Top 107 Derivatives Quotes & Sayings

Explore popular Derivatives quotes.

Last updated on April 14, 2025.

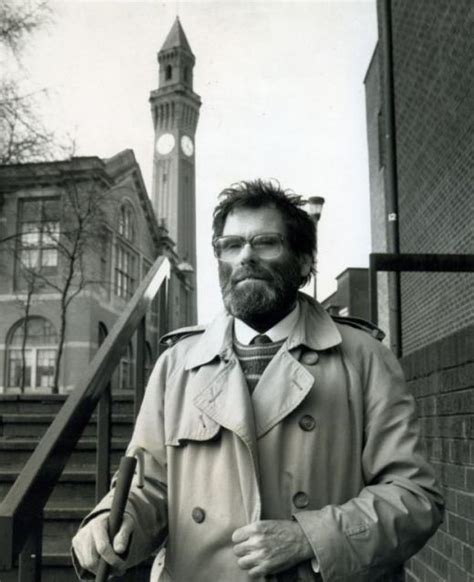

Everyone caved, adopted loose [accounting] standards, and created exotic derivatives linked to theoretical models. As a result, all kinds of earnings, blessed by accountants, are not really being earned. When you reach for the money, it melts away. It was never there. It [accounting for derivatives] is just disgusting. It is a sewer, and if I'm right, there will be hell to pay in due course. All of you will have to prepare to deal with a blow-up of derivative books.

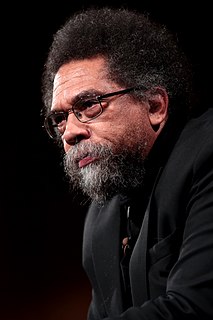

I mean, we've always had gold bugs, but now we sort of realize that Treasure Bills might be in the same category. And we have derivatives like credit default swaps which are in this category, and we have derivatives like volatilities that are actually an asset class that we can invest in which are now - would out perform if we have another financial crisis.

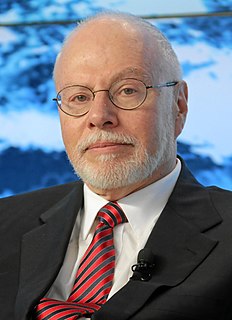

From the 1990s onward, the financial sector created a vast array of instruments designed to separate investors from their money, financial derivatives of an ever-increasing level of complexity. At some point, this complexity reached a point where even the creators of the derivatives themselves didn't understand them.