Top 1200 Bull Market Quotes & Sayings - Page 17

Explore popular Bull Market quotes.

Last updated on December 22, 2024.

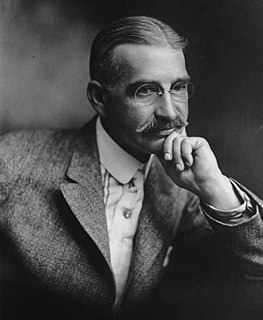

The great virtue of free enterprise is that it forces existing businesses to meet the test of the market continuously, to produce products that meet consumer demands at lowest cost, or else be driven from the market. It is a profit-and-loss system. Naturally, existing businesses generally prefer to keep out competitors in other ways. That is why the business community, despite its rhetoric, has so often been a major enemy of truly free enterprise.

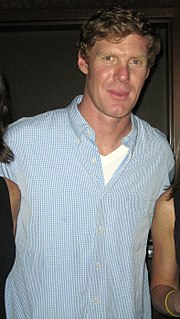

I love working for myself. I've grown to dislike the Hollywood machine. Too much bull, disappointment, and quite frankly, untalented, mindless, and hugely disrespectful people involved in the process. I'll take carrying the load on my back, all the way up Everest if needed, to be able to steer away from it.

If you go back to Adam Smith, you find the idea that markets and market forces operate as an invisible hand. This is the traditional laissez-faire market idea. But today, when economics is increasingly defined as the science of incentive, it becomes clear that the use of incentives involves quite active intervention, either by an economist or a policy maker, in using financial inducements to motivate behavior. In fact, so much though that we now almost take for granted that incentives are central to the subject of economics.

For they (capitalists) hold as their chief heresy, in a coarser form, the fundamental falsehood that things are not made to be used but made to be sold. All the collapse of their commercial system in their own time has been due to that fallacy of forcing things on a market where there was no market; of continually increasing the power of supply without increasing the power of demand; of briefly, of always considering the man who sells the potato and never considering the man who eats it.

One of my favorite patterns is the tendency for the markets to move from relative lows to relative highs and vice versa every two to four days. This pattern is a function of human behavior. It takes several days of a market rallying before it looks really good. That’s when everyone wants to buy it, and that’s the time when the professionals, like myself, are selling. Conversely, when the market has been down for a few days, and everyone is bearish, that’s the time I like to be buying.

There are a few elements - especially platinum and palladium - that have the amazing ability to absorb up to 900 times their own volume in hydrogen gas. To get a sense of the scale there, that's roughly equivalent to a 250-pound man swallowing something the size of a dozen African bull elephants and not gaining an inch on his waistline.

Experience conclusively shows that index-fund buyers are likely to obtain results exceeding those of the typical fund manager, whose large advisory fees and substantial portfolio turnover tend to reduce investment yields. Many people will find the guarantee of playing the stock-market game at par every round a very attractive one. The index fund is a sensible, serviceable method for obtaining the market's rate of return with absolutely no effort and minimal expense.

There are times when a market such as housing, transportation or the stock or mortgage market keep rising and people with capital want to join in this growth. Soon the markets become overheated, partly because of the abundance of investment money and speculation. This is when the government should raise interest rates and increase the cost of borrowed money. Governments are shy about doing this because it could cause the very recession. Yet this is the best time to do this so that the inevitable recession never reaches the magnitude of the recent Great Recession.

Many politicians and pundits claim that the credit crunch and high mortgage foreclosure rate is an example of market failure and want government to step in to bail out creditors and borrowers at the expense of taxpayers who prudently managed their affairs. These financial problems are not market failures but government failure. ... The credit crunch and foreclosure problems are failures of government policy.

The great multinationals are unwilling to face the moral and economic contradictions of their own behavior - producing in low-wage dictatorships and selling to high-wage democracies. Indeed, the striking quality about global enterprises is how easily free-market capitalism puts aside its supposed values in order to do business. The conditions of human freedom do not matter to them so long as the market demand is robust. The absence of freedom, if anything, lends order and efficiency to their operations.

How have people come to be taken in by The Phenomenon of Man? We must not underestimate the size of the market for works of this kind [pseudoscience/'woo'], for philosophy-fiction. Just as compulsory primary education created a market catered for by cheap dailies and weeklies, so the spread of secondary and latterly tertiary education has created a large population of people, often with well-developed literary and scholarly tastes, who have been educated far beyond their capacity to undertake analytical thought.

The switch to the market in Eastern Europe, of course, has not exactly been one of the greatest advertisements for the market. There's no question the socialist system - and I hate to use the word 'socialist,' but I suppose some description of a system in which the state is in control - was breaking down, really collapsing. In these countries, most markedly in Russia itself and in a number of the others, it obviously was based on a tyranny, which is unacceptable even if it were producing good economic results, which it was not.

I respect not his labors, his farm where everything has its price, who would carry the landscape, who would carry his God, to market, if he could get anything for him; who goes to market for his god as it is; on whose farm nothing grows free, whose fields bear no crops, whose meadows no flowers, whose trees no fruits, but dollars.

One of the most important analytic tools when assessing an investment is an intellectually advantaged disparate view. This includes knowing more and perceiving the situation better than others do. It is also critical to have a keen understanding of what the market expectations for any investment truly are. Thus, the process by which a disparate perception, when correct, becomes consensus should lead to meaningful profit. Understanding market expectation is at least as important as, and often different from fundamental knowledge.

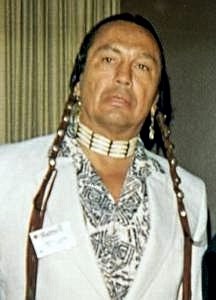

The proud spirit of the original owners of these vast prairies inherited through centuries of fierce and bloody wars for their possession, lingered last in the bosom of Sitting Bull. With his fall the nobility of the Redskin is extinguished, and what few are left are a pack of whining curs who lick the hand that smites them.

Let’s begin with capitalism, a word that has gone largely out of fashion. The approved reference now is to the market system. This shift minimizes - indeed, deletes - the role of wealth in the economic and social system. And it sheds the adverse connotation going back to Marx. Instead of the owners of capital or their attendants in control, we have the admirably impersonal role of market forces. It would be hard to think of a change in terminology more in the interest of those to whom money accords power. They have now a functional anonymity.

The business plan should address: "How will I get customers? How will I market the product or service? Who will I target?" The principles of a business plan are pretty much the same. But after page one to two, everything is unpredictable, because costs or competition will change and you don't know how things will be received by the market. You have to be able to continually adapt. Companies that fail to adapt will die. Others are brilliant at adapting.

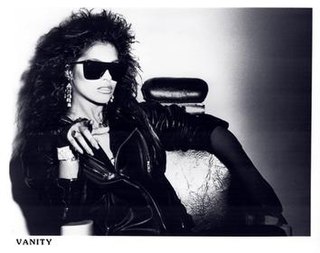

I think when you commit to somebody, and you take them off the market, right, I think it is your job as a woman or as a man to ... I don't think you should ever say no. I'm talking about if you're tired or somebody's like 'I'm tired.' No, because at the end of the day you took that person off of the market. They can't go and be with someone else because they're with you. So, don't you ever say no.

In short, what the living wage is really about is not living standards, or even economics, but morality. Its advocates are basically opposed to the idea that wages are a market price-determined by supply and demand, the same as the price of apples or coal. And it is for that reason, rather than the practical details, that the broader political movement of which the demand for a living wage is the leading edge is ultimately doomed to failure: For the amorality of the market economy is part of its essence, and cannot be legislated away.

If you let interest rates be freed, be set by the free market, they would rise dramatically. There would be a lot of broken furniture on Wall Street. It needs to be broken. The back of the speculative bubble would be broken and we could slowly heal the financial system. That's what I think we need to do but it's never going to happen because there's trillions of asset values dependent on the Fed continuing to suppress, repress interest rates and shovel $85 billion a month of liquidity into the market.

Warren Buffett is right when he says you should invest as if the market is going to be closed for the next five years. The fundamental principles of value investing, if they make sense to you, can allow you to survive and prosper when everyone else is rudderless. We have a proven map with which to navigate. It sounds kind of crazy, but in times of turmoil in the market. I’ve felt a sort of serenity in knowing that if I’ve checked and rechecked my work, one plus one still equals two regardless of where a stock trades right after I buy it.

If we somehow put a value on species extinction and factor that into our costs that bottom line would look very different. IF we put any resource depletion into costs our bottom line would change. So what we have is a dishonest market that does not take into account all the costs when it establishes its prices. We need an honest marketplace before we can let the market work for sustainability rather than against it as it works today.

What I believe is that people have many modes in which they can be. When we live in cities, the one we are in most of the time is the alert mode. The 'take control of things' mode, the 'be careful, watch out' mode, the 'speed' mode - the 'Red Bull' mode, actually. There's nothing wrong with it. It's all part of what we are.

The idea that a bell rings to signal when investors should get into or out of the stock market is simply not credible. After nearly fifty years in this business, I do not know of anybody who has done it successfully and consistently. I don't even know anybody who knows anybody who has done it successfully and consistently. Yet market timing appears to be increasingly embraced by mutual fund investors and the professional managers of fund portfolios alike.

America's universities are filled with economically ignorant haters of the free market, so university campuses have become major forums for union denunciations of such companies as Nike, Wal-mart, and others. Faculty and students claim to be concerned about 'social justice,' but they are simply being used as dupes by unions who are not at all concerned with justice of any sort. Rather, their main concern is increasing the coffers of union treasuries by driving non-union competitors from the market.

What is the free market? Well, the free market, [we're told] is really a terrible, inhuman kind of arrangement, because it treats people like commodities. But how does the government treat people? Like garbage-worse than garbage. Not like commodities, but like nothing. We libertarians understand that we are not humane, we are not compassionate. It's the leftists and the liberals, they're the ones who are human and compassionate, but you'd better not get in their way.

There is a bit of a problem with the match between derivative securities markets and the primary markets. We have long ago instituted principles, essentially high margin requirements, to prevent certain instabilities in the stock market, and I think they're basically correct. The trouble is that there's a linkage, let's say, between something like the stock market and the index futures markets, and the fact that the margin requirements are very different, for example, played some role in the October '87 crash.

Having observed his market calls real time over the years, I can say that Jason Perl's application of the DeMark Indicators distinguishes his work from industry peers when it comes to market timing. This book demonstrates how traders can benefit from his insight, using the studies to identify the exhaustion of established trends or the onset of new ones. Whether you're fundamentally or technically inclined, Perl's DeMark Indicators is an invaluable trading resource.