on.

The most absurd public opinion polls are those on taxes. Now, if there is one thing we know about taxes, it is that people do not want to pay them. If they wanted to pay them, there would be no need for taxes. People would gladly figure out how much of their money that the government deserves and send it in. And yet we routinely hear about opinion polls that reveal that the public likes the tax level as it is and might even like it higher. Next they will tell us that the public thinks the crime rate is too low, or that the American people would really like to be in more auto accidents.

I call this the Fundamental Problem of Political Economy. How do we limit the power that idiots have over us? ... [Milton] Friedmans insight is that a market limits the power that others have over us; conversely, limiting the power that others have over us allows us to have markets. Friedman argued that no matter how wise the officials of government may be, market competition does a better job of protecting us from idiots.

If the government were obliged to come to the people for money instead of vice-versa, the people would keep government under control and operate their economy satisfactorily with prosperity and peace resulting. The peoples of the nations do not make war. For them peace is the natural and permanent order. Wars are planned and perpetrated by politicians and their diplomats; and the money power of government is the means by which the people are maneuvered into wars.

Architects mostly work for privileged people, people who have money and power. Power and money are invisible, so people hire us to visualize their power and money by making monumental architecture. I love to make monuments, too, but I thought perhaps we can use our experience and knowledge more for the general public, even for those who have lost their houses in natural disasters.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

As long as we cling to the superstition that we must look to government for money supply, instead of requiring it to look to us, just so long must we remain the subjects of government and it is vain to follow this or that policy or party or ism in the hope of salvation. We can control government and our own destiny only through our money power and until we exert that power it is useless for us to debate the pros and cons of political programs.