Top 1200 Commodity Prices Quotes & Sayings - Page 2

Explore popular Commodity Prices quotes.

Last updated on April 18, 2025.

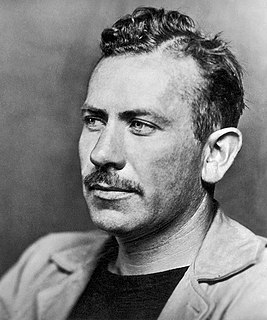

There used to be a thing or a commodity we put great store by. It was called the People. Find out where the People have gone. I don't mean the square-eyed toothpaste-and-hair-dye people or the new-car-or-bust people, or the success-and-coronary people. Maybe they never existed, but if there ever were the People, that's the commodity the Declaration was talking about, and Mr. Lincoln.

I think a lot of longevity, especially as a performer, depends on kind of what your commodity is. If your commodity is your cuteness and your chubby cheeks and your big gap between your teeth, if that's what your greatest asset is, of course that fails or that changes, you know, that goes away. Of course that fades.

The banker, therefore, is not so much primarily a middleman in the commodity "purchasing power" as a producer of this commodity. However, since all reserve funds and savings today usually flow to him, and the total demand for free purchasing power, whether existing or to be created, concentrates on him, he has either replaced private capitalists or become their agent; he has himself become the capitalist par excellence.

Economic theory has nothing to say as to what commodity will acquire the status of money. Historically, it happened to be gold. But if the physical makeup of our world would have been different or is to become different from what it is now, some other commodity would have become or might become money. The market will decide.

Under the antitrust laws, a man becomes a criminal from the moment he goes into business, no matter what he does. If he complies with one of these laws, he faces criminal prosecution under several others. For instance, if he charges prices which some bureaucrats judge as too high, he can be prosecuted for monopoly or for a successful 'intent to monopolize'; if he charges prices lower than those of his competitors, he can be prosecuted for 'unfair competition' or 'restraint of trade'; and if he charges the same prices as his competitors, he can be prosecuted for 'collusion' or 'conspiracy.'

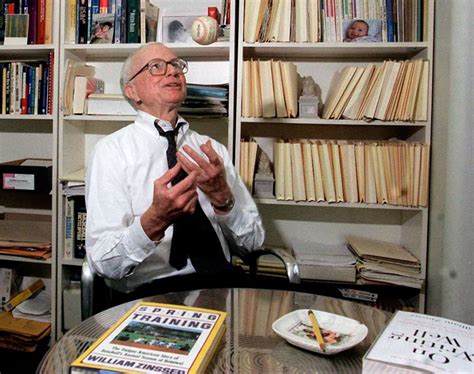

My commodity as a writer, whatever I'm writing about, is me. And your commodity is you. Don't alter your voice to fit the subject. Develop one voice that readers will recognize when they hear it on the page, a voice that's enjoyable not only in its musical line but in its avoidance of sounds that would cheapen its tone: breeziness and condescension and clichés.

The best taxes are such as are levied upon consumptions, especially those of luxury; because such taxes are least felt by the people. They seem, in some measure, voluntary; since a man may choose how far he will use the commodity: They naturally produce sobriety and frugality, if judiciously imposed: And being confounded with the natural price of the commodity, they are scarcely perceived by the consumers. Their only disadvantage is that they are expensive in the levying.

[The masses] ... must turn their hopes toward a miracle. In the depths of their despair reason cannot be believed, truth must be false, and lies must be truth. "Higher bread prices," "lower bread prices," "unchanged bread prices" have all failed. The only hope lies in a kind of bread price which is none of these, which nobody has ever seen before, and which belies the evidence of one's reason.

Women oftentimes are the ones making those economic decisions, sitting around the kitchen table and trying to figure out how to pay for rising gas prices or food prices or the health insurance costs. And I think that they see where they expect their leaders in Congress to also make those tough decisions.

People want to buy cheap and sell dear; this by itself makes them countertrend. But the notion of cheapness or dearness must be anchored to something. People tend to view the prices they’re used to as normal and prices removed from these levels as aberrant. This perpective leads people to trade counter to an emerging trend on the assumption that prices will eventually return to “normal”. Therein lies the path to disaster.

The mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful, it is an important element of the free-market system. The opportunity to charge monopoly prices - at least for a short period - is what attracts 'business acumen' in the first place; it induces risk taking that produces innovation and economic growth.

IQ is a commodity, data is a commodity. I'm far more interested in watching people interact at a restaurant with their smartphone. We can all read 'Tech Crunch,' 'Ad Age.' I would rather be living in the trenches. I would rather be going to Whole Foods in Columbus Circle to watch people shop with their smartphones.

The greatest danger to an adequate old-age security plan is rising prices. A rise of 2% a year in prices would cut the purchasing power of pensions about 45% in 30 years. The greatest danger of rising prices is from wages rising faster than output per man-hour.... Whether the nation succeeds in providing adequate security for retired workers depends in large measure upon the wage policies of trade unions.

Exporting oil would not drive up prices at the pump. American drivers buy refined products, which the U.S. already exports. Many studies - from a range of institutions and government agencies, including the Congressional Budget Office and the Energy Information Administration - have shown that lifting the export ban could actually lower gas prices.

I don't even think about the money when I consider roles, I turn it over to my agency. Money will come. I respect it but I don't thirst for it. I wish Americans thought more like Europeans when it comes to money and work. They take time off, they do what they love. We think work is the most valued commodity. Really the most valued commodity is time.

No politician can praise unemployment or inflation, and there is no way of combining high employment with stable prices that does not involve some control of income and prices. Otherwise the struggle for more consumption and more income to sustain it-a struggle that modern corporations, modern unions and modern democracy all facilitate and encourage-will drive up prices. Only heavy unemployment will then temper this upward thrust. Not many wish to confront the truth that the modern economy gives a choice only between inflation, unemployment, or controls.

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.

It's estimated that about 30 percent of the increase in grain prices could be attributed to the decision to embrace biofuels, particularly corn-based ethanol. It has done nothing for climate change and the business is in real trouble now with the collapse of oil prices. It's completely dependent on a dollar subsidy and tariff from the government.

The major changes that will be occurring within the new merged partnership are exciting in many ways. First, we will have the highest forecast distribution growth rate of any of the major MLPs. Second, our coverage will be above average for the same peer group with expected $1.1 billion of excess cash flow coverage through 2017 and the Access cash flows, along with our major new fee based projects continue to dramatically reduce exposure to commodity prices.

In the ten years leading up to 2013, quinoa prices nearly tripled on the back of skyrocketing international demand for the latest 'superfood'. The grain had traditionally been cultivated in the high Andean plateau, principally for household consumption. But as prices rose, farmers' incentive to sell it as a cash crop grew.