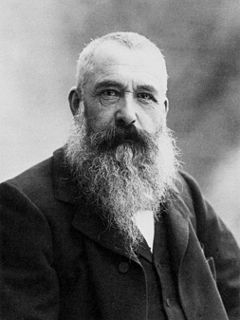

A Quote by Edgar Degas

There is too much talk and gossip; pictures are apparently made, like stock-market prices, by competition of people eager for profits... All this traffic sharpens our intelligence and falsifies our judgment.

Related Quotes

It seems to me that today, if the artist wishes to be serious - to cut out a little original niche for himself, or at least preserve his own innocence of personality - he must once more sink himself in solitude. There is too much talk and gossip; pictures are apparently made, like stock-market prices, by competition of people eager for profit; in order to do anything at all we need (so to speak) the wit and ideas of our neighbors as much as the businessmen need the funds of others to win on the market. All this traffic sharpens our intelligence and falsifies our judgment.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Too many people are apt to redeem their profits too quickly. In a huge bull market they wind up with piddling profits, only to watch their former holdings soar. That usually prompts them into making mistakes later when, believing that the market owes them some money, they buy at the wrong time at much higher levels.

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.

It is argued by our GDP obsessed policy planners that eventually the money being made by the stock market operators or the IT industry would trickle down to the poor farmers in terms of ancillary jobs that would be created. But the fact is, that this has not happened, despite the boom in the stock market and the IT industry.

Treatment of the apparently whimsical fluctuations of the stock quotations as truly non stationary processes requires a model of such complexity that its practical value is likely to be limited. An additional complication, not encompassed by most stock market models, arises from the manifestation of the market as a nonzero sum game.

The correct attitude of the security analyst toward the stock market might well be that of a man toward his wife. He shouldn't pay too much attention to what the lady says, but he can't afford to ignore it entirely. That is pretty much the position that most of us find ourselves vis-à-vis the stock market.