Top 290 Earnings Quotes & Sayings

Explore popular Earnings quotes.

Last updated on April 14, 2025.

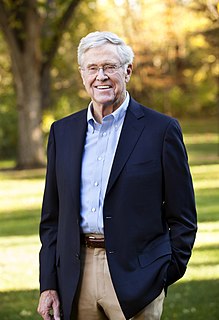

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

The big picture is: the main thing you should be concerned about in the future are incremental returns on capital going forward. As it turns out, past history of a good return on capital is a good proxy for this but obviously not foolproof. I think this is an area where thoughtful analysis can add value to any simple ranking/screening strategy such as the magic formula. When doing in depth analysis of companies, I care very much about long term earnings power, not necessarily so much about the volatility of that earnings power but about my certainty of "normal" earnings power over time.

I think there's an awful lot of twaddle and bullshit on EVA. The whole game is to turn retained earnings into more earnings. EVA has ideas about cost of capital that make no sense. Of course, if a company generates high returns on capital and can maintain this over time, it will do well. But the mental system as a whole does not work.

A brother with small earnings may ask,''Should I also give? My earning are already so small that my family can barely make ends meet.'' My reply is, ''Have you ever considered that the very reason your earnings remain so small may be because you spend everything on yourself? If God gave you more, you would only use it to increase your own comfort instead of looking to see who is sick or who has no work at all that you might help them.

The key is if the economic data stays soft, maybe we don't have to worry much about interest rates anymore. Then we need to worry about earnings. What gave us a really strong move in stock prices from late May until about two weeks ago was this heightened optimism that maybe interest rates are at that high. That gave you a relief rally. Now reality is setting in - if we've seen the worst on interest rates then we've seen the best on earnings.

Liberals believe government should take people's earnings to give to poor people. Conservatives disagree. They think government should confiscate people's earnings and give them to farmers and insolvent banks. The compelling issue to both conservatives and liberals is not whether it is legitimate for government to confiscate one's property to give to another, the debate is over the disposition of the pillage.

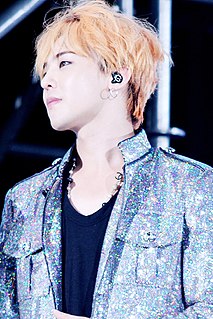

A young financial writer once brought ridicule upon himself by stating that a certain company had nothing to commend it except excellent earnings. Well, there are companies whose earnings are excellent but whose stocks I would never recommend. In selecting investments, I attach prime importance to the men behind them. I'd rather buy brains and character than earnings. Earnings can be good one year and poor the next. But if you put your money into securities run by men combining conspicuous brains and unimpeachable character, the likelihood is that the financial results will prove satisfactory.

After careful consideration, we have decided that for our next fiscal year, we'll issue guidance on comparable store used unit sales and on earnings per share only for the full fiscal year. We will no longer issue quarterly guidance. This decision reflects our continuing focus on longer-term store, sales, and earnings growth and on return on invested capital, and our recognition that the performance in shorter-term periods can be more volatile than over the longer term. As we report our quarterly results, we plan to comment on how our performance is tracking against our annual guidance.

If drugs were legalized in the US, the Mexican economy would collapse since the earnings from drugs bring in more hard currency than its largest licit source, oil sales. Mexico is a corrupt state that has now become dependent on the earnings on an illegal product. But inevitably, the product will become legal and then Mexico will retain its corruption but must face the needs of its citizens now employed by the drug industry who have become steeped in violence and conditioned to higher incomes.

I can remember the time when, if we wanted a house or housing, we relied on private enterprise. In fact, Americans built more square feet of housing per person than any other country on the face of the earth. Despite that remarkable accomplishment, more and more people are coming to believe that the only way we can have adequate housing is to use government to take the earnings from some and give these earnings, in the form of housing, to others.