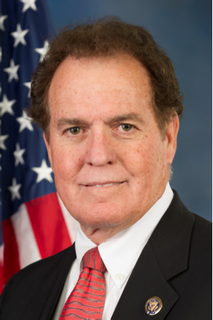

A Quote by Phil Gingrey

To create employment, we need to stimulate the economy, and to stimulate the economy, we need to cut spending and reduce the deficit.

Related Quotes

Hold on to your wallets folks because with the passage of this trillion-dollar baby, the Democrats will be poised to spend as much as $3 trillion in your tax dollars. Taxpayers will be on the hook for spending that will stimulate the debt, stimulate the growth of government, but will do little to stimulate jobs or the economy.

There is a clear and strong link between the economy's present woes and the Iraq war. The war was at least one of the factors contributing to rising oil prices - which meant Americans were spending money on imported oil, rather than on things that would stimulate the american economy. Hiring Nepalese contractors in Iraq, moreover, doesn't stimulate the American economy in the way that building a school in America would do - and obviously doesn't have the long term benefits.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

Our practical choice is not between a tax-cut deficit and a budgetary surplus. It is between two kinds of deficits: a chronic deficit of inertia, as the unwanted result of inadequate revenues and a restricted economy; or a temporary deficit of transition, resulting from a tax cut designed to boost the economy, increase tax revenues, and achieve -- and I believe this can be done -- a budget surplus. The first type of deficit is a sign of waste and weakness; the second reflects an investment in the future.