Top 1200 Financial Services Quotes & Sayings - Page 8

Explore popular Financial Services quotes.

Last updated on November 15, 2024.

As the worldly philosophers of the past affirmed, the goal of economics is to improve the way society functions. In The New Financial Order, Robert Shiller joins this proud tradition by directing his brilliant economic skills toward the creation of financial institutions designed to reduce the risks an unknown future visits on most members of our society and others. Shiller's imaginative and compelling analysis will appeal to all readers who share his passion for initiating not only a richer, but a better, century.

A global financial cabal engineered a fraudulent housing and debt bubble [2008], illegally shifted vast amounts of capital out of the US; and used 'privatization' as a form of piracy - a pretext to move government assets to private investors at below-market prices and then shift private liabilities back to government at no cost to the private liability holder Clearly, there was a global financial coup d'etat underway.

There really are two Americas, one for the grifter class and one for everybody else. In everybody-else land, the world of small businesses and wage-earning employees, the government is something to be avoided, an overwhelming, all-powerful entity whose attentions usually presage some kind of financial setback, if not complete ruin. In the grifter world, however, government is a slavish lapdog that the financial companies that will be the major players in this book use as a tool for making money.

The banks, because of mismanagement, because of huge risk taking, are now in very vulnerable positions. We can expect that we're gonna have to do more to shore up the financial system. We also are gonna have to make sure that we set up financial regulations so that not only does this never happen again, but you start having some sort of - trust in how the credit markets work again.

As value investors, our business is to buy bargains that financial market theory says do not exist. We've delivered great returns to our clients for a quarter century-a dollar invested at inception in our largest fund is now worth over 94 dollars, a 20% net compound return. We have achieved this not by incurring high risk as financial theory would suggest, but by deliberately avoiding or hedging the risks that we identified.

The essence of the this-time-is-different syndrome is...rooted in the firmly held belief that financial crises are things that happen to other people in other countries at other times; crises do not happen to us, here and now. We are doing things better, we are smarter, we have learned from past mistakes. The old rules of valuation no longer apply. Unfortunately, a highly leveraged economy can unwittingly be sitting with its back at the edge of a financial cliff for many years before chance and circumstance provoke a crisis of confidence that pushes it off.

In terms of my profession, I'm passionate about financial literacy. I want to live in a financially literate society. I want kids to understand the importance of savings and investing. I want to try to replicate the great savers who came out of the Depression, the best savers the country has ever seen. It's crucial that people understand the importance of financial literacy, because it's actually life saving.

In a system of capitalism, as people's wealth rises, the financial incentive to serve them rises. As their wealth falls, the financial incentive to serve them falls, until it becomes zero. We have to find a way to make the aspects of capitalism that serve wealthier people serve poorer people as well.

It is no exaggeration to say that rising inequality has driven many of the 99 percent into a financial ditch. It also helped spawn the housing bubble that gave us the financial crisis of 2008, the lingering effects of which have forced many OWS protesters to try to launch their careers in by far the most inhospitable labor market we've seen since the Great Depression. Even those recent graduates who manage to find jobs will suffer a lifelong penalty in reduced wages.

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.

It's really an interesting crazy world where like ultimately you have to work your ass off and sacrifice a lot in your life and the end goal is personal and financial gain. You know, it's not like you're doing anything helpful to the world. You're really just trying to get ahead and to beat out the next person and to be on top and at the very top of those financial firms, like the people that make the crazy amounts of money I mean that's what their after.

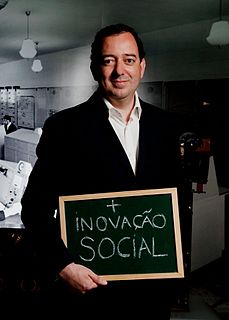

In the eighties and nineties, the innovation agenda was exclusively focused on enterprises. There was a time in which economic and social issues were seen as separate. Economy was producing wealth, society was spending. In the 21st century economy, this is not true anymore. Sectors like health, social services and education have a tendency to grow, in GDP percentage as well as in creating employment, whereas other industries are decreasing. In the long term, an innovation in social services or education will be as important as an innovation in the pharmaceutical or aerospatial industry.

In the immediate postwar era, financial crises in advanced countries were rare events, and before 1970 did not happen at all. Since then they have occurred more often, and 2008 was the most damaging of them all to date. If we have moved back to a regime of regular financial crises - like the one we had from the 1870s to the 1930s - then our economic future will be very different from our recent past.

I myself have participated in girl-on-girl shows for men that would ask for it, of which were very, very many. It is a popular request, especially at bachelor parties. It also paid a much higher dividend. Also when I worked the escort services, certain male/female clients would call and ask for a male/male team and the escort services that I worked for provided this specific request.

I love the fact that Satya Nadella's checked the checkbox for cross-platform for a number of our services. I still think it's very important to do the right kind of innovative integration across Windows and our hardware platforms with our cloud services. I think the company's doing a lot of good stuff. Real competition in AWS. Real competition in terms of the clients, particularly from a hardware perspective, there's also [competition] from Chrome. But all in all pretty good.

It's critical to level the playing field, to make prices and risks clear up front, so when someone signs on for a student loan or a mortgage or a credit card, they know the tricks and traps hidden in the fine print. That's why the Consumer Financial Protection Bureau has been working on a new financial aid shopping sheet. A shorter, two-page credit card agreement, a simpler mortgage disclosure form. All those are aimed toward helping people understand the basic bargain.

80% of all products and services that will be on the market in five years do not exist today. So therefore, always be innovative, always be creative, always think, 'What new products or services could I create, could I represent, could I joint venture?" Sometimes you can find someone else that has a fabulous product or service that you can use your existing business or resources to sell and you can double your income or sales in your business by selling somebody else's product to the same customers that are buying yours.

Finance ministers and central bank governors have the seats at the table, not labor unions or labor ministers. Finance ministers and central bank governors are linked to financial communities in their countries, so they push policies that reflect the viewpoints and interests of the financial community and barely hear the voices of those who are the first victims of dictated policies.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

Maybe [the Republicans] 'll find ways around it, but the financial system of the world depends very heavily on the credibility of the US Treasury Department. US Treasury securities are what's called "good as gold"; they're the basis of international finance, and if the government can't uphold them, if they become valueless, the effect on the international financial system could be quite severe. But in order to destroy a limited health-care law, the right-wing Republicans, the reactionary Republicans, are willing to do that.

The free enterprise concept inherent in the economic model of capitalism should mean common people, or lower and middle class wage-earners, have greater potential to rise up and gain financial independence. In reality, however, free enterprise all too often leads to an almost total lack of government regulation that in turn allows the global elite to run amuck in Gordon Gecko-style financial coups.

A rentier is an investor whose relationship to a company or enterprise is strictly limited to the ownership of financial wealth (such as stocks or bonds) and the receipt of income on that wealth (such as dividends or interest). The financial system performs dismally at its advertised task, that of efficiently directing society's savings towards their optimal investment pursuits. The system is stupefyingly expensive, gives terrible signals for the allocation of capital, and has surprisingly little to do with real investment.

One measure for promoting both stability and fairness across financial market segments is a small sales tax on all financial transactions - what has come to be known as a Robin Hood Tax. This tax would raise the costs of short-term speculative trading and therefore discourage speculation. At the same time, the tax will not discourage "patient" investors who intend to hold their assets for longer time periods, since, unlike the speculators, they will be trading infrequently.

Financial innovation can be highly dangerous, though almost no one will tell you this. New financial products are typically created for sunny days and are almost never stress-tested for stormy weather. Securitization is an area that almost perfectly fits this description; markets for securitized assets such as subprime mortgages completely collapsed in 2008 and have not fully recovered. Ironically, the government is eager to restore the securitization markets back to their pre-collapse stature.

Kevin Freeman has been warning America’s leadership of the dangers of financial terrorism for the last three years. It is happening now and Kevin provides the evidence in his book Secret Weapon. Every American needs to understand how our financial markets have been manipulated by people who want to destroy the nation and how they can do even greater damage in the future. This book is a critical read for everyone.

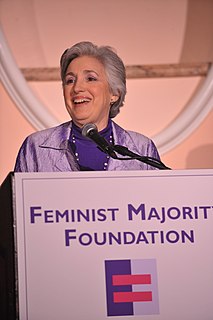

She [Carolyn Maloney] understands the whole picture. She is comfortable with these issues 'cause she is chair of the committee, and she's dogged and will make sure the average woman and man is represented as well as making sure that our financial system stays afloat. In other words, she gets it and she has represented the financial district, but she also represents the average person and definitely the average woman.