Top 109 Goldman Sachs Quotes & Sayings

Explore popular Goldman Sachs quotes.

Last updated on November 28, 2024.

Because I wrote a book about Goldman Sachs. And I know that, from talking to people at Goldman Sachs, that Trump is the poster child for the kind of client they don't want to do business with, mainly because he would borrow all this money from Wall Street to build his casinos, and then didn't pay it back.

The concept of productivity in America is income divided by labor. So if you're Goldman Sachs and you pay yourself $20 million a year in salary and bonuses, you're considered to have added $20 million to GDP, and that's enormously productive. So we're talking in a tautology. We're talking with circular reasoning here.

In truth, it's not the shareholders of the American International Group who benefited most from its bailout; they were mostly wiped out. The great beneficiaries have been the creditors and counterparties at the other end of A.I.G.'s derivatives deals - firms like Goldman Sachs, Merrill Lynch, Deutsche Bank, Societe Generale, Barclays and UBS.

We're not going to beat Barack Obama with some guy who has Swiss bank accounts, Cayman Island accounts, owns shares of Goldman Sachs while it forecloses on Florida and is himself a stockholder in Fannie Mae and Freddie Mac while he tries to think the rest of us are too stupid to put the dots together to understand what this is all about.... People matter more than Wall Street.

I understand Goldman Sachs businesses. We do lot of business with him, and GE has been - I think it's the longest running stock in the Dow Jones industrial average. It will be 100 years now it will be around. I hope I'm around then, too. And it was an attractive investment. And we have had a lot of money around, over the last two years, and we're seeing things that are attractive now.

People think that this concept of GDP is scientific economics, partly because it has a precise number and can be quantified. But the underlying concept of "the market" makes it appear as if today's poverty is natural. It makes it appear that Goldman Sachs and Donald Trump are job creators instead of job destroyers. That is illogical, when you think about it.

Today's national income statistics make it appear that Goldman Sachs is productive. As if Donald Trump plays a productive role. The aim is to make it appear that people who take money from the rest of the economy without working are productive, despite not really providing any service that actually contributes to GDP and economic growth.

This is what class warfare looks like: The Business Roundtable - representing Goldman Sachs, Bank of America, JP Morgan Chase and others - has called on Congress to raise the eligibility age of Social Security and Medicare to 70, cut Social Security and veterans' COLAs, raise taxes on working families and cut taxes for the largest corporations in America.

I don't agree with Bernie Sanders that the banks should be broken up at this point. But Hillary Clinton's acceptance of huge contributions from Goldman Sachs and others... And we don't debate what Clinton has done. She has a public record. She's been Secretary of State. She's basically a candidate of Wall Street, for Wall Street.

Goldman Sachs was one of those companies whose illegal activity helped destroy our economy and ruin the lives of millions of Americans. But this is what a rigged economy and a corrupt campaign finance system and a broken criminal justice is about. These guys are so powerful that not one of the executives on Wall Street has been charged with anything after paying, in this case of Goldman Sachs, a $5 billion fine.

Mysterious can be cool, if you're in Hollywood and everyone's happy. But it can be really bad if people perceive that the financial interests are adversarial, that there's money versus people. A lot of Goldman Sachs people went into government, so at a time when there's a distrust of institutions, some of that reflects on us.

Goldman Sachs was fundamentally responsible for the crash of 2008, but by that time its former Chairman and Chief Executive Officer, Henry 'Hank' Paulson, had been installed as US Treasury Secretary to begin the bank bail out policy, with enormous benefit to Goldman Sachs, in the closing weeks of the Bush administration. Goldman Sachs was also instrumental in the collapse of the economy in Greece that started the 'euro panic' that later engulfed Ireland.

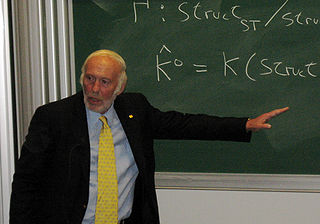

I started out as a lawyer and came in laterally to Goldman Sachs. So I learned myself that life is unpredictable. That you really should, in terms of your career, try to be excellent at what you're doing. I think if you focus on your job, and you focus on being broad in the context of your job, the next jobs follow from that.