Цитата Уоррена Баффета

Я бы сказал, что самой большой причиной был невероятный пузырь на рынке жилой недвижимости.

Связанные цитаты

Сегодня стратегии многих компаний в сфере недвижимости основаны на низких процентных ставках, что привело к быстрому расширению бизнеса по секьюритизации недвижимости. Эту тенденцию можно рассматривать как фактор риска, поскольку она подвергает сектор недвижимости как минимум трем потенциальным проблемам: во-первых, повышению процентных ставок; во-вторых, пересмотр стандартов бухгалтерского учета секьюритизации; в-третьих, перегрев рынка недвижимости.

Деловая сторона инвестирования в недвижимость сопряжена с риском. В отличие от покупки взаимных фондов или сберегательных облигаций, с недвижимостью вы можете потерять деньги; это одна из причин, по которой опытные инвесторы в недвижимость предостерегают новичков никогда не слишком эмоционально относиться к недвижимости и всегда быть готовыми уйти.

Большинство канадцев раньше понятия не имели, что происходит в школах-интернатах. Скажи канадцам, что последний закрылся в 1996 году, они в ужасе. Так что теперь, когда канадцы знают о школах-интернатах, вы можете подумать, что это станет огромным стимулом для прогресса. Это не так, и это удивительно.

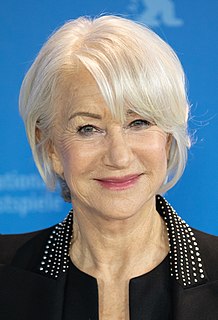

Я не выигрывал разные награды - много, много раз - так что, к счастью, я практиковал, что всякий раз, когда вас номинируют на что-либо, вы попадаете в этот чудесный, фантастический пузырь, называемый пузырем номинаций. В ту минуту, когда конверт открыт и ваше имя не названо, пузырь лопается. И никто не позвонит вам на следующий день, чтобы сказать: «Как жаль, что ты не выиграл» или «Ты выглядел великолепно — ничего. Если вы выиграете, вы проведете еще около 24 часов в этом прекрасном пузыре, а затем — хлоп — вы слегка промокнете от пузыря и поймете, что вам нужно жить в реальной жизни.