Top 126 Regulators Quotes & Sayings - Page 2

Explore popular Regulators quotes.

Last updated on November 17, 2024.

There are a number of institutions globally where the Federal Reserve typically leads the U.S. effort to work with financial regulators from other countries, and we try to, to the extent possible, establish international standards for how - the amount of capital a bank should hold, for example, or how much.

In India, I personally believe yes, there is a clear fear of unknown; there's a lot of risk aversions in science and technology. They want predictability in everything they do, and it starts from people. It starts from investors. It starts from the regulators. You see that mindset across the society.

Most companies aim to get bigger. But beyond a certain point, bigness becomes synonymous with badness. Think of Big Pharma, Big Auto, Big Oil. Worse, if you are regularly described as one of the Big Four, Five, or Six in any business sector, you are probably already in the sights of regulators and lawmakers.

By common consent of the nations, gold and silver are the only true measure of value. They are the necessary regulators of trade. I have myself no more doubt that these metals were prepared by the Almighty for this very purpose, than I have that iron and coal were prepared for the purposes in which they are being used.

Growth requires risk-taking. If you want to dampen risk and make sure you never have a problem, you do so, but that also will have an effect on growth. This is a decision that doesn't necessarily belong to financial institutions. It belongs to regulators and legislators who represent the body politic.

The securitisation of mortgages added a new dimension of systemic risk. Financial engineers claimed they were reducing risks through geographic diversification: in fact they were increasing them by creating an agency problem. The agents were more interested in maximising fee income than in protecting the interests of bondholders. That is the verity that was ignored by regulators and market participants alike.

Enforced by genetics, sexual reproduction, perspective, and experience, the most manifest characteristic of human beings is their diversity. The freer an economy is, the more this human diversity of knowledge will be manifested. By contrast, political power originates in top-down processes-governments, monopolies, regulators, and elite institutions- all attempting to quell human diversity and impose order. Thus power always seeks centralization.

They've lied about everything.-about the fence, and the existence of Invalids, about a million other things besides. They told us the raids were carried out for our own protection. They told us the regulators were only interested in keeping the peace. They told us love was a disease. They told us it would kill us in the end. For the very first time I realize, that this, too, maight also be a lie.

The financial collapse of 2008 got its start with predatory mortgages, that weren’t sold by community banks and credit unions, they were sold by fly by night mortgage brokers who had almost zero federal oversight and then the big banks looked over, saw the profit potential and they wanted it bad. So they jumped in and sold millions of these terrible mortgages while the bank regulators just looked the other way.

I have one of the self-driving Teslas; it drives itself periodically. It's a marvel of science, but it's still frightening. I think we've got a while before regulators and the general public wrap their heads around the path that will lead to the ubiquity of driverless cars. There's no doubt Uber will be a leader in that space.

It's a competitive business and obviously a lot of money is involved in the sport and the regulators sometimes have difficult decisions to make, but hopefully for the benefit of Formula 1 and all the fans across the world, we can move forwards into 2008 with all the focus on the race track rather than in the courtroom.

Our party [Republicans] has been focused on big business too long. I came through small business. I understand how hard it is to start a small business. That's why everything I'll do is designed to help small businesses grow and add jobs. I want to keep their taxes down on small business. I want regulators to see their job as encouraging small enterprise, not crushing it.

There are regulators at the SEC and elsewhere who are really excited about the potential of the blockchain. They understand you can build a robust financial system - it would solve all your black swan problems. All kinds of mischief and games that are played in the current system become impossible in this system.

Debt, we've learned, is the match that lights the fire of every crisis. Every crisis has its own set of villains - pick your favorite: bankers, regulators, central bankers, politicians, overzealous consumers, credit rating agencies - but all require one similar ingredient to create a true crisis: too much leverage.

This is the joint responsibility of everyone who was involved in the introduction of the euro without understanding the consequences. When the euro was introduced, the regulators allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital. And the European Central Bank discounted all government bonds on equal terms. So commercial banks found it advantageous to accumulate the bonds of the weaker countries to earn a few extra basis points.

What I do know is, in little more than 30 years, we have gone from a nation where the “quiet enjoyment” of one’s private property was a sacred right, to a day when the so-called property “owner” faces a hovering hoard of taxmen and regulators threatening to lien, foreclose, and “go to auction” at the first sign of private defiance of their collective will ... a relationship between government and private property rights which my dictionary defines as “fascism.”

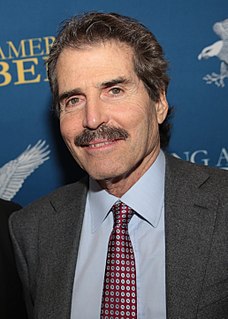

I started out by viewing the marketplace as a cruel place, where you need intervention by government and lawyers to protect people. But after watching the regulators work, I have come to believe that markets are magical and the best protectors of the consumer. It is my job to explain the beauties of the free market.

Debt, weve learned, is the match that lights the fire of every crisis. Every crisis has its own set of villains - pick your favorite: bankers, regulators, central bankers, politicians, overzealous consumers, credit rating agencies - but all require one similar ingredient to create a true crisis: too much leverage.

It strikes me as hubris that Universal will buy EMI. What it will do is create a super-major that will have far too much power... I think when Universal goes up over 40 percent market share, I don't see how reasonable regulators can countenance. It will impact not just labels, but artists and cultural diversity.

Under Bill Clinton's HUD Secretary Andrew Cuomo, Community Reinvestment Act regulators gave banks higher ratings for home loans made in 'credit-deprived' areas. Banks were effectively rewarded for throwing out sound underwriting standards and writing loans to those who were at high risk of defaulting.

Boxing has a problem - a big one. Think of it as a monster that's hiding under the bed. Eventually, the monster is going to come out and take a big chunk out of the sport. Fighters, trainers, managers, promoters, even government regulators can legally bet on fights. They can also bet on fights they're involved with.

Regulation has gone astray. . . . Either because they have become captives of regulated industries or captains of outmoded administrative agencies, regulators all too often encourage or approve unreasonably high prices, inadequate service, and anticompetitive behavior. The cost of this regulation is always passed on to the consumer. And that cost is astronomical.