Top 1200 Stock Market Crash Quotes & Sayings - Page 2

Explore popular Stock Market Crash quotes.

Last updated on November 4, 2024.

I was lucky enough to see with my own eyes the recent stock-market crash, where they lost several million dollars, a rabble of dead money that went sliding off into the sea. Never as then, amid suicides, hysteria, and groups of fainting people, have I felt the sensation of real death, death without hope, death that is nothing but rottenness, for the spectacle was terrifying but devoid of greatness... I felt something like a divine urge to bombard that whole canyon of shadow, where ambulances collected suicides whose hands were full of rings.

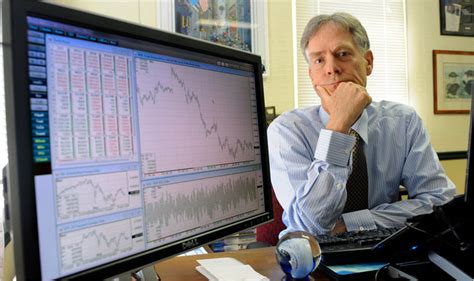

In college I started studying the stock market. I went down to the stock exchange, watched all the activity from the visitors' gallery, people running around, calling numbers, shouting, and all the paper flying and the bells ringing, and of course that was exciting, and it seemed to lend itself to my analytical skills.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

And at a relatively early age, ten or so, I invested my first share of stock. And I used to follow, look at companies and so forth. But throughout the whole period, and indeed right through my college years, while I was involved in the stock market, always interested in finance, I never thought of it as a full-time job.

The model I like to sort of simplify the notion of what goes on in a market for common stocks is the pari-mutuel system at the racetrack. If you stop to think about it, a pari-mutuel system is a market. Everybody goes there and bets and the odds change based on what's bet. That's what happens in the stock market.

The other dynamic keeping the stock market up - both for technology stocks and others - is that companies are using a lot of their income for stock buybacks and to pay out higher dividends, not make new investment,. So to the extent that companies use financial engineering rather than industrial engineering to increase the price of their stock you're going to have a bubble. But it's not considered a bubble, because the government is behind it, and it hasn't burst yet.

Successful investors like stocks better when they’re going down. When you go to a department store or a supermarket, you like to buy merchandise on sale, but it doesn’t work that way in the stock market. In the stock market, people panic when stocks are going down, so they like them less when they should like them more. When prices go down, you shouldn’t panic, but it’s hard to control your emotions when you’re overextended, when you see your net worth drop in half and you worry that you won’t have enough money to pay for your kids’ college.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

A major boom in real stock prices in the US after Black Tuesday brought them halfway back to 1929 levels by 1930. This was followed by a second crash, another boom from 1932 to 1937, and a third crash. Speculative bubbles do not end like a short story, novel, or play. There is no final denouement that brings all the strands of a narrative into an impressive final conclusion. In the real world, we never know when the story is over.

There are several things that can create an alpha - stock buybacks are one. High dividend yields are another, especially nowadays because the stock market yields more than the banks and the tenure treasury. But by and large, it tends to be companies with a strong cash flow, rising sales, accelerated earnings, a profit margin expansion.

Our best long-term and intermediate cycles suggest another slowdown and stock crash accelerating between very early 2014 and early 2015, and possibly lasting well into 2015 or even 2016. The worst economic trends due to demographics will hit between 2014 and 2019. The U.S. economy is likely to suffer a minor or major crash by early 2015 and another between late 2017 and late 2019 or early 2020 at the latest.

The market has a simple way of whittling all excessive pride and overblown egos down to size. After all, the whole idea is to be completely objective and recognize what the marketplace is telling you, rather than try to prove that the thing you said or did yesterday or six weeks ago was right. The fastest way to take a bath in the stock market or go broke is to try to prove that you are right and the market is wrong.

It's got to be the best intellectual exercise out there. You're seeing through new situations every ten minutes. In the stock market you don't base your decisions on what the market is doing, but on what you think is rational. Bridge is about weighing gain/loss ratios. You're doing calculations all the time.

The correct method for tracking the stock market is to use semilogarithmic chart paper, since the market's history is sensibly related only on a percentage basis. The investor is concerned with percentage gain or loss, not the number of points traveled in a market average. Arithmetic scale is quite acceptable for tracking hourly waves. Channeling techniques work acceptably well on arithmetic scale with shorter term moves.