Top 112 Buffett Quotes & Sayings - Page 2

Explore popular Buffett quotes.

Last updated on April 16, 2025.

There's a clarity that comes with great ideas: You can [easily and simply] explain why something's a great business, how and why it's cheap, why it's cheap for temporary reasons and how, on a normal basis, it should be trading at a much higher level. You're never sitting there on the 40th page of your spreadsheet, as Buffett would say, agonizing over whether you should buy or not.

Warren Buffett likes to say that the first rule of investing is "Don't lose money," and the second rule is, "Never forget the first rule." I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather "don't lose money" means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

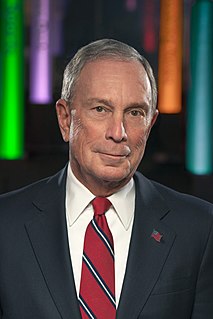

At least once a year, I meet with a group called the Giving Pledge. It's a group of billionaires - including me, Warren Buffett, Bill Gates, and Ted Turner - who have pledged to give away most of their money to charity. We meet for three days to talk about what we're doing to help make the planet a better place to live.

Berkshire has the lowest turnover of any major company in the U.S.The Walton family owns more of Wal-Mart than Buffett owns of Berkshire, so it isn't because of large holdings. It's because we have a really unusual shareholder body that thinks of itself as owners and not holders of little pieces of paper.

To value investors the concept of indexing is at best silly and at worst quite hazardous. Warren Buffett has observed that "in any sort of a contest - financial, mental or physical - it's an enormous advantage to have opponents who have been taught that it's useless to even try." I believe that over time value investors will outperform the market and that choosing to match it is both lazy and shortsighted.

If P=NP, then the world would be a profoundly different place than we usually assume it to be. There would be no special value in “creative leaps,” no fundamental gap between solving a problem and recognizing the solution once it's found. Everyone who could appreciate a symphony would be Mozart; everyone who could follow a step-by-step argument would be Gauss; everyone who could recognize a good investment strategy would be Warren Buffett.

I'm probably wouldn't do anything differently if I had to do it again. Every little thing that happens to you, good and bad, becomes a little piece of the puzzle of who you become. Every successful person you read about - Warren Buffett, Bill Gates - they all say pretty much the same thing. 'Do what you love.' I know I did.

Buffett's uncommon urge to chronicle made him a unique character in American life, not only a great capitalist but the Great Explainer of American capitalism. He taught a generation how to think about business, and he showed that securities were not just tokens like the Monopoly flatiron, and that investing need not be a game of chance. It was also a logical, commonsensical enterprise, like the tangible businesses beneath. He stripped Wall Street of its mystery and rejoined it to Main Street -- a mythical or disappearing place, perhaps, but one that is comprehensible to the ordinary American.

The great lesson in microeconomics is to discriminate between when technology is going to help you and when it's going to kill you. And most people do not get this straight in their heads. But a fellow like Buffett does. For example, when we were in the textile business, which is a terrible commodity business, we were making low-end textiles-which are a real commodity product. And one day, the people came to Warren and said, "They've invented a new loom that we think will do twice as much work as our old ones."

Behind every liberal philanthropist fortune is a huge capitalist score. Bill Gates and Warren Buffett can afford now to be liberal - an expensive indulgence - because in their early incarnations they were no-holds-barred capitalists who made lots of enemies conducting business without mercy and in search of pure profit.

Buffett's methodology was straightforward, and in that sense 'simple.' It was not simple in the sense of being easy to execute. Valuing companies such as Coca-Cola took a wisdom forged by years of experience; even then, there was a highly subjective element. A Berkshire stockholder once complained that there were no more franchises like Coca-Cola left. Munger tartly rebuked him. 'Why should it be easy to do something that, if done well two or three times, will make your family rich for life?

Over and over again, financial experts and wonkish talking heads endeavor to explain these mysterious, 'toxic' financial instruments to us lay folk. Over and over, they ignobly fail, because we all know that no one understands credit default obligations and derivatives, except perhaps Mr. Buffett and the computers who created them.

I was announcing to the public, in 2006, that I'd be leaving Microsoft in a couple of years and focusing full-time on the foundation. That was the time at which we went back to New York and Warren [Buffett] announced these gifts to a number of foundations, with a very high percentage of it going to us and basically doubling our capacity.

If there are still honest-smart men and women within those old and noble traditions, they should think carefully, observe and diagnose the illness. They should face the contradiction. Discuss the conflation. And then do as Warren Buffett and Bill Gates and many others have done. Choose the miracle of creative competition over an idolatry of cash. They should stand up.

At one point, I recognized that Warren Buffett, though he had every advantage in learning from Ben Graham, did not copy Ben Graham but, rather, set out on his own path and ran money his way, by his own rules... I also immediately internalized the idea that no school could teach someone how to be a great investor.

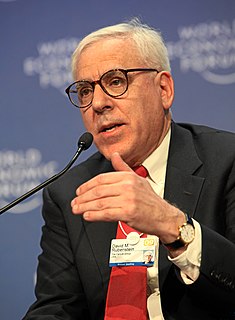

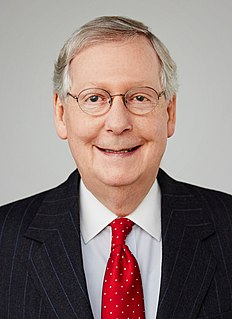

I've said repeatedly publicly, and other members have, that until you adjust the eligibility for entitlements, do things like raising the age for Medicare for future beneficiaries. Not for those currently receiving or those about to receive. Have serious means testing for high income people. You know Warren Buffett's always complaining about not paying enough taxes. And what I'm complaining about is we're paying for his Medicare. We ought not to be providing these kinds of benefits for millionaires and billionaires.

Warren Buffett is right when he says you should invest as if the market is going to be closed for the next five years. The fundamental principles of value investing, if they make sense to you, can allow you to survive and prosper when everyone else is rudderless. We have a proven map with which to navigate. It sounds kind of crazy, but in times of turmoil in the market. I’ve felt a sort of serenity in knowing that if I’ve checked and rechecked my work, one plus one still equals two regardless of where a stock trades right after I buy it.

In the philanthropy game, you're going for different outcomes: saving childhood lives, having kids grow up - because they don't have malnutrition or disease - that they achieve their full potential. We take for Warren [Buffett] things that, because he's very intelligent about the world but doesn't get to go out in Africa and see what we see, we've taken and say to him where we stand and it's basically a very positive report that his gift has made a phenomenal difference.

At what age did Warren Buffett come into philanthropy? At 76. He gave a very good reason. He said his wife was considerably younger than him. And all Americans believe they would live till 80, and they do live till 80. He told his wife that when he is gone, she should take care of whatever they need to do.

Vladimir Putin is the wealthiest man on the planet, for sure. But this is different to the wealth of a Bill Gates or a Warren Buffett, a Carlos Slim or a Sergey Brin. They stay wealthy whether it is Barack Obama or Donald Trump in power. Putin's wealth depends on him staying in power. It is all about controlling the budget, the hard currency reserves and keeping under his thumb the oligarchs who cannot move their money without his permission. It is something close to a trillion dollars that he can control and move.

I think reading intelligent expressions of different points of view is a good thing, and there is a way in which being in academia in a classroom at the University probably gives you, can give you an academic view of things, and reading actual real time debates about what should we do in Syria or the Buffett rule, budget issues...gives you a kind of sense that's hard to get in a classroom.

We came from where people don't look like they have money anyway. We came up in an era where the dudes who had all of the money looked regular, the same way you see billionaires in some run down shoes or old jeans. You see how Warren Buffett, Bill Gates and those dudes dress. Even in our era, the dudes with the money weren't flashy.

I admire leaders in science, people who really figure things out like Richard Fineman or people who work on vaccines, tons of people working on [the] HIV vaccine. There's leaders in business, people like Warren Buffett, who've got a certain approach they take that are pretty amazing. There [are] product innovators like Steve Jobs was, where he gets behind a concept and does a fantastic job.

There are many people who think we should have zero tax on capital gains, interest and dividends for everybody, as - the very, very wealthy. But recognize that means that Bill Gates and Warren Buffett would pay no income tax at all. And some people say, 'Well, that's a good thing for growth of the economy.'

Buffett was a billionaire who drove his own car, did his own taxes, and still lived in a home he had bought in 1958 for $31,500. He seemed to answer to a deeply rooted, distinctly American mythology, in which decency and common sense triumphed over cosmopolitan guile, and in which an idealized past held firm against a rootless and too hurriedly changing present.

Wal-Mart, with its legendary focus on customer value in terms of price, is innovating in sustainability. Now, we're beginning to see the mirror image, a convergence, as the not-for-profit sector is beginning to serve more effectively by applying private sector accountability and efficiencies to social needs. This reflects a rising recognition that to serve others best requires more than good intentions; it mandates a focus on real-world results. Bill Gates and Warren Buffett are among the most conspicuous advocates and representatives of this transformation.