Top 1200 Capital Gains Tax Quotes & Sayings - Page 19

Explore popular Capital Gains Tax quotes.

Last updated on November 5, 2024.

It is significant that, as innocent babies are killed, and capital punishment is withheld from their murderers, the same men who plead for the murderer's life also demand the “right” to abortion. Usually, the same picketers that carry a sign one day, “Abolish Capital Punishment,” also carry “Legalize Abortion” another day. When this is called to their attention, their answer is, “There is no contradiction involved.” They are right: the thesis is “condemn the innocent and free the guilty.

Suppose that throughout your childhood you were good with numbers. Other kids used to copy your homework. You figured store discounts faster than your parents. People came to you for help with such things. So you took accounting and eventually became a tax auditor for the IRS. What an embarrassing job, right? You feel you should be writing poetry or doing aviation mechanics or whatever. But then you realize that tax collecting can be a calling too.

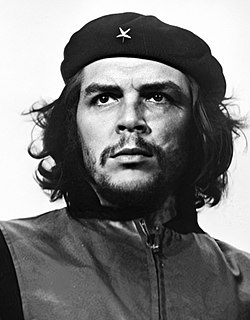

We must bear in mind that imperialism is a world system, the last stage of capitalism-and it must be defeated in a world confrontation. The strategic end of this struggle should be the destruction of imperialism. Our share, the responsibility of the exploited and underdeveloped of the world, is to eliminate the foundations of imperialism: our oppressed nations, from where they extract capital, raw materials, technicians, and cheap labor, and to which they export new capital-instruments of domination-arms and all kinds of articles, thus submerging us in an absolute dependence.

In proportion as the bourgeoisie, i.e., capital, is developed, in the same proportion is the proletariat, the modern working class, developed - a class of labourers, who live only so long as they find work, and who find work only so long as their labour increases capital. These labourers, who must sell themselves piecemeal, are a commodity, like every other article of commerce, and are consequently exposed to all the vicissitudes of competition, to all the fluctuations of the market.

Capital, and the question of who owns it and therefore reaps the benefit of its productiveness, is an extremely important issue that is complementary to the issue of full employment... I see these as twin pillars of our economy: Full employment of our labor resources and widespread ownership of our capital resources. Such twin pillars would go a long way in providing a firm underlying support for future economic growth that would be equitably shared.

We really believe that we can bring about changes in the tax code that will make America more attractive for investment and job creation and business. But the president has also made it very clear that he wants to put - he wants to put new elements in the tax code that are going to have companies pay a price if they decide to take jobs out of the country and then sell their goods back into the United States.

I think what grows the economy is when you get that tax credit that we put in place for your kids going to college. I think that grows the economy. I think what grows the economy is when we make sure small businesses are getting a tax credit for hiring veterans who fought for our country. That grows our economy.

Now all of the ideas that I'm talking about, they are not radical ideas. Making public colleges and universities tuition free, that exists in countries all over the world, used to exist in the United States. Rebuilding our crumbling infrastructure, and creating 13 million jobs by doing away with tax loopholes that large corporations now enjoy by putting their money into the Cayman Islands and other tax havens. That is not a radical idea.

After 25 quarters of so-called recovery under Obama, it has increased a total of only 14.3 percent. Compare this to earlier periods. After the JFK tax cuts of the early 1960s, the economy grew in total by roughly 40 percent. After the Reagan tax cuts of the 1980s, the economy grew by a total of 34 percent.

I know the difference between venture capital[ism] and vulture capitalism. Venture capitalism is a good thing, comes in, gives that gap funding to help these companies get off and get started creating jobs, and work. But Mitt Romney and Bain Capital were involved with what I call vulture capitalism. And they walked into Gaffney and took over that photo album company for no other reason than to basically pick the bones clean. And those people lost their jobs.

The Government in their own terms, for example, they banked the income for the backpackers' tax. But they had a process attached to the backpackers' tax of review that they wanted to go through. What the Government's saying now with this bill is any process, any detail, any reinvestment that Labor had as part of its package, we're meant to ignore all of that and it's only the cut part of it that we're meant to be committed to.

When a company wants to move to Mexico or another company - or another country and they want to build a nice, beautiful factory and they want to sell their product through our border, no tax, and the people that all got fired, so we end up with unemployment and debt, and they end up with jobs and factories and all of the other things, not going to happen that way. And the way you stop it is by imposing a tax.

In those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States. Many American investors properly made use of this deferral in the conduct of their foreign investment.

I kid the Republicans, with love. I feel bad for them. They got nobody for next time. Who are they gonna run? Sarah Palin, reading off her hand. Did you see that? You saw this? She wrote "tax cuts" on her hand. A Republican so stupid she has to be reminded of the one thing - Tax cuts! This is like if you saw the coyote's paw and it said "Road Runner".

You compare the nation to a parched piece of land and the tax to a life-giving rain. So be it. But you should also ask yourself where this rain comes from, and whether it is not precisely the tax that draws the moisture from the soil and dries it up. You should also ask yourself further whether the soil receives more of this precious water from the rain than it loses by the evaporation?

We also need to encourage Americans to become more fiscally responsible themselves. We can do this by redesigning our tax system into an expenditure tax with a single flat rate. ... We have to substantially reduce the size and scope of the federal government, fundamentally increase the role of the states in choosing their own practices, and bring decision-making closer to the people, not to unelected administrators. These steps are crucial to getting our nation on a path of fiscal, political and constitutional responsibility.

From 2008 to 2016 all the growth in the American economy, all the growth in national income, was earned just by the wealthiest 5% of the population. So they got all the growth. 95% of the population didn't grow. If you can get a flat tax or other lower tax, as Trump is suggesting, then this richest 5% will be able to keep even more money. That means that the 95% will be even poorer than they were before, relative to the very top.

For me, the goal is always to write a novel that I myself would like to read. People frequently ask me what my favorite book is, and in effect, there's always a capital-F Favorite, capital-B Book that I would like to write myself someday. I try to go for that ideal of writing the best, most entertaining, most beautifully written book that I possibly can.

It was an easy thing to tax for a young country. And then gradually we moved to property taxes, manufacturing taxes, and the income tax was the answer to a populist demand: Let's go after the rich guys. We got into World War I, and they raised the rates and started taxing the rich. Then we got into World War II, and that's when they taxed everybody, because they just needed more revenue.

You know, development sometimes is viewed as a project in which you give people things and nothing much happens, which is perfectly valid, but if you just focus on that, then you'd also have to say that venture capital is pretty stupid, too. Its hit rate is pathetic. But occasionally, you get successes, you fund a Google or something, and suddenly venture capital is vaunted as the most amazing field of all time. Our hit rate in development is better than theirs, but we should strive to make it better.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

Remember back in the nineties, a bunch of Democrats decided to tax luxury items, including yachts? They figured it was not fair that some people could afford yachts, and so since they could, they said, "We're gonna tax the hell out of yachts at the point of sale, 'cause it's not fair. We need to collect revenue from all this!" What happened was that the people who actually build the yachts lost their jobs because people stopped buying them.

If we can’t puncture some of the mythology around austerity, politics or tax cuts or the mythology that’s been built up around the Reagan revolution, where somehow people genuinely think that he slashed government and slashed the deficit and that the recovery was because of all these massive tax cuts, as opposed to a shift in interest-rate policy - if we can’t describe that effectively, then we’re doomed to keep on making more and more mistakes.

Even if Bush could be forgiven for taking America, and much of the rest of the world, to war on false pretenses, and for misrepresenting the cost of the venture, there is no excuse for how he chose to finance it. His was the first war in history paid for entirely on credit. As America went into battle, with deficits already soaring from his 2001 tax cut, Bush decided to plunge ahead with yet another round of tax "relief" for the wealthy.

I don't like the income tax. Every time we talk about these taxes we get around to the idea of 'from each according to his capacity and to each according to his needs'. That's socialism. It's written into the Communist Manifesto. Maybe we ought to see that every person who gets a tax return receives a copy of the Communist Manifesto with it so he can see what's happening to him.

Currency speculation-over a trillion dollars a day-is a tax-free activity. The notion of a tax on "day trades" or other speculative swaps was revived in recent years, but has been studiously ignored by all our purveyors of conventional economic wisdom. That is because we have been persuaded, against logic, and moral sense, that the institution that most needs our support these days is not society, nor the human community, but the global corporation.

Today, financial capital is no longer the key asset. It is human capital. Success is no longer about economic competence as the main leverage. It is about emotional intelligence. It is no longer about controls. It is about collaboration. It is no longer about hierarchies. It is about leading through networks. It is no longer about aligning people through structures and spreadsheets. It is about aligning them through meaning and purpose. It is no longer about developing followers. It is about developing leaders.

The information revolution has changed people's perception of wealth. We originally said that land was wealth. Then we thought it was industrial production. Now we realize it's intellectual capital. The market is showing us that intellectual capital is far more important that money. This is a major change in the way the world works. the same thing that happened to the farmers during the Industrial Revolution is now happening to people in industry as we move into the information age.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

What sets imperialism of the capitalist sort apart from other conceptions of empire is that it is the capitalist logic that typically dominates, though ... there are times in which the territorial logic comes to the fore. But this then poses a crucial question: how can the territorial logics of power, which tend to be awkwardly fixed in space, respond to the open spatial dynamics of endless capital accumulation? And what does endless capital accumulation imply for the territorial logics of power?