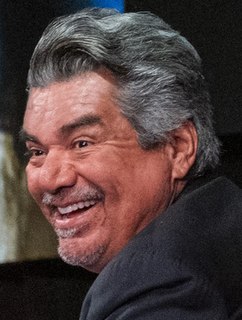

A Quote by Chuck Schumer

There are some tax expenditures that are there for very obvious and very important and very good policy reasons. Whether it's the charitable deduction or the deduction for homes, it's not a loophole.

Related Quotes

Lawmakers misrepresent the facts when they call the manufacturing deduction known as Section 199 - passed by Congress in 2004 to spur domestic job growth - a 'subsidy' for oil and gas firms. The truth is that all U.S. manufacturers, from software producers to filmmakers and coffee roasters, are eligible for this deduction.

It turns out a VAT - a value-added tax - is a very easy tax to collect and a very hard tax to evade. It's a really good idea. It was invented about 60 years ago in France, of course. Because they're so good at taxing. They had a business tax that was easy to evade, and the head of the French IRS invented this value-added tax, which is very hard to evade.

Paraphrase, in the sense of summary, is as indispensable to the novel-critic as close analysis is to the critic of lyric poetry. The natural deduction is that novels are paraphrasable whereas poems are not. But this is a false deduction because close analysis is itself a disguised form of paraphrase.