Top 1200 Bull Markets Quotes & Sayings

Explore popular Bull Markets quotes.

Last updated on April 15, 2025.

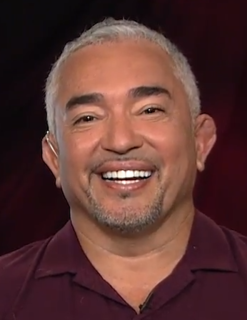

All dogs can become aggressive, but the difference between an aggressive Chihuahua and an aggressive pit bull is that the pit bull can do more damage. That's why it's important to make sure you are a hundred percent ready for the responsibility if you own a 'power' breed, like a pit bull, German shepherd, or Rottweiler.

On the one hand, you have markets such as Singapore and Thailand, with an extremely strong inbound booker market and a well-developed tourism industry. You also have markets that are just opening up to tourists, like Myanmar, that have massive growth potential and then markets that are extremely fragmented within themselves such as Indonesia.

During the night, while Bull and Lucy slept, Edward, with ever-open eyes, stared up at the constellations. He said their names, and then he said the names of the people who loved him. He started with Abilene, and then went on to Nellie and Lawrence and from there to Bull and Lucy, and then he ended again with Abilene: Abilene, Nellie, Lawrence, Bull, Lucy, Abilene. See? Edward told Pellegrina. I am not like the princess. I know about love.

The ability to change one's mind is probably a key characteristic of the successful investor. Dogmatic and rigid personalities rarely, if ever, succeed in the markets. The markets are a dynamic process, and sustained investment success requires the ability to modify and even change strategies as markets evolve.

Private equity capital in each of those markets Europe and Asia - while those markets have very different characteristics - fills a niche where either strategic investors or the public markets don't go, or don't want to go for some particular reason. I think that's going to continue to be the case going forward.

Markets are a social construction, they're made from institutions. We in a democratic society create markets, we constitute markets, we bring them into existence, and we shouldn't turn markets over to a narrow group of people who regulate them and run them in their interests, rather they should be run democratically for the common good.

Don Pedro - (...)'In time the savage bull doth bear the yoke.' Benedick - The savage bull may, but if ever the sensible Benedick bear it, pluck off the bull's horns and set them in my forehead, and let me be vildly painted; and in such great letters as they writes, 'Here is good horse for hire', let them signify under my sign, 'Here you may see Benedick the married man.

There are markets extending from Mali, Indonesia, way outside the purview of any one government which operated under civil laws, so contracts weren't, except on trust. So they have this free market ideology the moment they have markets operating outside the purview of the states, as prior to that markets had really mainly existed as a side effect of military operations.

In fighting a bull you're always aware of a paradox concerning your perceptions of the bull. On the one hand it's your perceptions of the bull that give you the upper hand. You read the bull, you learn to read the bull more and more accurately, and this reading of the bull is how you deploy your intelligence against the bull's intelligence. Your accuracy in reading the bull is a weapon, maybe your most important weapon, against all the bull's weapons. On the other hand, you're human, you have the human tendency to read into the bull things which may not actually be there.

In bullfighting there is a term called querencia. The querencia is the spot in the ring to which the bull returns. Each bull has a different querencia, but as the bullfight continues, and the animal becomes more threatened, it returns more and more often to his spot.As he returns to his querencia, he becomes more predictable. And so, in the end, the matador is able to kill the bull because in.

In bullfighting there is an interesting parallel to the pause as a place of refuge and renewal. It is believed that in the midst of a fight, a bull can find his own particular area of safety in the arena. There he can reclaim his strength and power. This place and inner state are called his querencia. As long as the bull remains enraged and reactive, the matador is in charge. Yet when he finds his querencia, he gathers his strength and loses his fear. From the matador's perspective, at this point the bull is truly dangerous, for he has tapped into his power.

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine--that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.