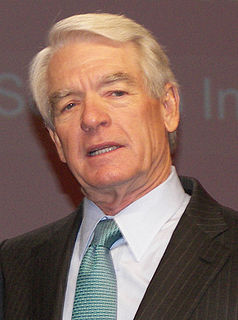

A Quote by Charles Schwab

If there's not enough money in the bank account, you don't spend it.

Quote Topics

Related Quotes

At the beginning of a remodel, money is everything, but as you go along, it becomes secondary to the vision. You can't have the house looking like a glorious jewel and leave the cracked linoleum or the icky light fixture, so you spend and spend and spend. Then one day it suddenly occurs to you that all that play money you've been throwing around is real - and it's in someone else's bank account.

The most important thing in your life is your health and your body. You can have all the education and you can have millions of dollars in the bank, but if you've got headaches every day, if you're fat and you are out of shape - what good is your money? Your health account and your bank account, build them both up!

For me, money is to use - it's only to use. So I never have money because I always spend. That's why in a way I protect myself in having houses. But if I had just cash or kept it in the bank, I'd spend it immediately. But not for stupid things. So I don't like to have money. I never have money in my pocket.

Then came the second Amsterdam discovery, although the principle was known elsewhere. Bank deposits...did not need to be left idly in the bank. They could be lent. The bank then got interest. The borrower then had a deposit that he could spend. But the original deposit still stood to the credit of the original depositor. That too could be spent. Money, spendable money, had been created. Let no one rub his or her eyes. It's still being done-every day. The creation of money by a bank is as simple as this, so simple, I've often said, that the mind is slightly repelled.