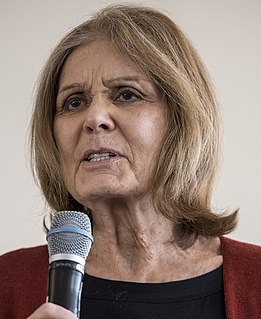

A Quote by Emma Goldman

Marriage is primarily an economic arrangement, an insurance pact. It differs from the ordinary life insurance agreement only in that it is more binding, more exacting.

Related Quotes

Insurance is meant for extraordinary circumstances. You don't use car insurance to pay for oil changes or gasoline; you have it as protection in case you have a terrible accident or your car is stolen. You don't use homeowners' insurance to pay your electricity and water bills; you have it as protection in case a fire or other catastrophic event produces a large expense. Obviously, any insurance policy that promises to cover every small, ordinary expense is going to be much more expensive than one that covers only extraordinary expenses.

The premise of insurance is to spread the risk. It's the premise of homeowner's insurance, of car insurance, and of health insurance. It's one reason why it's important to have insurance when you're healthy, so that when you get sick, you won't go sign up just when you get sick, because that increases the cost for everyone.

The best tool today is longevity insurance - they call it income insurance. Most people know the value of life insurance. But what if you live? So instead of trying to guess one or the other, you plan for those 20 years and you get this income insurance. If you live beyond 85, you have money that's guaranteed for as long as you live in the form of an annuity.

Health insurance, which is exceedingly difficult to secure as an individual in New York. Obamacare, while certainly better than nothing, is pretty awful, and if you have a complicated health history, as I do, you need premium insurance, which means private insurance. The challenge, though, is finding a company that will give you the privilege of paying up to $1,400 a month for it. When I didn't have a job, I spent more time thinking about insurance - not just paying for it, but securing it in the first place - than I wanted to.

We can all instinctively understand the idea of life insurance; most of us will feel an instinctive repugnance at the thought of the viatical industry, or 'dead peasants insurance.' As market thinking penetrated the life insurance industry, a moral line was crossed, and the application of market ideas was taken too far.