Top 338 Euro Quotes & Sayings

Explore popular Euro quotes.

Last updated on November 21, 2024.

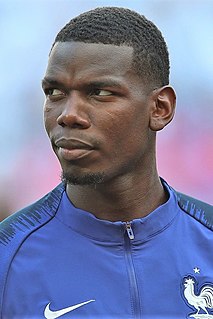

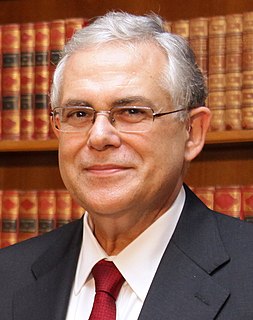

Businesses will only invest in Greece if three conditions are fulfilled. First, there must be a clear commitment to the euro. No businesses will invest if they have to fear that Greece will leave the euro zone at some point. Second, the Greek government must be prepared to work together with European institutions in order to restructure the country.

In China the largest denomination bill they have is 100 yen, and that's maybe $7. So here you have a whole economy working with only a $7 note as the largest denomination. The euro wants to get rid of the 500-euro bill just as the United States years ago got rid of the $1,000 bill because only the criminals used $1,000 bills.

Greeks have to know that they are not alone ... Those who are fighting for the survivor of Greece inside the Euro area are deeply harmed by the impression floating around in the Greek public opinion that Greece is a victim. Greece is a member of the EU and the euro. I want Greece to be a constructive member of the Union because the EU is also benefiting from Greece.

Europe is sort of like the Soviet Union in the '30s and '40s. There was an argument, is it reformable or not? There is a feeling, and I think it's correct, that the European Union, the eurozone, and the euro, is not reformable, as a result of the Lisbon treaties and the other treaties that have created the euro. Europe has to be taken apart in order to be put together not on a right-wing, neoliberal basis, but on a more social basis.

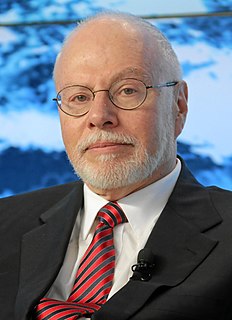

I'm not trying to be diplomatic. I'm trying to be more nuanced and realistic. I think there has to be a serious examination of the shortcomings of the Euro structure. Euro central institutions, whether it be fiscal policy, monetary policy, financial regulation, are simply not as robust as they are in a currency that has a national government behind it.

If you go back to the Euro campaign in 1999, how many chief executives and chairmen of FTSE 100 companies were speaking out on this? I think two. Two out of 200 people. Did that represent the reality of what businesses in Britain thought about the Euro? Of course it didn't. Did it represent what CBI members thought? Of course it didn't.

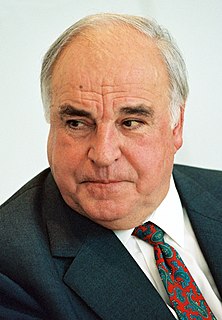

This is the joint responsibility of everyone who was involved in the introduction of the euro without understanding the consequences. When the euro was introduced, the regulators allowed banks to buy unlimited amounts of government bonds without setting aside any equity capital. And the European Central Bank discounted all government bonds on equal terms. So commercial banks found it advantageous to accumulate the bonds of the weaker countries to earn a few extra basis points.

If European monetary policy is run according to German interests, huge structural imbalances will accumulate. The Germans will then either have to pay to correct those imbalances or agree that the euro should not be run primarily according to German interests. If they are unwilling to do either of those things, the euro can't survive.

Italy may well be the main problem. It has benefited most from the euro by having been able to get the euro interest rate instead of what otherwise would have been its own. That would be much higher because Italy has been accumulating so much debt. In the past, Italy has inflated away its debt. The virtue of the euro is that Italy can't do it alone. A tight ECB policy wouldn't permit that to happen again.

Thanks to the euro, our pockets will soon hold solid evidence of a European identity. We need to build on this, and make the euro more than a currency and Europe more than a territory... In the next six months, we will talk a lot about political union, and rightly so. Political union is inseparable from economic union. Stronger growth and Euorpean integration are related issues. In both areas we will take concrete steps forward.

For a small open economy that trades mostly with the euro zone it makes absolute sense to be part of the currency union. Our currency has already pegged to the euro since 2002. We don't have an independent monetary policy. We are regulated by the European Central Bank in Frankfurt, but we are not able to reap all the profits. Our businesses want to save the transaction costs.

As Dutch, British and French explorers literally put this Great Southern Land on the map it would be ridiculous to say that modern day Australia is anything other than a grand - and successful - outpost of

Euro-colonialism and, more specifically Anglo-Celt British colonialism. It's a fact of life like the Euro-colonization of the Americas etc. If it was an outpost of, let's say, Iranian or Zimbabwean colonialism would so many people still be so desperately trying to get into Australia by any means necessary, legal or otherwise? It's doubtful. Thank the Gods for Euro-colonialism!

I don't want euro bonds that serve to mutualize the entire debt of the countries in the euro zone. That can only work in the longer-term. I want euro bonds to be used to finance targeted investments in future-oriented growth projects. It isn't the same thing. Let's call them 'project bonds' instead of euro bonds.