Top 1200 Banks Quotes & Sayings - Page 2

Explore popular Banks quotes.

Last updated on November 12, 2024.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

In the old days we were the challenger brand competing against the big banks, but today I go round the world and I sit with governors of central banks and finance ministers and, in some cases, prime ministers. They all know Travelex. We are regarded as the establishment - the world's largest retailer of foreign currency.

Temporary nationalization of the banks that are in very bad shape would mean basically that the government is the temporary owner. I always believe that the government should focus on its comparative advantages, and banking is not one of them. It should, therefore, if it nationalizes banks, sell them back to the private sector.

Critics, often for good reason, are concerned that the Fed is wielding its vast powers in the interests of the banks and not in the interests of the people. After the financial crisis, Americans have perceived that the banks have been bailed out, but a significant proportion of the population is still in serious economic trouble.

There's only one thing that all of the central banks control and that is the base, their own liability, and they can control that in various ways. They can control it directly by open market operations, buying and selling government securities or other assets, for example, buying and selling gold, or they can control it indirectly by altering the rate at which banks lend to one another.

I admit that one should never underestimate the capacity of banks to destroy enormous amounts of accumulated capital and reduce, temporarily, the supply. After all, capital is the accumulated savings of mankind. And banks are great masters in destroying enormous amounts of capital with great regularity.

On the Glass-Steagall thing, like I said, if you could demonstrate to me that it was a mistake, I'd be glad to look at the evidence. But I can't blame [the Republicans]. This wasn't something they forced me into. I really believed that given the level of oversight of banks and their ability to have more patient capital, if you made it possible for [banks] to go into the investment banking business as continental European investment banks could always do, that it might give us a more stable source of long-term investment.

On banks, I make no apology for attacking spivs and gamblers who did more harm to the British economy than Bob Crow could achieve in his wildest Trotskyite fantasies, while paying themselves outrageous bonuses underwritten by the taxpayer. There is much public anger about banks and it is well deserved.

To save the banks from making losses that would wipe out their net worth, you'll have to get rid of Social Security. It means that you'll essentially have to abolish government and turn it over to the banking system to run, with an idea that the role of governments is to extract income from the economy to pay to the bondholders and the banks.

People have to pay so much money to the banks that they don't have enough money to buy the goods and services they produce. So there's not much new investment, there's not new employment (except minimum-wage "service" jobs), markets are shrinking, and people are defaulting. So many companies can't pay their banks.

If the government has any courage, it will punish those at the top of failed banks. Accountability is critical in every area of human endeavour - there has to be a penalty for failure; otherwise, it's only a matter of time before the economic pain our banks have caused to so many innocent businesses and homeowners is forgotten.

We've been following many forms of democratized ownership, starting with co-ops, land banks at the neighborhood level, municipal ownership and state ownership of banks - there's a whole series of these that attempt to fill the small-scale infrastructure that can build up to a larger theoretical vision.

The goal of the FED, as with all central banks, is three-fold: (1) to protect the largest commercial banks from their depositors, who occasionally exercise their contractual right to withdraw currency (the ungrateful cads); (2) to control entry of newcomers into the bankers' cartel (interlopers); (3) to keep the stock market from collapsing in a panic, thereby persuading depositors to withdraw currency

The States is run by the Federal Reserve, an institution that answers only to itself and to a few large banks. It's modelled on the Bank of England. Ben Franklin said that one of the main reasons America revolted was to get away from the Bank of England, the mother of all central banks - the most pernicious and insidious of all.

Instead of abandoning competition and giving banks protected monopolies once again, the public would be better served by making it easier to close banks when they get into trouble. Instead of making banking boring, let us make it a normal industry, susceptible to destruction in the face of creativity.

Under Bill Clinton's HUD Secretary Andrew Cuomo, Community Reinvestment Act regulators gave banks higher ratings for home loans made in 'credit-deprived' areas. Banks were effectively rewarded for throwing out sound underwriting standards and writing loans to those who were at high risk of defaulting.

Yes, when they're buying there are more buyers in the market and that's supportive of the price. The more buyers you have, the firmer the price is going to be. When central banks were selling it was a headwind the market had to overcome. Now it's a tailwind that central banks are joining the buyers.

What central banks can control is a base and one way they can control the base is via manipulating a particular interest rate, such as a Federal Funds rate, the overnight rate at which banks lend to one another. But they use that control to control what happens to the quantity of money. There is no disagreement.

The Fed has a lot of power in the economy because it has a big impact on the supply and cost of credit, that is, interest rates. It also plays a key role in supervising banks and historically has seemed to take it easy on the banks when it shouldn't have, such as in the lead up to the financial crisis.

Of other countries, to impose economic sanctions, it'd really begin to dry up the enormous amount of money coming into North Korea, a lot of it from China - from Chinese banks - whereas, if we sanction the Chinese banks, there could be friction with China. But this is something we're going to have to face.

If two parties, instead of being a bank and an individual, were an individual and an individual, they could not inflate the circulating medium by a loan transaction, for the simple reason that the lender could not lend what he didn't have, as banks can do. Only commercial banks and trust companies can lend money that they manufacture by lending it.

It's responsible for the sloppiness and imprecision of the War on Terror, for example. It's responsible for taking people's tax dollars and spending the country into debt on useless wars and pointless pork projects to buy votes. It's responsible for bailing out the banks instead of standing up for the people the banks cheated. It's responsible for plenty.

Instability mostly comes from the interface between the fact that the banks (or shadow banks) can create credit, money, and purchasing power in infinite quantities if we don't constrain them, and the fact that credit is primarily created to fund the purchase of urban real estate and land, which is somewhat fixed in supply.

Here's Hillary Clinton getting away with tying the Republicans to rich people. She's tying the Republican Party to Wall Street, to the big banks. She's tying the Republican Party to the financial crisis in 2008. It's all their fault. She's tying herself as with the low-income crowd - and the average, ordinary middle class American - as their champion, as their defender. They don't know that it's not the Republicans in bed with banks. They don't know that it's the banks that are practically paying for and underwriting the Democrat Party and Hillary Clinton today.

We [US government] have used our taxpayer dollars not only to subsidize these banks but also to subsidize the creditors of those banks and the equity holders in those banks. We could have talked about forcing those investors to take some serious hits on their risky dealings. The idea that taxpayer dollars go in first rather than last - after the equity has been used up - is shocking.

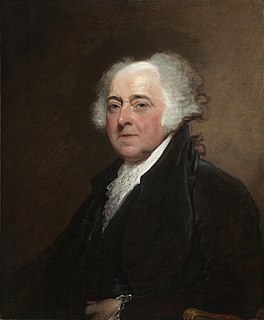

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.

Fannie Mae and Freddie Mac - two bloated and corrupt government-sponsored programs - contributed heavily to the crisis.In order to prevent another crisis, we need to do what we should have done years ago - reform Fannie Mae and Freddie Mac. We also need to repeal Dodd-Frank, the Democrats' failed solution. Under Dodd-Frank, 10 banks too big to fail have become five banks too big to fail. Thousands of community banks have gone out of business.