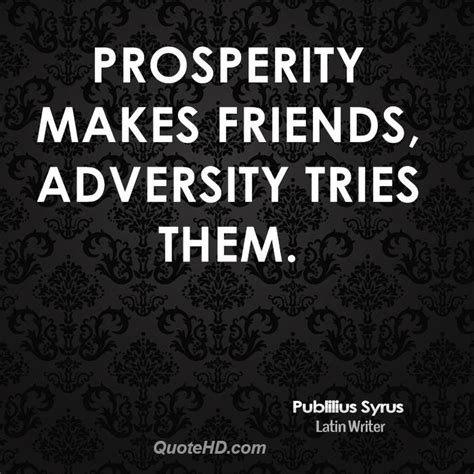

Top 1200 Financial Prosperity Quotes & Sayings - Page 6

Explore popular Financial Prosperity quotes.

Last updated on November 19, 2024.

Finance ministers and central bank governors have the seats at the table, not labor unions or labor ministers. Finance ministers and central bank governors are linked to financial communities in their countries, so they push policies that reflect the viewpoints and interests of the financial community and barely hear the voices of those who are the first victims of dictated policies.

In the immediate postwar era, financial crises in advanced countries were rare events, and before 1970 did not happen at all. Since then they have occurred more often, and 2008 was the most damaging of them all to date. If we have moved back to a regime of regular financial crises - like the one we had from the 1870s to the 1930s - then our economic future will be very different from our recent past.

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.

The generally accepted theory is that financial markets tend towards equilibrium, and...discount the future correctly. I operate using a different theory, according to which financial markets cannot possibly discount the future correctly because the do not merely discount the future; they help to shape it.

A rentier is an investor whose relationship to a company or enterprise is strictly limited to the ownership of financial wealth (such as stocks or bonds) and the receipt of income on that wealth (such as dividends or interest). The financial system performs dismally at its advertised task, that of efficiently directing society's savings towards their optimal investment pursuits. The system is stupefyingly expensive, gives terrible signals for the allocation of capital, and has surprisingly little to do with real investment.

The free enterprise concept inherent in the economic model of capitalism should mean common people, or lower and middle class wage-earners, have greater potential to rise up and gain financial independence. In reality, however, free enterprise all too often leads to an almost total lack of government regulation that in turn allows the global elite to run amuck in Gordon Gecko-style financial coups.

In terms of my profession, I'm passionate about financial literacy. I want to live in a financially literate society. I want kids to understand the importance of savings and investing. I want to try to replicate the great savers who came out of the Depression, the best savers the country has ever seen. It's crucial that people understand the importance of financial literacy, because it's actually life saving.

Happiness is yours in the here and now. The painful states of anxiety and loneliness are abolished permanently. Financial affairs are not financial problems. You are at ease with yourself. You are not at the mercy of unfulfilled cravings. Confusion is replaced with clarity. There is a relieving answer to every tormenting question. You possess a True Self. Something can be done about every unhappy condition. While living in the world you can be inwardly detached from its sorrows to live with personal peace and sanity.

The banks, because of mismanagement, because of huge risk taking, are now in very vulnerable positions. We can expect that we're gonna have to do more to shore up the financial system. We also are gonna have to make sure that we set up financial regulations so that not only does this never happen again, but you start having some sort of - trust in how the credit markets work again.

No one anticipates divorce when they're exchanging vows, and it can be devastating emotionally and financially. To ease the financial side of the blow, you need to maintain your financial identity in your relationship. That means having your own credit history - you need your own credit card - and your own savings and retirement accounts.

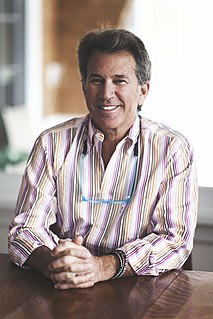

Kevin Freeman has been warning America’s leadership of the dangers of financial terrorism for the last three years. It is happening now and Kevin provides the evidence in his book Secret Weapon. Every American needs to understand how our financial markets have been manipulated by people who want to destroy the nation and how they can do even greater damage in the future. This book is a critical read for everyone.

A global financial cabal engineered a fraudulent housing and debt bubble [2008], illegally shifted vast amounts of capital out of the US; and used 'privatization' as a form of piracy - a pretext to move government assets to private investors at below-market prices and then shift private liabilities back to government at no cost to the private liability holder Clearly, there was a global financial coup d'etat underway.

But in the West today, we see a free world that has achieved a level of prosperity and well-being unprecedented in all human history. In the Communist world, we see failure, technological backwardness, declining standards of health, even want of the most basic kind - too little food. Even today, the Soviet Union still cannot feed itself. After these four decades, then, there stands before the entire world one great and inescapable conclusion: Freedom leads to prosperity. Freedom replaces the ancient hatreds among the nations with comity and peace. Freedom is the victor.

I think that today, more so than ever, corporate responsibility is the best strategic as well as financial path that most businesses can follow. For most businesses there are both compelling reasons to be responsible and compelling statistics that validate that responsible businesses do better according to traditional financial metrics. Of course, how you define "responsible" is somewhat of a conundrum.

As value investors, our business is to buy bargains that financial market theory says do not exist. We've delivered great returns to our clients for a quarter century-a dollar invested at inception in our largest fund is now worth over 94 dollars, a 20% net compound return. We have achieved this not by incurring high risk as financial theory would suggest, but by deliberately avoiding or hedging the risks that we identified.

Financial institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks-when one fails, they all fall. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur... I shiver at the thought.

At Travelers, we were much more opportunistic. It was very successful, but it wasn't an integrated financial services company. We had a property casualty company, a life company, a brokerage company. We were a financial conglomerate. It wasn't a unified, coordinated strategy of any sort. When it merged with Citi, that became a big issue; Citi, at that time, wasn't yet a fully integrated, coordinated company.

Financial innovation can be highly dangerous, though almost no one will tell you this. New financial products are typically created for sunny days and are almost never stress-tested for stormy weather. Securitization is an area that almost perfectly fits this description; markets for securitized assets such as subprime mortgages completely collapsed in 2008 and have not fully recovered. Ironically, the government is eager to restore the securitization markets back to their pre-collapse stature.