Top 1200 Financial Hardship Quotes & Sayings - Page 2

Explore popular Financial Hardship quotes.

Last updated on November 7, 2024.

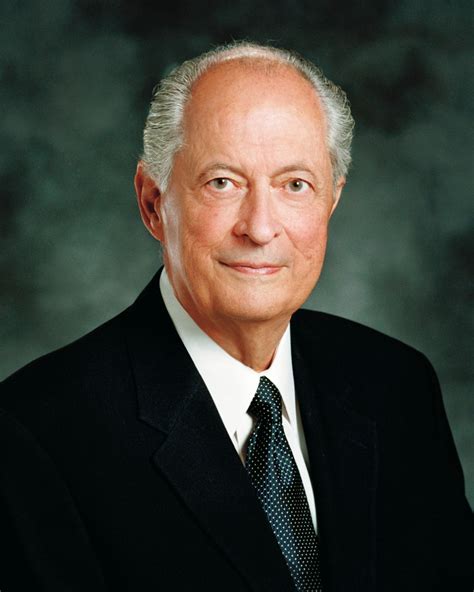

Does this mean we will always understand our challenges? Won't all of us, sometime, have reason to ask, 'O God, where art thou?' Yes! When a spouse dies, a companion will wonder. When financial hardship befalls a family, a father will ask. When children wander from the path, a mother and father will cry out in sorrow. Yes, 'weeping may endure for a night, but joy cometh in the morning.' Then, in the dawn of our increased faith and understanding, we arise and choose to wait upon the Lord, saying, 'Thy will be done.'

Financial literacy is not an end in itself, but a step-by-step process. It begins in childhood and continues throughout a person's life all the way to retirement. Instilling the financial-literacy message in children is especially important, because they will carry it for the rest of their lives. The results of the survey are very encouraging, and we want to do our part to make sure all children develop and strengthen their financial-literacy skills.

The most miserable man in the world of those meant for Paradise will be dipped once in Paradise. Then he will be asked, "Son of Adam, did you ever face any misery? Did you ever experience any hardship?" So he will say, "No, by God, O Lord! I never faced any misery, and I never experienced any hardship."

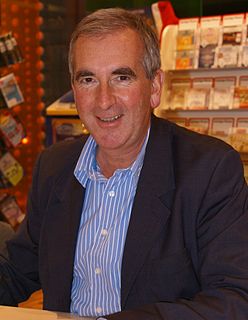

Anyone interested in the past, present, or future of banking and financial crises should read The Bankers' New Clothes. Admati and Hellwig provide a forceful and accessible analysis of the recent financial crisis and offer proposals to prevent future financial failures. While controversial, these proposals--whether you agree or disagree with them--will force you to think through the problems and solutions.

That's the problem with the financial sector. Banks and the financial sector live in the short run, not the long run. In principle the government is supposed to make regulations that help the economy over time. But once it's taken over by the financial sector, the government lives in the short run too.

FinCEN directs financial institutions to file suspicious activity reports (SARs) to inform law enforcement of certain types of cyber-enabled crime. As the agency charged with protecting the United States from financial crime, FinCEN's guidance does not deem financial institutions who process such transactions to be involved in a criminal activity.

We don't invest in financial literacy in a meaningful way. We should be teaching elementary school children how to balance a checkbook, how to do basic accounting, why it's important to pay your bills on time. First, education. Begin the learning process as early as possible, in elementary school. Second, encourage and support entrepreneurism. Third, policy. I know it's a priority of the US Treasury to augment financial inclusion and increase financial literacy.