Top 539 Banking Quotes & Sayings - Page 9

Explore popular Banking quotes.

Last updated on April 15, 2025.

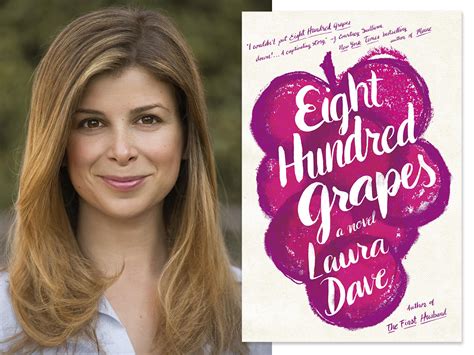

It does no one any good to say their novel sucks if you don't have an idea how to make it better, how to approach it from different angles and make it work. It's obviously a subjective process, right? But the thing about subjectivity, at least in the classroom, is that you're banking on your professor's subjectivity to be both personal and professional - that he or she has some sense about the world outside the workshop.

One nation banking recognises that banks must not be isolated from the rest of the economy. Because banks and small businesses must succeed or fail together, banks must lend to small businesses so we can get the growth and jobs we need for the future. As things stand, that is not happening enough. Lending was down £10.8billion last year.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

Part of the concept of the euro zone was to establish a common market. The banks were going to bank across all their countries like we bank across states. But that concept got killed for a whole bunch of reasons that I won't get into. That was a good concept, by the way. It may yet return, because there are huge economies of scale in banking. That's another thing people don't quite get.

Barack Obama is telling the banking industry what it can and can't charge and what profit he will accept and what level of profit he won't accept. Bill Clinton and Jimmy Carter came up with this scheme that resulted in the subprime mortgage crisis. They said it was unfair that poor and minority people didn't have houses, so we're basically gonna give 'em houses. How are we gonna do that? We're going to make the banks loan them money, knowing full well they can't pay it back.

The job has its grandeurs, yes. There is the exultation of arriving safely after a storm, the joy of gliding down out of the darkness of night or tempest toward a sun-drenched Alicante or Santiago; there is the swelling sense of returning to repossess one's place in life, in the miraculous garden of earth, where are trees and women and, down by the harbor, friendly little bars. When he has throttled his engine and is banking into the airport, leaving the somber cloud masses behind, what pilot does not break into song?

Kissinger's major, and most lucrative role, has come as head of Kissinger Associates in New York City, founded on a loan obtained in 1982 from the international banking firm of E.M. Warburg, Pincus and Company. Nominally, Kissinger Associates (KA) is an "international consulting firm" but "consultant" covers many sins, and in KA's case, this means international political influence-peddling for its two dozen or so important corporate clients.

[Oliver North is a] document-shredding, Constitution-trashing, Commander in Chief-bashing, Congress-thrashing, uniform-shaming, Ayatollah-loving, arms-dealing, criminal-protecting, résumé-enhancing, Noriega-coddling, Social

Security-threatening, public school-denigrating, Swiss-banking-law-breaking, letter-faking, self-serving, election-losing, snake-oil salesman who can't tell the difference between the truth and a lie.

But at some point, you know that - you know what poem keeps going through my mind is, "first they came for the Jews." People, all of us, are like, "Well, this news doesn't really affect me." "Well, I'm not a bondholder." "Well, I'm not in the banking industry." "Well, I'm not a big CEO." "Well, I'm not on Wall Street." "Well, I'm not a car dealer." "I'm not an auto worker." Gang, at some point, they're going to come for you!

In my opinion humanity is being prayed upon, I mean as a species. Not only by old satanic families like the Rothschilds and Rockefellers, Collins, Dupont, Warner, Russell, the world's monarchies, the Vatican. But also prayed upon by these family's employees, by governments, by the military, by banking institutions, by academia. So who does that leave? That's all the people who aren't wealthy, aren't connected, aren't educated, who are easy to manipulate, are easy to persecute and who don't believe any of the issues which you cover on Red Ice. And that's a problem. And that breaks my heart.

Suppose a bad guy guesses the password for your throwaway Yahoo address. Now he goes to major banking and commerce sites and looks for an account registered to that email address. When he finds one, he clicks the 'forgot my password' button and a new one is sent - to your compromised email account. Now he's in a position to do you serious harm.

The money problem facing the country from 1789 to 1896 existed because Congress never exercised is authority to "coin money or regulate the value thereof" - but rather delegated that authority, sometimes by charter and sometimes by default, to the banking system. This despite the provision in the Constitution that charged Congress with the power to 'coin money, regulate the value thereof, and of foreign Coin, and fix the Standards of weight and Measures.'

Monetary reform, if it is to be genuine and successful, must sever money and banking from politics. That's why a modern gold standard must have: no central bank; no fixed rations between gold and silver; no bail-outs; no suspension of gold payments or other bank frauds; no monetization of debt; and no inflation of the money supply, all of which have proved so disastrous in the past.

If we're talking about buying exchanges abroad, we have to have global securities standards, as we have global banking regulations. I'm talking about margins. Now, the United States has certain margin requirements that are not the same in London. Investors and hedge funds that want to borrow more money against securities ? if they can't in the U.S., they go abroad. That could add additional risks to the global economy.

What would've happened, do you think, had the government not intervened in October 2008? The catastrophe to the economy would've been absolutely unbelievable. And yet classical economists say, "Oh, well, no, it would've adjusted perfectly happily, a few weeks of pain and then everything would've gone on as before, without a banking system left." And that's what makes it so maddening, that these bankers are back saying it was all the government's fault. The government saved their skins. It didn't want to, but it needed to save their skins in order to save the rest of us.

When you own gold you're fighting every central bank in the world. That's because gold is a currency that competes with government currencies and has a powerful influence on interest rates and the price of government bonds. And that's why central banks long have tried to suppress the price of gold. Gold is the ticket out of the central banking system, the escape from coercive central bank and government power.

I am not from the political or banking elite. I am a child of the middle class far from Paris. And if someone had told me that success is bad or if they had placed hurdles in my path, I wouldn't be where I am today. I want it to be possible for young people in our country to be successful - whether they want to find that success in the family, as an artist or by founding a company.

When the Federal Reserve Act was passed, the people of these United States did not perceive that a world banking system was being set up here. A super-state controlled by international bankers and international industrialists acting together to enslave the world for their own pleasure. Every effort has been made by the Fed to conceal its powers but the truth is - The Fed has usurped the government!!

Yet another hedge fund manager explained Icelandic banking to me this way: you have a dog, and I have a cat. We agree that each is worth a billion dollars. You sell me the dog for a billion, and I sell you the cat for a billion. Now we are no longer pet owners but Icelandic banks, with a billion dollars in new assets.

Banking was conceived in iniquity and born in sin... Bankers own the Earth. Take it away from them but leave them the power to create money, and, with the flick of a pen, they will create enough money to buy it back again... Take this great power away from them and all the great fortunes like mine will disappear and they ought to disappear, for then this would be a better and happier world to live in... But, if you want to continue to be a slave of the bankers and pay the cost of your own slavery, then let the bankers continue to create money and control credit.

There seems to be something in the zeitgeist, and maybe it's a function of - I'm no analyst, nor am I a psychologist - when you look at things and say, What if I could go back and change things? I think we live in a world right now where people are asking those questions a lot. What if we could go back and change what we did? How would we change the way we handled things in the Middle East, and how would we change things with the banking industry, and how would we change economic and educational issues?

I helped make Mexico, especially Tampico, safe for American oil interests in 1914. I helped make Haiti and Cuba a decent place for the National City Bank boys to collect revenues in. I helped in the raping of half a dozen Central American republics for the benefits of Wall Street. The record of racketeering is long. I helped purify Nicaragua for the international banking house of Brown Brothers in 1909-1912. I brought light to the Dominican Republic for American sugar interests in 1916. In China I helped to see to it that Standard Oil went its way unmolested.

We had to struggle with the old enemies of peace - business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering. They had begun to consider the Government of the United States as a mere appendage to their own affairs. We know now that Government by organized money is just as dangerous as Government by organized mob. Never before in all our history have these forces been so united against one candidate as they stand today. They are unanimous in their hate for me - and I welcome their hatred.

The Federal Reserve Bank of New York is eager to enter into close relationship with the Bank for International Settlements....The conclusion is impossible to escape that the State and Treasury Departments are willing to pool the banking system of Europe and America, setting up a world financial power independent of and above the Government of the United States....The United States under present conditions will be transformed from the most active of manufacturing nations into a consuming and importing nation with a balance of trade against it.

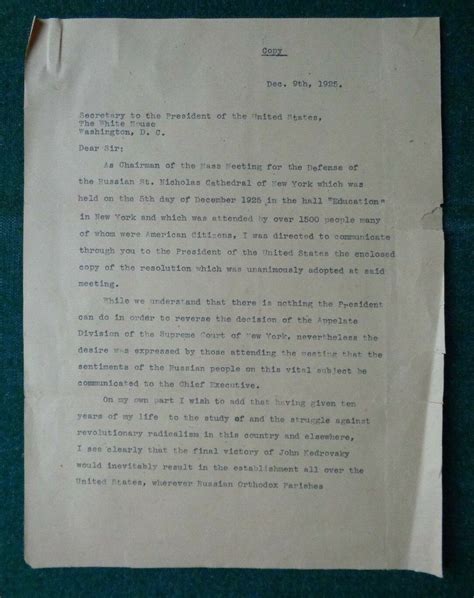

The full history of the interlocking participation of the Imperial German Government and international finance in the destruction of the Russian Empire is not yet written...It is not a mere coincidence that at the notorious meeting held at Stockholm in 1916, between the former Russian Minister of the Interior, Protopopoff, and the German Agents, the German Foreign Office was represented by Mr. Warburg, whose two brothers were members of the international banking firm, Kuhn, Loeb and Company, of which the late Mr. Jacob Schiff was a senior member.

The Internet will not become a money machine until the banking industry figures out how to transfer money for free so you can charge USD 0.005 (half a cent) for some simple service like, say, reading a newspaper article you have searched for. With today's payment system, the cost of the transfer of the funds completely dwarf the cost of the service paid for. ... This situation, however, is what acutely prevents the Internet from taking off as a network for paid services.

The majority of America's colossal fortunes have been made by entering industries in their early stages and developing leadership in them.... Think of what opportunities the present and the future contain in such fields as ship-building and ship-owning, aircraft, electrical development, the oil industry, different branches of the automotive industry, foreign trade, international banking, invention, the chemical industry, moving pictures, color photography, and, one night add, labor leadership.

Essentially, not only do we believe in this myth of 'de-risking', but it has become the one overriding goal; de-risking above growth, de-risking above innovation, de-risking above everything else. And we've reached the point where the Fed is using $70 Billion a month to 'de-risk' a largely insolvent banking system. And this can only end badly. The idea that you can do capitalism without risk is ridiculous on its face.

In our election manifesto is: we keep the right to create money and to bring in circulation, for the cause of the government ... Those who do not share this view, reply us to the issue of paper money is for the banks, the government should stay out of the banking business. I agree with Jefferson's opinion ... and just like him I say again: the issue of money is a matter for the government and the banks should stay out of government activity.

I often have said to people that there are really two cities in the country where the outlook is always forward-looking - there is never really a backward-looking tendency. My banking work has taken me out to Palo Alto, what is commonly called Silicon Valley. And you sense out there is always a forward-looking outlook. And New York City.

Peak oil is already upon us. It is destroying our banking system, that is, our system for marshalling capital, and that is about to put us out of business-as-usual. So, we have to carry on with business-not-so-usual. This could mean anything from your children finding careers in farming (rather than show biz or plastic surgery) to reorganizing households differently to traveling from New York to Boston by boat.

I realize this is blasphemy, but a few weeks ago I tried to watch a NASCAR race being run at Talladega. I lasted about five minutes before terminal boredom overtook me. It appeared to be nothing more than a high-speed freeway commute--a mob of luridly painted, identical lumps of metal loping at 180 mph around the banking, fender to fender, nose to tail. Knowing the scenario would surely devolve into a multicar demolition derby that would thrill the goobers in the grandstands, I turned off the set to later learn that this time it was Jimmie Johnson who triggered the eight-car melee.

They have a policy in China for their big companies called "Go abroad." It's a rational thing for both the company and the country to say, "We want big, successful companies." Particularly in areas where they need it: agriculture, energy, technology. I think banking, too. One or two have bought a trading house. Some have already begun expanding around the world. Of course they're going to have those ambitions. Why wouldn't they? They're just doing it methodically. It's a logical strategy and, well-executed, they will succeed.

It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. [I]f the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with 'free banking.' The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.

One of the things I do in banking committees is put pressure on them, and one of the other things I do is through my website, through outside pressure, and I ask people to come and help us join that fight where we can get people outside to keep putting the pressure on the Senate to make sure there are no compromises and weakening of Dodd-Frank.

Anyone interested in the past, present, or future of banking and financial crises should read The Bankers' New Clothes. Admati and Hellwig provide a forceful and accessible analysis of the recent financial crisis and offer proposals to prevent future financial failures. While controversial, these proposals--whether you agree or disagree with them--will force you to think through the problems and solutions.

I understand that it's a huge luxury for people to dwell on the problems in Washington. Things have to be pretty tidy in your own life that you have the time to worry about what's going on in Washington. Most of us spend our time worrying about the things that are directly around us: our love lives, our careers, and our banking accounts.

It's my guess that something like 5% of GDP goes to money management and itsattendant friction. I define it broadly - annuities, incentive pay, all trading, etc. Nobody else has used figures that high, but that's my guess. Worst of all, the people doing this are among the best and the brightest. Hundreds and thousands of engineers, etc. are going into hedge funds and investment banking. That is not an intelligent allocation of the brainpower of the civilization.

When I first started out in my career, I'd been a lit major in college so I didn't have a lot of choices. The traditional options were management consultant or investment banking, and I hadn't even taken an economics class so those were pretty much out. I didn't want to go into academia. For me, research and instinct were my unique tools that seemed to work best on a marketing and merchandizing path. It's kind of right-brain and left-brain.

On the Glass-Steagall thing, like I said, if you could demonstrate to me that it was a mistake, I'd be glad to look at the evidence. But I can't blame [the Republicans]. This wasn't something they forced me into. I really believed that given the level of oversight of banks and their ability to have more patient capital, if you made it possible for [banks] to go into the investment banking business as continental European investment banks could always do, that it might give us a more stable source of long-term investment.

The art of banking is always to balance the risk of a run with the reward of a profit. The tantalizing factor in the equation is that riskier borrowers pay higher interest rates. Ultimate safety - a strongbox full of currency - would avail the banker nothing. Maximum risk - a portfolio of loans to prospective bankrupts at usurious interest rates - would invite disaster. A good banker safely and profitably treads the middle ground.

Every four years the naive half who vote are encouraged to believe that if we can elect a really nice man or woman President everything will be all right. But it won't be. Any individual who is able to raise $25 million to be considered presidential is not going to be much use to the people at large. He will represent oil, or aerospace, or banking, or whatever moneyed entities are paying for him. Certainly he will never represent the people of the country, and they know it. Hence, the sense of despair throughout the land as incomes fall, businesses fail and there is no redress.

It's always been government's role to protect the security of the nation. And cyber-attacks is a security issue, from our perspective. And it's a security issue of particular concern with respect to the nation's core critical infrastructure, the infrastructure everyone relies on, the energy sector, the telecommunications sector, the banking sector.

[The right] may never bring prayer back to schools, but it has rescued all manner of rightwing economic nostrums from history's dustbins. Having rolled back the landmark economic reforms of the sixties (the war on poverty) and those of the thirties (labor law, agricultural price supports, banking regulation), its leaders now turn their guns on the accomplishments of the earliest years of progressivism (Woodrow Wilson's estate tax; Theodore Roosevelt's anti-trust measures). With a little more effort, the backlash may well repeal the entire twentieth century.

When we think about living donor transplant, what we're banking on is the ability of the liver to regenerate itself. Now, it's not the same sort of regeneration we think about with the starfish where we cut off the arm and it grows a new arm. With the liver, what happens is the remaining liver gets bigger, and your body knows the size of the liver that it needs, and when it recognizes that there is not enough liver, it sends nutrients and signals to the liver and says "get bigger."

This wasn't because he liked me, I was sure. It had more to do with him banking on what we of wedding age had all become witnesses to-how during these wedding weekends, single women, feeling a little lonely, maybe, or just feeling a little too far from being the bride, found themselves loosening their own rules, opting to be more flexible, more quickly.

I particularly remember the time I gave (the research director) my paper on the banking industry. I felt very proud of my work. However, he read through it and said, 'This is useless. What makes the stock go up and down?' That comment acted as a spur. Thereafter, I focused my analysis on seeking to identify the factors that were strongly correlated to a stock's price movement as opposed to looking at all the fundamentals. Frankly, even today, many analysts still don't know what makes their particular stocks go up and down.

A possibility is that we see more and more leverage, and credit-to-GDP ratios rise once more to even higher levels; eventually the banking systems of all advanced economies reach magnitudes of 500 percent, 1000 percent or more of GDP, so that every economy starts to have financial systems that resemble recent cases like Switzerland, Ireland, Iceland, or Cyprus. That might be a very fragile world to live in.

Such regulations may, no doubt, be considered as in some respect a violation of natural liberty. But those exertions of the natural liberty of a few individuals, which might endanger the security of the whole society, are, and ought to be, restrained by the laws of all governments; of the most free, as well as or the most despotical. The obligation of building party walls, in order to prevent the communication of fire, is a violation of natural liberty, exactly of the same kind with the regulations of the banking trade which are here proposed.

Congress can protect small businesses by providing effective oversight over SBA policies and make sure they take into account the needs of small businesses while also protecting taxpayer dollars. Congress also needs to make sure that new banking regulations do not make it more costly for community banks to lend to small businesses.

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

The real menace of our Republic is the invisible government which like a giant octopus sprawls its slimy legs over our cities, states and nation. At the head is a small group of banking houses... This little coterie...runs our government for their own selfish ends. It operates under cover of a self-created screen...seizes...our executive officers...legislative bodies...schools... courts...newspapers and every agency created for the public protection.

National law has no place in cyberlaw. Where is cyberspace? If you don't like banking laws in the United States, set up your machine on the Grand Cayman Islands. Don't like the copyright laws in the United States? Set up your machine in China. Cyberlaw is global law, which is not going to be easy to handle, since we seemingly cannot even agree on world trade of automobile parts.

The main thing that I learned about conspiracy theory, is that conspiracy theorists believe in a conspiracy because that is more comforting. The truth of the world is that it is actually chaotic. The truth is that it is not The Iluminati, or The Jewish Banking Conspiracy, or the Gray Alien Theory. The truth is far more frightening - Nobody is in control. The world is rudderless.

The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

It is not competition, but monopoly, that deprives labor of its product. Destroy the banking monopoly, establish freedom in finance, and down will go interest on money through the beneficent influence of competition. Capital will be set free, business will flourish, new enterprises will start, labor will be in demand, and gradually the wages of labor will rise to a level with its product.

The gang that trashed the town was now back in town to trash it even more and you'll never guess.. they decided that the only way to save an economy brought to its knees by their collective actions and the banking system they represent was to, well, no, surely not.. hand trillions of taxpayer-borrowed dollars to the Rothschild-controlled banks and insurance companies like CitiGroup, J. P. Morgan, AIG and a long list of others.