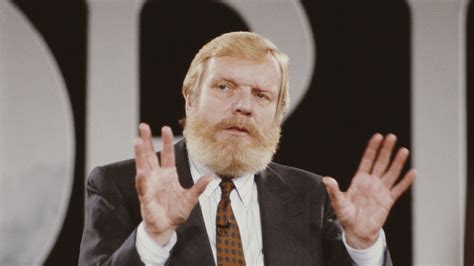

A Quote by Jose Angel Gurria

In a globally interdependent world, a better financial and investment system cannot be achieved on a country-by-country basis. There may be no one-size-fits-all model for economic development, but without global standards and complementary regulations, the long-term outlook for the world economy will remain bleak.

Quote Topics

Related Quotes

You cannot ask which system is the better because you cannot standardize one system for the whole of the world. You cannot have one stereotyped code of morality for every country. One system may work very well in one country and very badly in another. You cannot grow a tropical flower in a cold climate.

The powers of financial capitalism had a far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences.

The economic borderlines of our world will not be drawn between countries, but around Economic Domains. Along the twin paths of globalization and decentralization, the economic pieces of the future are being assembled in a new way. Not what is produced by a country or in a country will be of importance, but the production within global Economic Domains, measured as Gross Domain Products. The global market demands a global sharing of talent. The consequence is Mass Customization of Talent and education as the number one economic priority for all countries

Only by transforming our own economy to one of peace can we make possible economic democracy in the Third World or our own country. The present economy generates wars to protect its profits and its short-term interests, while squandering the future. Unless we transform the economy, we cannot end war.

What Asia's postwar economic miracle demonstrates is that

capitalism is a path toward economic development that is potentially

available to all countries. No underdeveloped country in the

Third World is disadvantaged simply because it began the growth

process later than Europe, nor are the established industrial powers

capable of blocking the development of a latecomer, provided

that country plays by the rules of economic liberalism.

As a city powered by our country's knowledge economy, Toronto will continue to benefit from developing, attracting and retaining the world's most promising young researchers at the University of Toronto. Our government will continue to invest in research awards that lead to long-term social and economic benefits for Canadians.