Top 1200 Commercial Banks Quotes & Sayings - Page 2

Explore popular Commercial Banks quotes.

Last updated on October 25, 2024.

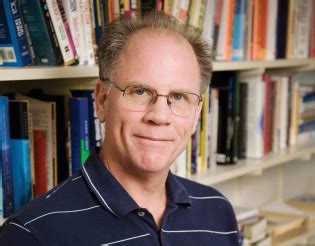

We [US government] have used our taxpayer dollars not only to subsidize these banks but also to subsidize the creditors of those banks and the equity holders in those banks. We could have talked about forcing those investors to take some serious hits on their risky dealings. The idea that taxpayer dollars go in first rather than last - after the equity has been used up - is shocking.

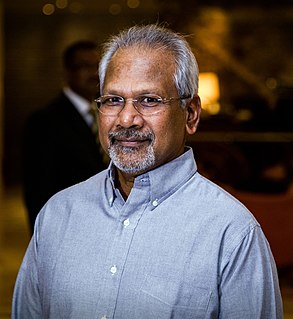

Both in the US and throughout the world, there needs to be a growing presence of public development banks. These banks would make loans based on social welfare criteria - including advancing a full-employment, climate-stabilization agenda - as opposed to scouring the globe for the largest profit opportunities regardless of social costs.... Public development banks have always played a central role in supporting the successful economic development paths in the East Asian economies.

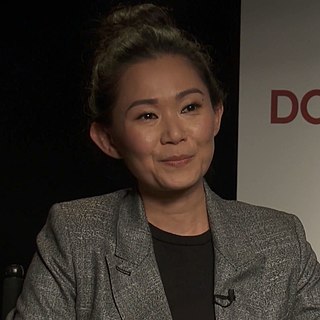

In the US, commercial interests stole the airwaves early on, before public broadcasters could get a stab at it. And the deal that was made with public broadcasting was, "Okay, we'll allow there to be a handful of public stations to do the educational programming that commercial broadcasters don't want to do, but the deal is they can't do anything that can generate an audience, anything that's commercially viable." Anything they do that could be commercially viable could be considered unfair competition to commercial interests and should only be on the commercial stations.

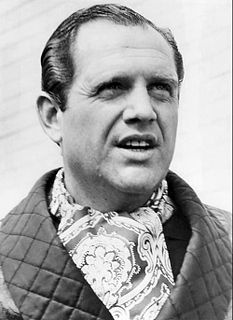

On the Glass-Steagall thing, like I said, if you could demonstrate to me that it was a mistake, I'd be glad to look at the evidence. But I can't blame [the Republicans]. This wasn't something they forced me into. I really believed that given the level of oversight of banks and their ability to have more patient capital, if you made it possible for [banks] to go into the investment banking business as continental European investment banks could always do, that it might give us a more stable source of long-term investment.

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

The Fed has a lot of power in the economy because it has a big impact on the supply and cost of credit, that is, interest rates. It also plays a key role in supervising banks and historically has seemed to take it easy on the banks when it shouldn't have, such as in the lead up to the financial crisis.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

Banks don't want certain asset classes, and that's created opportunities for private equity, hedge funds, Silicon Valley. In this case I think he was referring to some of the European banks shedding assets, and the big buyers are probably not going to be big American banks. Someone like Blackstone may have a very good chance to buy those assets, leverage them, borrow up a little bit, and do something good there.

I really love sharing with young Canadians the changes we're seeing in the space program right now with what we call "commercial space." We have commercial cargo delivery to the space station, and now we have what we call "commercial crew," where we're going to be delivering people to low orbit on new vehicles that are being designed by Boeing and SpaceX.

My first professional audition - god, I've never told anybody about this - was for a test commercial, I think it was for Xbox. It involved me getting kidnapped by a granny who wanted to play the Xbox. It was very weird and I definitely had no idea what I was doing. I actually got the gig. It wasn't a commercial; it was what directors did when they wanted to show the company what they would do with a commercial.