Top 1200 Capital Investment Quotes & Sayings - Page 2

Explore popular Capital Investment quotes.

Last updated on April 16, 2025.

The risk of an investment is described by both the probability and the potential amount of loss. The risk of an investment-the probability of an adverse outcome-is partly inherent in its very nature. A dollar spent on biotechnology research is a riskier investment than a dollar used to purchase utility equipment. The former has both a greater probability of loss and a greater percentage of the investment at stake.

Obviously, consideration of costs is key, including opportunity costs. Of course capital isn't free. It's easy to figure out your cost of borrowing, but theorists went bonkers on the cost of equity capital. They say that if you're generating a 100% return on capital, then you shouldn't invest in something that generates an 80% return on capital. It's crazy.

Netflix, Amazon, iTunes - whatever platforms emerge - we are looking at as having the same potential that home video had for the movie business. Which means there are entirely new opportunities to monetize our capital investment in content and do so in ways that work for distributors, for consumers and for creators.

Investment in the eradication of hunger today is a good business decision. If we fail to make this investment, it is doubtful that we can sustain healthy economic growth. Without this investment, our nation may disintegrate into a country sharply divided between those who have enough to eat and those who do not.

The purpose of the capital formation presentations and roundtable discussions is to create a dialogue with business leaders, economic development organizations, business incubators, and community leaders to promote investment in Montana and support businesses as they start up and/or grow their existing operations.

My rather puritanical view is that any investment manager, whether operating as broker, investment counselor of a trust department, investment company, etc., should be willing to state unequivocally what he is going to attempt to accomplish and how he proposes to measure the extent to which he gets the job done.

You know, in a business, you have to operate on the basis of voluntary investment by individuals in a cause. With government, there is no voluntary effort to invest capital. It's just taken and invested. And the same accountability is not at play. The same natural forces in the economy are not at play.

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

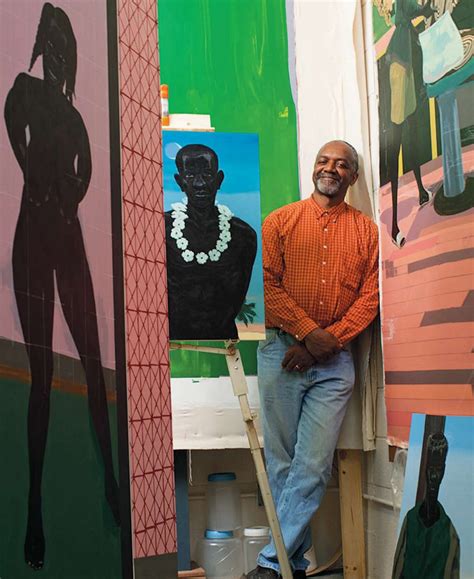

Working in the context of ultra-famous brands like Dior and Vuitton, creative spirits are always going to feel reined in. It's important that they are free to develop ideas. And rather than detracting from the principal job, it reinforces it. I think of that money as venture capital. It's not a big investment.