Top 1200 Credit Default Swap Quotes & Sayings

Explore popular Credit Default Swap quotes.

Last updated on April 14, 2025.

I do not allow myself to suppose that either the convention or the League, have concluded to decide that I am either the greatest or the best man in America, but rather they have concluded it is not best to swap horses while crossing the river, and have further concluded that I am not so poor a horse that they might not make a botch of it in trying to swap.

The best companies with the strongest credit ratings borrow like the United States: on a non-prioritized basis. This means that in the event of a default, all of their debts are of equal priority because lenders and creditors believe default is highly unlikely. And they spend considerable effort maintaining this status.

I have no credit cards. That was the decision that was made jointly by the credit card companies, and by me. I can't say that that was completely on my account. I buy nothing on credit now, nothing. If I can't afford it, I don't buy it. I have a debit card, that's all I have. Any debt that I have, I am paying down.

The full consequences of a default or even the serious prospect of default by the United States are impossible to predict and awesome to contemplate. Denigration of the full faith and credit of the United States would have substantial effects on the domestic financial markets and on the value of the dollar in exchange markets. The Nation can ill afford to allow such a result. The risks, the cost, the disruptions, and the incalculable damage lead me to but one conclusion: the Senate must pass this legislation before the Congress adjourns.

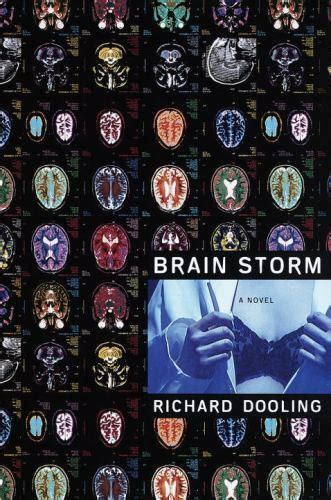

Over and over again, financial experts and wonkish talking heads endeavor to explain these mysterious, 'toxic' financial instruments to us lay folk. Over and over, they ignobly fail, because we all know that no one understands credit default obligations and derivatives, except perhaps Mr. Buffett and the computers who created them.

As you know, in the latter part of 2008 and early 2009, the Federal Reserve took extraordinary steps to provide liquidity and support credit market functioning, including the establishment of a number of emergency lending facilities and the creation or extension of currency swap agreements with 14 central banks around the world.

Of course most Americans don't know how A.I.G. brought the world's financial system to near-ruin or what credit-default swaps are. They may not even know what A.I.G. stands for. But Americans do make the connection between their fears about their own jobs and their broad understanding of the A.I.G. debacle.

As participants in a mobile culture, our default is to move. God embraces our broken world, and I have no doubt that God can use our movement for good. But I am convinced that we lose something essential to our existence as creatures if we do not recognize our fundamental need for stability. Trees can be transplanted, often with magnificent results. But their default is to stay.

The money has to be deferred with what they call "clawback," which means they can get it back if I lose it all. So that guy making ten million a year selling credit default swaps, if we're going to keep five million of it in escrow for ten years, and with the right to go back and get it, if he starts losing money, then we're going to give people the right incentives not too take so much risk.

I think the credit default swaps can take the place of the rating agencies who really have missed the ball in this procedure and are quite conflicted by the way the ratings are paid for. So, I would like to see credit default swaps become an evermore important way of understanding credit risk in the economy.

I mean, we've always had gold bugs, but now we sort of realize that Treasure Bills might be in the same category. And we have derivatives like credit default swaps which are in this category, and we have derivatives like volatilities that are actually an asset class that we can invest in which are now - would out perform if we have another financial crisis.