Top 64 Borrowers Quotes & Sayings

Explore popular Borrowers quotes.

Last updated on April 21, 2025.

Beware leverage in all its forms. Borrowers - individual, corporate, or government - should always match fund their liabilities against the duration of their assets. Borrowers must always remember that capital markets can be extremely fickle, and that it is never safe to assume a maturing loan can be rolled over. Even if you are unleveraged, the leverage employed by others can drive dramatic price and valuation swings; sudden unavailability of leverage in the economy may trigger an economic downturn.

The Treasury plan is a disgrace: a bailout of reckless bankers, lenders and investors that provides little direct debt relief to borrowers and financially stressed households and that will come at a very high cost to the US taxpayer. And the plan does nothing to resolve the severe stress in money markets and interbank markets that are now close to a systemic meltdown.

I had begun to worry about the housing market back in 2003, when lenders first resurrected interest-only mortgages, loosening their credit standards to generate a greater volume of loans. Throughout 2004, I had watched as these mortgages were offered to more and more subprime borrowers - those with the weakest credit.

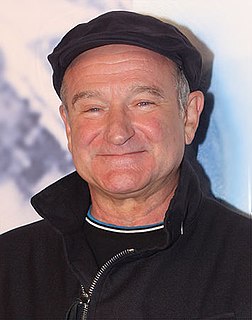

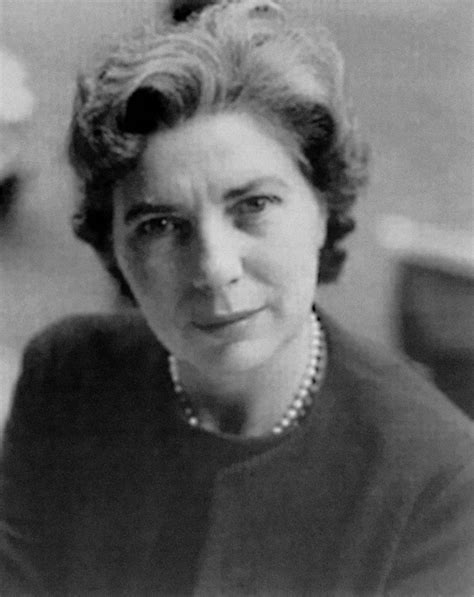

I was a kid who loved to read. I read everything I could get my hands on. I didn't have one favorite book. I had lots of favorite books: 'The Borrowers' by Mary Norton, 'Paddington' by Michael Bond, 'A Little Princess' by Frances Hodgson Burnett, 'Stuart Little' by EB White, 'A Cricket in Times Square,' all the Beverly Cleary books.

As the run-by-capital society of producers turned since into the run-by-capital society of consumers, I would say that the main, indeed "meta", function of the governments has become now to assure that it is the meetings between commodities and the consumers, and credit issuers and the borrowers, that regularly take place.

While conventional wisdom has traditionally sided against borrowing from retirement savings, sentiment has shifted toward borrowing from one's own assets with the realization that other forms of credit come at a much higher cost and often are not even available to borrowers with limited means and urgent needs.