Top 1200 Capital Gains Quotes & Sayings - Page 3

Explore popular Capital Gains quotes.

Last updated on December 22, 2024.

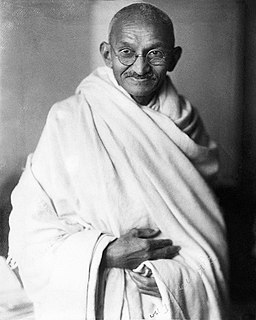

I think the money for the solutions for global poverty is on Wall Street. Wall Street allocates capital. And we need to get capital to the ideas that are successful, whether it's microfinance, whether it's through financial literacy programs, Wall Street can be the engine that makes capital get to the people who need it.

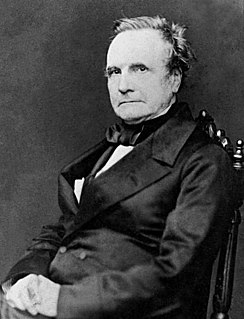

Remember that accumulated knowledge, like accumulated capital, increases at compound interest: but it differs from the accumulation of capital in this; that the increase of knowledge produces a more rapid rate of progress, whilst the accumulation of capital leads to a lower rate of interest. Capital thus checks it own accumulation: knowledge thus accelerates its own advance. Each generation, therefore, to deserve comparison with its predecessor, is bound to add much more largely to the common stock than that which it immediately succeeds.

I admit that one should never underestimate the capacity of banks to destroy enormous amounts of accumulated capital and reduce, temporarily, the supply. After all, capital is the accumulated savings of mankind. And banks are great masters in destroying enormous amounts of capital with great regularity.

While it is probably a poor idea to own actively managed funds in general, it is truly a terrible idea to own them in taxable accounts... taxes are a drag on performance of up to 4 percentage points each year... many index funds allow your capital gains to grow largely undisturbed until you sell... For the taxable investor, indexing means never having to say you're sorry.

The public psychology of going into debt for gain passes through several more or less distinct phases: (a) the lure of big prospective dividends or gains in income in the remote future; (b) the hope of selling at a profit, and realizing a capital gain in the immediate future; (c) the vogue of reckless promotions, taking advantage of the habituation of the public to great expectations; (d) the development of downright fraud, imposing on a public which had grown credulous and gullible.

I don't like the idea of capitalism anyway. Because it's not capital we are talking about; it's knowledge and creating well-being. Because I mean, that gets people on the wrong track when it's capital and how we allocate capital - no. How do we create the Republic of Science in America? How do we have a system of mutual benefits where people succeed by helping others improve their lives? So I don't like that at all.

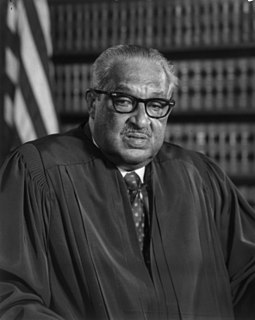

When in Gregg v. Georgia the Supreme Court gave its seal of approval to capital punishment, this endorsement was premised on the promise that capital punishment would be administered with fairness and justice. Instead, the promise has become a cruel and empty mockery. If not remedied, the scandalous state of our present system of capital punishment will cast a pall of shame over our society for years to come. We cannot let it continue.

There are but three political-economic roads from which we can choose... We could take the first course and further exacerbate the already concentrated ownership of productive capital in the American economy. Or we could join the rest of the world by taking the second path, that of nationalization. Or we can take the third road, establishing policies to diffuse capital ownership broadly, so that many individuals, particularly workers, can participate as owners of industrial capital. The choice is ours.

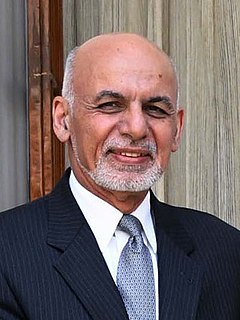

We have a legal system, and this is not something that happens all the time. We have capital punishment. America has capital punishment. Iran has capital punishment. Iran hangs people and leaves their bodies hanging on cranes. Iran put to death more than a thousand people last year. I don't see EU reporting on it.

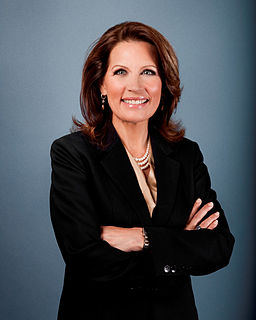

I'd like to help struggling homeowners who can't pay their mortgages, I'd like to invest in our crumbling infrastructure, I'd like to reform the tax system so multimillionaires can't pretend their earnings are capital gains and pay at the rate of 15 percent. I'd like to make public higher education free, and pay for it with a small transfer tax on all financial transactions. I'd like to do much more - a new new deal for Americans. But Republicans are blocking me at every point.

Contrary to the rhetoric emanating from the American left, the 'rich' are currently paying a lot more than 'their fair share.' It is only a handful of mega-rich, those whose entire incomes are derived from dividends and capital gains, rather than salaries or business profits, who have the ability to pay lower tax rates than some members of the middle class. The left knows this but continues to build their 'freeloading millionaire' straw man because it makes good politics.

The biggest gains, in terms of decreasing the country's energy bill, the amount of carbon dioxide we put into the atmosphere, and our dependency on foreign oil, will come from energy efficiency and conservation in the next 20 years. Make no doubt about it. That's where everybody who has really thought about the problem thinks the biggest gains can be and should be.

I'll give you a simple formula for straightening out the problems of the United States. First, you tax the churches. You take the tax off of capital gains and the tax off of savings. You decriminalize all and tax them same way as you do alcohol. You decriminalize . You make gambling legal. That will put the budget back on the road to recovery, and you'll have plenty of tax revenue coming in for all of your social programs, and to run the army.

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

Churches are more prosperous than at any time within the past several hundred years. But the alarming thing is that our gains are mostly external and our losses wholly internal; and since it is the quality of our religion that is affected by internal conditions, it may be that our supposed gains are but losses spread over a wider field.