Top 1200 Commercial Banks Quotes & Sayings - Page 3

Explore popular Commercial Banks quotes.

Last updated on October 25, 2024.

Instability mostly comes from the interface between the fact that the banks (or shadow banks) can create credit, money, and purchasing power in infinite quantities if we don't constrain them, and the fact that credit is primarily created to fund the purchase of urban real estate and land, which is somewhat fixed in supply.

Here's Hillary Clinton getting away with tying the Republicans to rich people. She's tying the Republican Party to Wall Street, to the big banks. She's tying the Republican Party to the financial crisis in 2008. It's all their fault. She's tying herself as with the low-income crowd - and the average, ordinary middle class American - as their champion, as their defender. They don't know that it's not the Republicans in bed with banks. They don't know that it's the banks that are practically paying for and underwriting the Democrat Party and Hillary Clinton today.

If the government has any courage, it will punish those at the top of failed banks. Accountability is critical in every area of human endeavour - there has to be a penalty for failure; otherwise, it's only a matter of time before the economic pain our banks have caused to so many innocent businesses and homeowners is forgotten.

Of other countries, to impose economic sanctions, it'd really begin to dry up the enormous amount of money coming into North Korea, a lot of it from China - from Chinese banks - whereas, if we sanction the Chinese banks, there could be friction with China. But this is something we're going to have to face.

Fannie Mae and Freddie Mac - two bloated and corrupt government-sponsored programs - contributed heavily to the crisis.In order to prevent another crisis, we need to do what we should have done years ago - reform Fannie Mae and Freddie Mac. We also need to repeal Dodd-Frank, the Democrats' failed solution. Under Dodd-Frank, 10 banks too big to fail have become five banks too big to fail. Thousands of community banks have gone out of business.

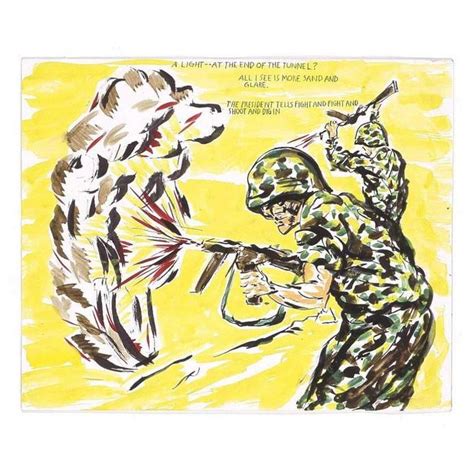

It's responsible for the sloppiness and imprecision of the War on Terror, for example. It's responsible for taking people's tax dollars and spending the country into debt on useless wars and pointless pork projects to buy votes. It's responsible for bailing out the banks instead of standing up for the people the banks cheated. It's responsible for plenty.

There is a problem on the so-called commercial stage in New York. The price of a ticket is exorbitant, and there are no longer original productions possible, apparently, on the commercial stage. They are all plays that were taken from either England or smaller theaters, off-Broadway theaters, and so on. The one justification there used to be for the commercial theater was that it originated everything we had, and now it originates nothing. But the powers that be seem perfectly content to have it that way. They don't risk anything anymore, and they simply pick off the cream.

The tragic effects of terrorism have forced the new-construction industry to re-evaluate traditional methods of fire protection in commercial infrastructures. That includes everything from building codes, to structural design issues and the less durable fireproofing materials currently specified for commercial steel structures.

Under Bill Clinton's HUD Secretary Andrew Cuomo, Community Reinvestment Act regulators gave banks higher ratings for home loans made in 'credit-deprived' areas. Banks were effectively rewarded for throwing out sound underwriting standards and writing loans to those who were at high risk of defaulting.

Value investors will not invest in businesses that they cannot readily understand or ones they find excessively risky. Hence few value investors will own the shares of technology companies. Many also shun commercial banks, which they consider to have unanalyzable assets, as well as property and casualty insurance companies, which have both unanalyzable assets and liabilities.

The States is run by the Federal Reserve, an institution that answers only to itself and to a few large banks. It's modelled on the Bank of England. Ben Franklin said that one of the main reasons America revolted was to get away from the Bank of England, the mother of all central banks - the most pernicious and insidious of all.

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.

In the old days we were the challenger brand competing against the big banks, but today I go round the world and I sit with governors of central banks and finance ministers and, in some cases, prime ministers. They all know Travelex. We are regarded as the establishment - the world's largest retailer of foreign currency.

On banks, I make no apology for attacking spivs and gamblers who did more harm to the British economy than Bob Crow could achieve in his wildest Trotskyite fantasies, while paying themselves outrageous bonuses underwritten by the taxpayer. There is much public anger about banks and it is well deserved.

Instead of abandoning competition and giving banks protected monopolies once again, the public would be better served by making it easier to close banks when they get into trouble. Instead of making banking boring, let us make it a normal industry, susceptible to destruction in the face of creativity.

Temporary nationalization of the banks that are in very bad shape would mean basically that the government is the temporary owner. I always believe that the government should focus on its comparative advantages, and banking is not one of them. It should, therefore, if it nationalizes banks, sell them back to the private sector.

To save the banks from making losses that would wipe out their net worth, you'll have to get rid of Social Security. It means that you'll essentially have to abolish government and turn it over to the banking system to run, with an idea that the role of governments is to extract income from the economy to pay to the bondholders and the banks.

Critics, often for good reason, are concerned that the Fed is wielding its vast powers in the interests of the banks and not in the interests of the people. After the financial crisis, Americans have perceived that the banks have been bailed out, but a significant proportion of the population is still in serious economic trouble.

We've been following many forms of democratized ownership, starting with co-ops, land banks at the neighborhood level, municipal ownership and state ownership of banks - there's a whole series of these that attempt to fill the small-scale infrastructure that can build up to a larger theoretical vision.