Top 675 Assets And Liabilities Quotes & Sayings - Page 11

Explore popular Assets And Liabilities quotes.

Last updated on April 22, 2025.

If you look at what's happened to the stock market, if you look at what's happened to housing values, if you look at what's happened to bank loan portfolios because the value of their other assets that they've already issued loans against were going down, there was a pretty good argument for trying to pass something at about this level of investment with the divisions as they were - unemployment, food stamps, and tax cuts, aid to education and healthcare, and job creation.

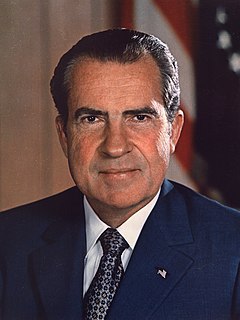

Nothing matters more to the future of this Nation than insuring that our young men and women learn to believe in themselves and believe in their dreams, and that they develop this capacitythat you develop this capacity, so that you keep it all of your lives. I believe one of Americas most priceless assets is the idealism which motivates the young people of America. My generation has invested all that it has, not only its love but its hope and faith, in yours.

The Catholic Church must be the biggest corporation in the United States. We have a branch office in every neighborhood. Our assets and real estate holdings must exceed those of Standard Oil, A.T.&T., and U.S. Steel combined. And our roster of dues-paying members must be second only to the tax rolls of the United States Government.

Once you identify positional needs, then I think, then, what you do is, you be very selective on how you go about acquiring those players. You have to look at the resources available on how to acquire those players, and then, if you can, go acquire those assets that can best help this team get over the hump.

I say we have not even had the decency to maintain the assets that our parents and grandparents built for us - our roads, our bridges, our wastewater systems, our sewer systems; by the way, those weren't Bolsheviks, those weren't socialists that built those things for us - much less build the infrastructure we need for the 21st century.

I'd guess blockchains will be the full-blown backbone of virtual worlds - the system for currency, assets, identity, even governance - before doing the same in the 'real world.' Which is where I think we will end up in the real world eventually; it's just a matter of which goes first and how long until it's the case for both.

Two thirds of the work in the world is done by women. Women own 1 percent of the assets. Young women are sold into prostitution, forced labour, premature marriage, forced to have children they don't want or they can't support. They're abused, raped, beaten up. Domestic violence is supposed to be a cultural problem. They are the first victims of war, fundamentalism, conflict, recession. And young women who have access to education and health care and have resources think that everything was done, they don't have to worry.

For society to function some kind of reasonable balance has to be stuck between the competing interests of creditors and debtors. Although the mandate of the Bank of Canada was to maintain a delicate balance between encouraging growth and fighting inflation, the Bank opted to focus exclusively on fighting inflation. In doing so it came down heavily in favour of those with financial assets to protect, and against those whose primary need was employment.

As alleged, David Hu directed a multimillion-dollar, years-long scheme to defraud investors. Putting profit ahead of his fiduciary duties, Hu allegedly mismarked millions of dollars of loan assets to cover up millions in losses. Hu also created fake entities and loans, and falsified paperwork to deceive auditors and avoid detection.

Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?

Liberals love to say things like, "We're just asking everyone to pay their fair share." But government is not about asking. It is about telling. The difference is fundamental. It is the difference between making love and being raped, between working for a living and being a slave. The Internal Revenue service is not asking anybody to do anything. It confiscates your assets and puts you behind bars if you don't pay.

When you can identify a specific tax that people don't like, and this is one that was designed for the Rockefellers, for the Carnegies in 1916, to fund World War I, but now it's beginning to hit small business people, real estate holders, a lot of people well down the income scale who just spent a life building assets. Suddenly they get hit with a 40%, 50% tax rate.

The average person can’t really trust anybody. They can’t trust a broker, because the broker is interested in churning commissions. They can’t trust a mutual fund, because the mutual fund is interested in gathering a lot of assets and keeping them. And now it’s even worse because even the most sophisticated people have no idea what’s going on.

Financial innovation can be highly dangerous, though almost no one will tell you this. New financial products are typically created for sunny days and are almost never stress-tested for stormy weather. Securitization is an area that almost perfectly fits this description; markets for securitized assets such as subprime mortgages completely collapsed in 2008 and have not fully recovered. Ironically, the government is eager to restore the securitization markets back to their pre-collapse stature.

Times of economic crises can change what the competitive landscape looks like, because when, for example, you have boom times, capital is easy to come by, growth is easy, sometimes what you focus on is, you know, how to accelerate in the boom. During economic crises, the question is, the companies that come out of, you know, that are sailing through that with the best liquidity, both assets on the balance sheet, making money, ability to grow their businesses, get a disproportionate competitive advantage.

When Berkshire Hathaway laid out three billion dollars for GE today, we didn't spend it, we invested it. When the Federal government buys the mortgages, they're not spending it, they're investing it. Now, they're investing it in distress type assets but they're buying them at distress prices if they buy them at market. It's the kind of stuff I love to do. I just don't have 700 million. Maybe we could go in it together.

I mean, you can explain the fact that these are depressed prices, you know. We think these assets are going to be worth a lot more. And I think that case can be made in certain situations. But I think to just say, you know, we're going to say a dollar of cash is worth $2 all of a sudden, it isn't worth $2. It's worth a dollar today.

The simple index fund solution has been adopted as a cornerstone of investment strategy for many of the nation's pension plans operated by our giant corporations and state and local governments. Indexing is also the predominant strategy for the largest of them all, the retirement plan for federal government employees, the Federal Thrift Savings Plan (TSP). The plan has been a remarkable success, and now holds some $173 billion of assets for the benefit of our public servants and members of armed services.

In the North, neither greenbacks, taxes, nor war bonds were enough to finance the war. So a national banking system was created to convert government bonds into fiat money, and the people lost over half of their monetary assets to the hidden tax of inflation. In the South, printing presses accomplished the same effect, and the monetary loss was total.

Capital movements are no longer necessarily related to the production of goods and services. Through the financial markets of the world, capital movements today are overwhelmingly concerned with the capture of and trade in property rights, the ownership of assets that magnify a corporation's wealth, power, and control. It is what John Maynard Keynes described as "a casino world"-wealth without worth.

When this crisis began, crucial decisions about what would happen to some of the world's biggest companies - companies employing tens of thousands of people and holding trillions of dollars in assets - took place in hurried discussions in the middle of the night. We should not be forced to choose between allowing a company to fall into a rapid and chaotic dissolution or forcing taxpayers to foot the bill.

The Catholic church, once all her assets have been put together, is the most formidable stockbroker in the world. The Vatican, independently of each successive pope, has been increasingly orientated towards the U.S. The Wall Street Journal said that the Vatican's financial deals in the U.S. alone were so big that very often it sold or bought gold in lots of a million or more dollars at one time.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

As we peer into society's future, we -- you and I, and our government -- must avoid the impulse to live only for today, plundering for our own ease and convenience the precious resources of tomorrow. We cannot mortgage the material assets of our grandchildren without risking the loss also of their political and spiritual heritage. We want democracy to survive for all generations to come, not to become the insolvent phantom of tomorrow.

Pop stars are sending the message that their sexuality is the strongest thing they have to offer, and that's confusing and misleading to girls and women, especially since there's not enough of a counterbalance from those who rely on their other assets, like their music. Also, with the new obsession with all things "booty," it's important that women - and it's often women of color - aren't turned into mere caricatures. Right now it's: "Bend over." That's all people want to see. That's crazy. It's so far from where we should be.

There is a strange idea aboard, held by all monetary cranks, that credit is something a banker gives to a man. Credit, on the contrary, is something a man already has. He has it, perhaps, because he already has marketable assets of a greater cash value than the loan for which he is asking. Or he has it because his character and past record have earned it. He brings it into the bank with him. That is why the banker makes him the loan.

There were the days when women were under contract, and they were thought of as a commodity, so they hired the best writers and a lot of them were women at the time. This was in the thirties and forties, to make product for the people who were under contract, who were their assets to the studios. But that doesn't exist anymore - and as a result, the people who are in the industry write products that interest them.

One measure for promoting both stability and fairness across financial market segments is a small sales tax on all financial transactions - what has come to be known as a Robin Hood Tax. This tax would raise the costs of short-term speculative trading and therefore discourage speculation. At the same time, the tax will not discourage "patient" investors who intend to hold their assets for longer time periods, since, unlike the speculators, they will be trading infrequently.

It is a mistake - as so many over-centralized socialist societies have discovered - to try to eliminate money as an incentive. Money is one incentive among many, and has its place. But to put no limits on the impulse to accumulate money obsessively is as destructive as to place no limits on the impulse to commit violence. A viable democratic society needs a ceiling and a floor with regard to the distribution of wealth and assets.

With QE3, we are essentially being bought out with our own money...and unemployment is being used to facilitate this process in a very clever manner. Monetary inflation is currently being offset by labor deflation. The way you avoid collapse is by printing money and stealing assets. The way you avoid inflation is with labor deflation.

Cloud storage in data centers will utilize the latest developments in physical storage virtualization, deduplication and other methods to make the most effective use of physical storage assets. Software defined storage could allow a further level of abstraction and cost effectiveness. The vast bulk of content stored "in the cloud" will reside on large SATA interface HDDs with some on magnetic (mostly LTO) tape (particularly for "archives.")

Yet another hedge fund manager explained Icelandic banking to me this way: you have a dog, and I have a cat. We agree that each is worth a billion dollars. You sell me the dog for a billion, and I sell you the cat for a billion. Now we are no longer pet owners but Icelandic banks, with a billion dollars in new assets.

With what moral authority can they speak of human rights - the rulers of a nation in which the millionaire and beggar coexist; the Indian is exterminated; the black man is discriminated against; the woman is prostituted; and the great masses of Chicanos, Puerto Ricans, and Latin Americans are scorned, exploited, and humiliated? How can they do this - the bosses of an empire where the mafia, gambling, and child prostitution are imposed; where the CIA organizes plans of global subversion and espionage, and the Pentagon creates neutron bombs capable of preserving material assets and wiping out human beings.

Each and every component that makes up your life experience is drawn to you by the powerful Law of Attraction's response to the thoughts you think and the story you tell about your life. Your money and financial assets; your body's state of wellness, clarity, flexibility, size, and shape; your work environment, how you are treated, work satisfaction, and rewards - indeed, the very happiness of your life experience in general - is all happening because of the story that you tell.

The fact that God accepts us should be our motivation for accepting ourselves. If we cannot accept ourselves the way we are, with our limitations and assets, weaknesses as well as strengths, shortcomings as well as abilities; then we cannot trust anyone else to accept us the way we are. We will always be putting on a front, building a facade around ourselves, never letting people know what we are really like deep down inside.

There's only one thing that all of the central banks control and that is the base, their own liability, and they can control that in various ways. They can control it directly by open market operations, buying and selling government securities or other assets, for example, buying and selling gold, or they can control it indirectly by altering the rate at which banks lend to one another.

I still believe that for good business analysts a concentrated portfolio is a good strategy combined with a long term horizon. Once again, the secret to success in following the formula strategy is patience, a quality in short supply for both professionals and individual investors alike. I think investors should have a large portion of their assets in equities over time.

I am deeply honored by the opportunity to lead Intel. We have amazing assets, tremendous talent, and an unmatched legacy of innovation and execution. I look forward to working with our leadership team and employees worldwide to continue our proud legacy while moving even faster into ultra-mobility to lead Intel into the next era.

A currency serves three functions: providing a means of payment, a unit of account and a store of value. Gold may be a store of value for wealth, but it is not a means of payment. You cannot pay for your groceries with it. Nor is it a unit of account. Prices of goods and services, and of financial assets, are not denominated in gold terms.

Size will hurt returns. Look at Berkshire Hathaway - the last five things Warren has done have generated returns that are splendid by historical standards, but now give him $100 billion in assets and measure outcomes across all of it, it doesn't look so good. We can only buy big positions, and the only time we can get big positions is during a horrible period of decline or stasis. That really doesn't happen very often.

They have passed the big inheritance tax, and that gets you when you are gone. You used to could die and be able to beat taxes, but not now. The undertaker don't go over your body as carefully as the assessor does your accumilated assets, and he gets his before the undertaker. They have it on these big fortunes now where they pay as high as 60 to 70 percent of what they leave. That's mighty expensive dying when it runs into money like that, and you won't see 'em dropping off as casually as they have been.

Just as our adversaries and threats continue to evolve, so, too, must the FBI. The key to this evolution lies with our greatest assets: our people and our partnerships. Every FBI professional understands that thwarting the threats facing our nation means constantly striving to be more effective and more efficient.

Rule One. You must know the difference between an asset and a liability, and buy assets. If you want to be rich, this is all you need to know. It is Rule No. 1. It is the only rule. This may sound absurdly simple, but most people have no idea how profound this rule is. Most people struggle financially because they do not know the difference between an asset and a liability.

If economic catastrophe does come, will it be a time that draws Christians together to share every resource we have, or will it drive us apart to hide in our own basements or mountain retreats, guarding at gunpoint our private stores from others? If we faithfully use our assets for his kingdom now, rather than hoarding them, can't we trust our faithful God to provide for us then?

The dilemma of our age is the combination of unprecedented material progress and systematic spiritual decline. The decline in public and private morality can be witnessed in the marketplace as well as the forums of international diplomacy. In the past, a man's honor and reputation were his most valuable assets. Business agreements were made with a handshake. Today one might be well advised to check the "bottom line" and read the "small print."

[T]he rule of law does more than ensure freedom from high-handed action by rulers. It ensures justice between man and man however humble the one and however powerful the other. A man with five dollars in the bank can call to account the corporation with five billion dollars in assets-and the two will be heard as equals before the law.

[Vladimir] Putin spoke unabashedly about the importance of national sovereignty in Syria, a concept apparently near and dear to his heart, unless it comes to the sovereignty of Georgia, Ukraine or any other country in which he intervenes. Then he offered his cooperation, but without making any concrete concessions at all. And he didn't have to, either. He knows what he can rely on. He has assets that are more valuable than words: He has tanks in Ukraine, fighter jets in Syria - and Barack Obama in the White House.

Capital, never concerned with distribution, is now less and less concerned with production. Capital is driving for power, for the control over markets, lands, resources. Capital, in corporate hands, can move anywhere and thus demand and get the utmost in concessions and privileges as well as the freedom to operate in the interest of ever-increasing wealth and assets.

You can't have the space for prosperity and success when you are obsessed with security. It is not possible to obtain unwavering security - physical, emotional, or economic - by having money. Keep in mind that security, like success, can be defined in many ways. If you focus less on how much your financial assets are worth, and more on what a creative and well-balanced individual you can be, security will take on a new meaning.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

Crush your individuality first. Shake off the dreams of personal comfort. Then start to work. Inch by inch you shall have to proceed. It needs courage, perseverance and very strong determination. No difficulties and no hardships shall discourage you. No failure and betrayals shall dishearten you. No travails (!) imposed upon you shall snuff out the revolutionary will in you. Through the ordeal of sufferings and sacrifice you shall come out victorious. And these individual victories shall be the valuable assets of the revolution.