Top 1200 Dodd-Frank Quotes & Sayings

Explore popular Dodd-Frank quotes.

Last updated on April 14, 2025.

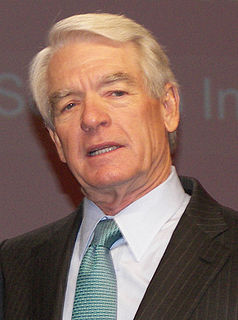

Dodd-Frank greatly expanded the regulatory reach of the Federal Reserve. It did not, however, examine whether it was correctly structured to account for these new and expansive powers. Therefore, the Committee will be examining the appropriateness of the Fed's current structure in a post Dodd-Frank world.

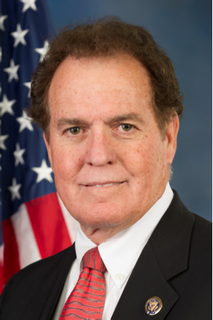

Fannie Mae and Freddie Mac - two bloated and corrupt government-sponsored programs - contributed heavily to the crisis.In order to prevent another crisis, we need to do what we should have done years ago - reform Fannie Mae and Freddie Mac. We also need to repeal Dodd-Frank, the Democrats' failed solution. Under Dodd-Frank, 10 banks too big to fail have become five banks too big to fail. Thousands of community banks have gone out of business.