Top 112 Buffett Quotes & Sayings

Explore popular Buffett quotes.

Last updated on April 14, 2025.

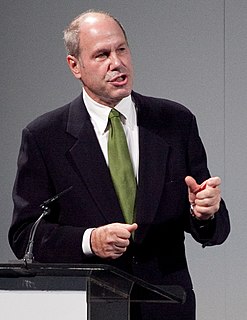

If Warren Buffett could change his mind about investing in airlines, Mohnish Pabrai could change his mind about investing in autos. Pabrai, who has modeled his investment career and fee structure after Buffett's original partnership, counts General Motors, Fiat Chrysler, and Ferrari in his highly concentrated portfolio.

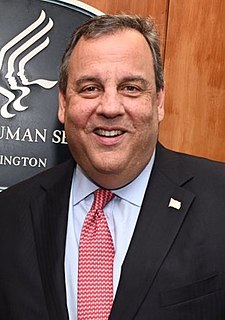

If you took every single penny that Warren Buffett has, it'd pay for 4-1/2 days of the US government. This tax-the-rich won't work. The problem here is the government is way bigger than even the capacity of the rich to sustain it. The Buffett Rule would raise $3.2 billion a year, and take 514 years just to pay off Obama's 2011 budget deficit.