Top 54 Bailouts Quotes & Sayings

Explore popular Bailouts quotes.

Last updated on April 14, 2025.

The government - the ultimate short-term-oriented player - cannot withstand much pain in the economy or the financial markets. Bailouts and rescues are likely to occur, though not with sufficient predictability for investors to comfortably take advantage. The government will take enormous risks in such interventions, especially if the expenses can be conveniently deferred to the future. Some of the price-tag is in the form of back- stops and guarantees, whose cost is almost impossible to determine.

Now that the most interesting matter of identity is not what place someone was born in, but what point in time they are from - where they sit in relation to time. Age has become much more divisive than place. With the Internet and globalization, a twenty-year-old in New York has far more cultural references in common with a twenty-year-old in Nebraska than they do with a thirty-year-old who lives next door. National identity is what they trick you with when they want your feet in their army boots or your taxes in their bailouts.

We paid for this instead of a generation of health insurance, or an alternative energy grid, or a brand-new system of roads and highways. With the $13-plus trillion we are estimated to ultimately spend on the bailouts, we could not only have bought and paid off every single sub-prime mortgage in the country (that would only have cost $1.4 trillion), we could have paid off every remaining mortgage of any kind in this country - and still have had enough money left over to buy a new house for every American who does not already have one.

Financial institutions are not being bailed out as a favor to them or their stockholders. In fact, stockholders have come out worse off after some bailouts. The real point is to avoid a major contraction of credit that could cause major downturns in output and employment, ruining millions of people, far beyond the financial institutions involved. If it was just a question of the financial institutions themselves, they could be left to sink or swim. But it is not.

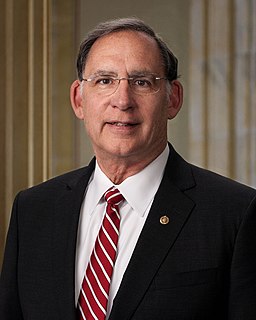

I have never believed in the fallacy that the federal government can buy its way out of economic troubles through needless spending. For that reason, I am proud to oppose 'stimulus' packages and endless corporate bailouts, which will do little but weaken the long-term integrity of the American economy.

Repeal the entire Banking Act of 1933, and Austrian School economists will cheer, especially if the current system were replaced by a 100%-reserve competitive banking with no central bank. That banking reform would give us a sound money system, meaning no more business cycle, bailouts, or inflation.

As bank customers, we tend to believe that we can have both perfect security for our money, drawing on it whenever we want and never expecting it not to be there, while still earning a regular rate of return. In a true free market, however, there tends to be a tradeoff: you can enjoy a money warehouse or you can hope for a return on your investment. You can't usually have both. The Fed, however, by backing up this fractional-reserve system with a promise of endless bailouts and money creation, attempts to keep the illusion going.

Conservative evangelicals don't want government support for our faith, because we believe God created all consciences free and a state-coerced act of worship isn't acceptable to God. Moreover, we believe the gospel isn't in need of state endorsement or assistance. Wall Street may need government bailouts but the Damascus Road never does.

We have the idea of saying that put limitations on bailouts, so that the bailouts don't occur in the future, so that we don't have to do the - look to see AIG situations or Bear Stearns situations or the Fannie Mae or Freddie Mac, which is probably going to be more money spent on those two institutions than the Congress spent on the TARP program.

If there is no cost to be paid for the indiscriminate dumping of pollution into the earth's atmosphere, then it should be a surprise to no one that today we will dump another 70 million tons of global warming pollution into the thin shell of atmosphere surrounding our planet. ... We have to [act] this year, not next year. Mother Nature does not do bailouts.

I've criticized President Bush for his failure to use his veto pen. There's plenty of blame to go around. The question is how to solve problems. It's not bailouts. What made America great? Free markets, free enterprise, manufacturing, job creation. That's how we're gonna do it, not by enlarging government.