Top 1200 Tax Cuts Quotes & Sayings

Explore popular Tax Cuts quotes.

Last updated on September 20, 2024.

What the Trump tax plan is a plan to give tiny little tax cuts to most Americans, raise taxes on perhaps one in five families and shower benefits on people who earn millions of dollars a year. And this fits with a fundamental principle the Republicans have been pursuing for a long time. The rich aren't investing and creating jobs, because they don't have nearly enough money, and so we need to get them money. And the way the Republicans want to get it to them is tax cuts first, and then to take away help for children, the disabled, the elderly and the poor.

Look, I'm very much in favor of tax cuts, but not with borrowed money. And the problem that we've gotten into in recent years is spending programs with borrowed money, tax cuts with borrowed money, and at the end of the day that proves disastrous. And my view is I don't think we can play subtle policy here.

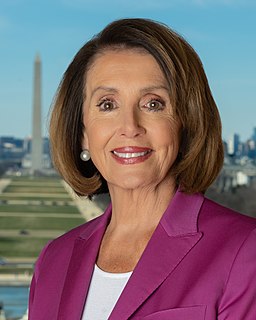

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

If we can’t puncture some of the mythology around austerity, politics or tax cuts or the mythology that’s been built up around the Reagan revolution, where somehow people genuinely think that he slashed government and slashed the deficit and that the recovery was because of all these massive tax cuts, as opposed to a shift in interest-rate policy - if we can’t describe that effectively, then we’re doomed to keep on making more and more mistakes.

Trump himself stands to benefit dramatically from the tax cuts. One of the things they're cutting is the alternative minimum tax. Last time we have tax returns for him was in 2005, where he paid about $31 million because of the alternative minimum tax. He won't have to pay that, if this tax bill goes through. So, not only is he reordering our constitutional democracy, he is personally enriching himself - which is not new, because, of course, he's done it ever since he swore an oath to become president of the United States.

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

In December, I agreed to extend the tax cuts for the wealthiest Americans because it was the only way I could prevent a tax hike on middle-class Americans. But we cannot afford $1 trillion worth of tax cuts for every millionaire and billionaire in our society. We can't afford it. And I refuse to renew them again.

Over the past 100 years, there have been three major periods of tax-rate cuts in the U.S.: the Harding-Coolidge cuts of the mid-1920s; the Kennedy cuts of the mid-1960s; and the Reagan cuts of the early 1980s. Each of these periods of tax cuts was remarkably successful as measured by virtually any public policy metric.

I kid the Republicans, with love. I feel bad for them. They got nobody for next time. Who are they gonna run? Sarah Palin, reading off her hand. Did you see that? You saw this? She wrote "tax cuts" on her hand. A Republican so stupid she has to be reminded of the one thing - Tax cuts! This is like if you saw the coyote's paw and it said "Road Runner".

All my adult life, I have lived with Labour lies about tax cuts. Their cry is always the same. Tax cuts are impossible in a civilised society. They mean less revenue for the state, which means sacked teachers, unemployed doctors, fewer nurses. I am amazed anyone still takes such arrant twaddle seriously.

Democrats in Washington predicted that tax cuts would not create jobs, would not increase wages, and would cause the federal deficit to explode. Well, the facts are in. The tax cuts have led to a strong economy. Real wages were on the rise, and deficit has been cut in half three years ahead of schedule.

Any Democrat who squirms on the tax-cut issue in the primaries has no chance ' zero ' to win the nomination. Each will have to take the “pledge” to oppose the Bush tax cuts. Thus, Bush will have succeeded in creating a situation where anyone who can win the nomination can't win the election. Democrats are not about to nominate anyone who backs the tax cut, and Americans are not going to elect anyone who favors a tax increase.

All those predictions about how much economic growth will be created by this, all of those new jobs, would be created by the things we wanted - the extension of unemployment insurance and middle class tax cuts. An estate tax for millionaires adds exactly zero jobs. A tax cut for billionaires - virtually none.

His presidency ended more than a decade ago, but politicians, Democrat and Republican, still talk about Ronald Reagan. Al Gore has an ad noting that in Congress he opposed the Reagan budget cuts. He says that because Bill Bradley was one of 36 Democratic Senators who voted for the cuts. Gore doesn’t point out that Bradley also voted against the popular Reagan tax cuts and that it was the tax cuts that piled up those enormous deficits, a snowballing national debt.

After 25 quarters of so-called recovery under Obama, it has increased a total of only 14.3 percent. Compare this to earlier periods. After the JFK tax cuts of the early 1960s, the economy grew in total by roughly 40 percent. After the Reagan tax cuts of the 1980s, the economy grew by a total of 34 percent.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

People in my hometown voted for President Reagan - for many, like my grandpa, he was their first Republican - because he promised that tax cuts would bring higher wages and new jobs. It seemed he was right, so we voted for the next Republican promising tax cuts and job creation, George W. Bush. He wasn't right.