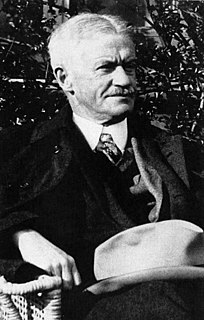

A Quote by Ambrose Bierce

TARIFF, n. A scale of taxes on imports, designed to protect the domestic producer against the greed of his consumer.

Related Quotes

Taxes, well laid and well spent, insure domestic tranquility, provide for the common defense, and promote the general welfare. Taxes protect property and the environment; taxes make business possible. Taxes pay for roads and schools and bridges and police and teachers. Taxes pay for doctors and nursing homes and medicine.

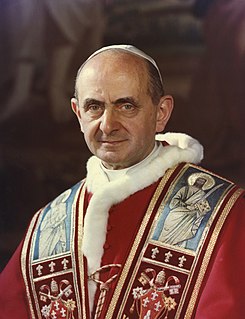

Is he prepared to support, at his own expense, projects and undertakings designed to help the needy? Is he prepared to pay higher taxes so that public authorities may expand their efforts in the work of development? Is he prepared to pay more for imported goods, so that the foreign producer may make a fairer profit? Is he prepared to emigrate from his homeland if necessary and if he is young, in order to help the emerging nations?

The great danger to the consumer is the monopoly -whether private or governmental. His most effective protection is free competition at home and free trade throughout the world. The consumer is protected from being exploited by one seller by the existence of another seller from whom he can buy and who is eager to sell to him. Alternative sources of supply protect the consumer far more effectively than all the Ralph Naders of the world.

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.

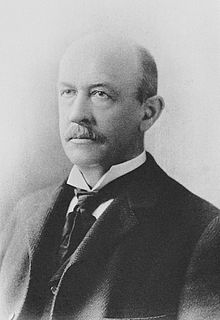

Business corporations in general are not defenders of free enterprise. On the contrary, they are one of the

chief sources of danger....Every businessman is in favor of freedom for everybody else, but when it comes to himself that's a different question. We have to have that tariff to protect us against competition from abroad. We have to have that special provision in the tax code. We have to have that subsidy.

Consumption is the sole end and purpose of all production; and the interest of the producer ought to be attended to only so far as it may be necessary for promoting that of the consumer. The maxim is so perfectly self-evident that it would be absurd to attempt to prove it. But in the mercantile system the interest of the consumer is almost constantly sacrificed to that of the producer; and it seems to consider production, and not consumption, as the ultimate end and object of all industry and commerce.

The consumers are merciless. They never buy in order to benefit a less efficient producer and to protect him against the consequences of his failure to manage better. They want to be served as well as possible. And the working of the capitalist system forces the entrepreneur to obey the orders issued by the consumers.