Top 1200 Bull Markets Quotes & Sayings - Page 3

Explore popular Bull Markets quotes.

Last updated on December 22, 2024.

The main purpose of advertising is to undermine markets. If you go to graduate school and you take a course in economics, you learn that markets are systems in which informed consumers make rational choices. That's what's so wonderful about it. But that's the last thing that the state corporate system wants. It is spending huge sums to prevent that.

In Germany it is good if as many people as possible join initiatives and peaceful demonstrations against the rule of the financial markets. Worshipping the unfettered freedom of global markets has brought the world to the brink of ruin. We now need social and ecological rules for the market economy.

The single most significant change has been the globalization of labor markets. Product markets - trade in goods - have been globalizing for years. But now, with the reduction in communication expenses and the building of all sorts of IT infrastructure, essentially any job can be done almost anywhere.

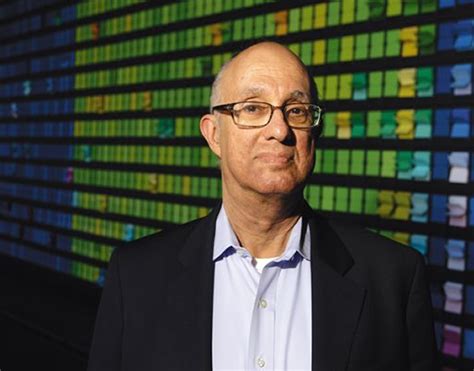

In the 40 years I've been working as an economist and investor, I have never seen such a disconnect between the asset market and the economic reality... Asset markets are in the sky, and the economy of the ordinary people is in the dumps, where their real incomes adjusted for inflation are going down and asset markets are going up.

Like its agriculture, Africa's markets are highly under-capitalized and inefficient. We know from our work around the continent that transaction costs of reaching the market, and the risks of transacting in rural, agriculture markets, are extremely high. In fact, only one third of agricultural output produced in Africa even reaches the market.

Fundamentals might be good for the first third or first 50 or 60 percent of a move, but the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic... There is no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it's the end of a bull market or the end of a bear market.

These people say free markets are the way to go, but wink, wink, the markets aren't really free. They're just a protectionist racket, and we have to pay for it all on every level. It's really quite extraordinary, and immoral, and illegal. These things need to be named, and shamed, and outed, and mocked, and prosecuted.

I mean the whole economy just comes to a grinding halt. Competence in markets and in institutions, it's a lot like oxygen. When you have it, you don't even think about it. Indispensable. You can go years without thinking about it. When it's gone for five minutes, it's the only thing you think about. And the oxygen has been sucked out of the credit markets.

I think people are complacent. But complacency is like any other metric. It's easy to measure where it is, but it's hard to tell how persistent it is. What causes really big bear markets is not just when people are overly complacent - it's when that complacency is sticky. As long as the skepticism can refresh itself, I think that the markets are still quite viable.

We have all learned everything we know physically—from walking to running a marathon—by trial and error, so there's no reason to become our own worst enemies when we suffer a setback. From time to time everyone falls short of their goals. It's an illusion to believe that champions succeed because they do everything perfectly. You can be certain that every archer who hits the bull's-eye has also missed the bull's-eye a thousand times while learning the skill.

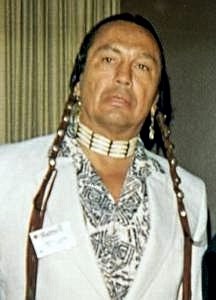

I feel obligated to offer the audience a good fight, and I have a responsibility to entertain the fans. But I also can't make the mistake of underestimating that bull. I would be stupid if I did. No matter how well prepared I am for a bullfight, I never know what will happen in the ring. I don't know how the bull will react and whether he'll give me an opportunity to display my skills. Perhaps he'll be too stubborn for that. And then there's also the wind that makes me afraid. It's a torero's greatest enemy.

The international institutions go around the world preaching liberalization, and the developing countries see that means open up your markets to our commodities, but we aren't going to open our markets to your commodities. In the nineteenth century, they used gunboats. Now they use economic weapons and arm-twisting.

In contrast, markets - oft mythologized as "natural" are the most unnatural things going. Libertarians will tell you "market laws are laws of nature", what baloney. Markets - and the other great modernist cornucopian tools - are magnificent wealth generating machines, built ad-hoc, through trial and error, constantly fine-tuned and refined, tinkered, adjusted.

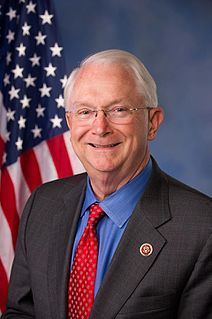

I was a Republican because I thought that those were the people who best supported markets. I think that is not true anymore. I was a Republican at a time when I felt like there was a problem that the markets were under a lot more strain. It worried me whether or not the government played too activist a role.

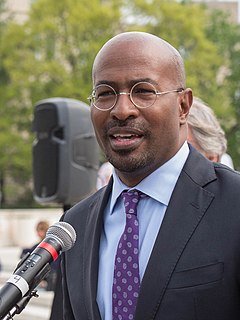

I think markets are mechanisms that determine prices that are necessary for mass heterogenous populations, and markets do generate levels of technological innovation and productivity that is crucial. But when unregulated, they often generate levels of vast inequality and ugly isolation that makes it difficult for people to relate and connect with one another.

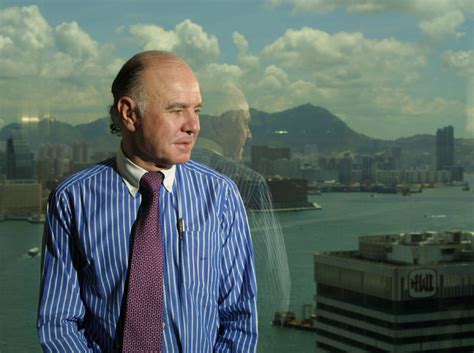

Part of my advantage is that my strength is economic forecasting, but that only works in free markets, when markets are smarter than people. That's how I started. I watched the stock market, how equities reacted to change in levels of economic activity, and I could understand how price signals worked and how to forecast them.

The Treasury plan is a disgrace: a bailout of reckless bankers, lenders and investors that provides little direct debt relief to borrowers and financially stressed households and that will come at a very high cost to the US taxpayer. And the plan does nothing to resolve the severe stress in money markets and interbank markets that are now close to a systemic meltdown.

History speaks pretty clearly that the markets do better with Democrats. Republicans' ideas of what constitutes fiscal responsibility simply are not good for the stock market. Democrats have many tendencies, but one of them is to look after the workers, and actually that tends to be good for demand and good for markets.

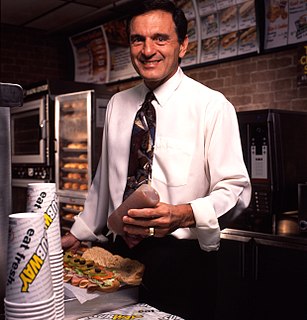

The thing about markets, and I think the thing people don't understand about that, is markets are not kind, but they're very efficient. So when the marketplace determines an inefficiency in the system, it corrects that, and a market system that's left alone will reward good behavior and punish bad behavior.

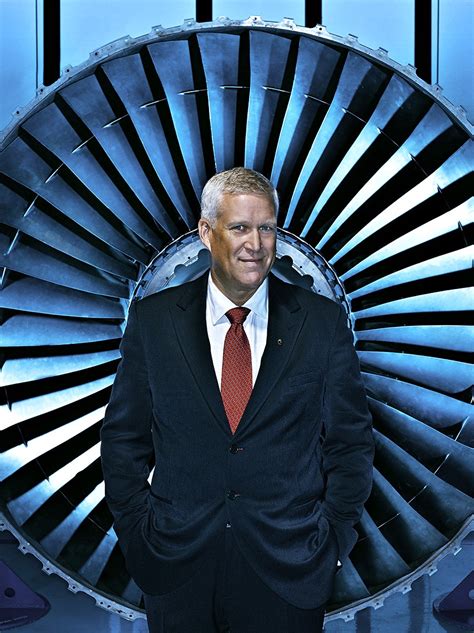

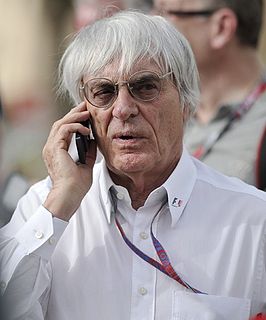

It's the engine. They should have never had that. The biggest mistake people have made... I say, "people," because it wasn't just me alone, was not insisting Mercedes supply Red Bull an engine. Because had they supplied the same engine as they had, you would have seen good racing, you would have seen Red Bull up there last year.