Top 1200 Fixed Income Quotes & Sayings - Page 5

Explore popular Fixed Income quotes.

Last updated on December 21, 2024.

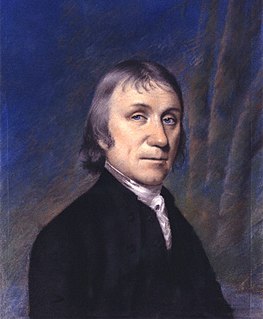

[The doctrine of air] I was led into in consequence of inhabiting a house adjoining to a public brewery, where I at first amused myself with making experiments on the fixed air [carbon dioxide] which I found ready made in the process of fermentation . When I removed from that house I was under the necessity of making the fixed air for myself; and one experiment leading to another, as I have distinctly and faithfully noted in my various publications on the subject, I by degrees contrived a convenient apparatus for the purpose, but of the cheapest kind.

Your profits are going to be cut down to a reasonably low level by taxation. Your income will be subject to higher taxes. Indeed in these days, when every available dollar should go to the war effort, I do not think that any American citizen should have a net income in excess of $25,000 per year after payment of taxes.

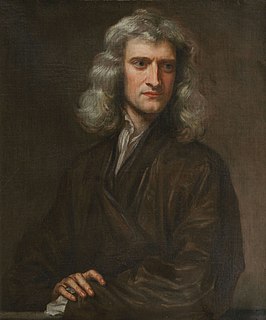

This most beautiful system of the sun, planets and comets could only proceed from the counsel and dominion of an intelligent and powerful Being. And if the fixed stars are the centres of other like systems, these, being formed by the like wise counsel, must be all subject to the dominion of One; especially since the light of the fixed stars is of the same nature with the light of the sun.

Residual income is passive income that comes in every month whether you show up or not. It’s when you no longer get paid on your personal efforts alone, but you get paid on the efforts of hundreds or even thousands of others and on the efforts of your money! It’s one of the keys to financial freedom and time freedom.

Any discuss about taxes ends up being, are you raising them or lowering them, as the opposed to the question I ask - are we raising them for high income individuals that can afford it, and lowering them for lower income people who really need help. Those old categories don't work, and they're preventing us from solving them problems.

All taxes, except a 'lump-sum tax,' introduce distortions in the economy. But no government can impose a lump-sum tax - the same amount for everyone regardless of their income or expenditures - because it would fall heaviest on those with less income, and it would grind the poor, who might be unable to pay it at all.

The Founding Fathers realized that "the power to tax is the power to destroy," which is why they did not give the Federal government the power to impose an income tax. Needless to say, the Founders would be horrified to know that Americans today give more than a third of their income to the Federal government.

In 2013 Citigroup had profits of $6.4 billion in the United States. They paid no federal income tax and, in fact, received a rebate from the IRS of $260 million. That same year J.P. Morgan had $17.2 billion in profits in the U.S. They also paid no federal income tax. Do you think it's time for tax reform?

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

Raising the minimum wage and lowering the barriers to union organization would carry a trade-off - higher unemployment. A better idea is to have the government subsidize low-wage employment. The earned-income tax credit for low-income workers - which has been the object of proposed cuts by both President Clinton and congressional Republicans - has been a positive step in this direction.

We got rich by violating one of the central tenets of economics: thou shall not sell off your capital and call it income. And yet over the past 40 years we have clear-cut the forests, fished rivers and oceans to the brink of extinction and siphoned oil from the earth as if it possessed an infinite supply. We've sold off our planet's natural capital and called it income. And now the earth, like the economy, is stripped.

You see, in our family we don't know whether we're coming or going - it's all my grandmother's fault. But, of course, the fault wasn't hers at all: it lay in language. Every language assumes a centrality, a fixed and settled point to go away from and come back to, and what my grandmother was looking for was a word for a journey which was not a coming or a going at all; a journey that was a search for precisely that fixed point which permits the proper use of verbs of movement.

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.

The idea that somehow "no self, no problem"- I don't exist because I don't have a self- would be a mistaken understanding. However, the selflessness teaching is not that hard to understand. What it means is a type of self that people feel they have, like a fixed, unchanging identity. Either they know they have it, or for some, they feel they need to seek it, and possibly have an experience where they feel like they found something. That type of fixed, unchanging, essential self, or absolute self doesn't exist. That's what "no self" means.

I guess you will have to go to jail. If that is the result of not understanding the Income Tax Law, I will meet you there. We shall have a merry, merry time, for all our friends will be there. It will be an intellectual center, for no one understands the Income Tax Law except persons who have not sufficient intelligence to understand the questions that arise under it.

What starting your company means: you will lose your stable income, your right to apply for a leave of absence, and your right to get a bonus. However, it also means your income will no longer be limited, you will use your time more effectively, and you will no longer need to beg for favours from people anymore.

If surface water can be compared with interest income, and non-renewable groundwater with capital, then much of the West was living mainly on interest income. California was milking interest and capital in about equal proportion. The plains states, however, were devouring capital as a gang of spendthrift heirs might squander a great capitalist's fortune.

Because U.K. artists aren't compensated when their music is played on U.S. radio stations, U.S. artists aren't compensated when their records are played on U.K. stations based on the fact that there's no reciprocity. If that income came in, our artists would be paying income taxes on it. So if we can get a lot of policy on the radar, that may have some positive influence.

Many people believe in eliminating gaps and eliminating poverty. They don't realize that in some sense those two things are antithetical. If you were to double everyone's income, or if everyone's income were doubled naturally over the course of time, then you would reduce poverty significantly but you would have also increased the gap.

You know, the elites always want to shame the poor - right? - and everyone else. I mean, the fact is, this economy is based on 70 percent of the people driving consumer demand. If people do not purchase goods and services, this economy will grind to recession. And that is why, if you are going to do a tax cut, it ought to really be aimed at low-income and middle-income people.

Those on the left who scream about income gaps choose to focus on the success of those at the top rather than the failures of those at the bottom. They conveniently ignore that liberals are the ones who have pushed the moral relativisim and welfare-state dependence that has destroyed black families over the last 60 years. And it is these same liberals who fight to keep low-income kids in failing public schools and fight efforts to get school choice.

To the engineer, all matter in the universe can be placed into one of two categories: (1) things that need to be fixed, and (2) things that will need to be fixed after you've had a few minutes to play with them. Skill without imagination is craftsmanship and gives us many useful objects such as wickerwork picnic baskets. Imagination without skill gives us modern art.

It is clear, then, that the idea of a fixed method, or of a fixed theory of rationality, rests on too naive a view of man and his social surroundings. To those who look at the rich material provided by history, and who are not intent on impoverishing it in order to please their lower instincts, their craving for intellectual security in the form of clarity, precision, "objectivity," "truth," it will become clear that there is only one principle that can be defended under all circumstances and in all stages of human development. It is the principle: anything goes.

We commonly say that the rich man can speak the truth, can afford honesty, can afford independence of opinion and action;--and that is the theory of nobility. But it is the rich man in a true sense, that is to say, not the man of large income and large expenditure, but solely the man whose outlay is less than his income and is steadily kept so.

The party should stand for a constantly wider diffusion of property. That is the greatest social and economic security that can come to free men. It makes free men. We want a nation of proprietors, not a state of collectivists. That is attained by creating a national wealth and income, not by destroying it. The income and estate taxes create an orderly movement to diffuse swollen fortunes more effectively than all the quacks.

For the three decades after WWII, incomes grew at about 3 percent a year for people up and down the income ladder, but since then most income growth has occurred among the top quintile. And among that group, most of the income growth has occurred among the top 5 percent. The pattern repeats itself all the way up. Most of the growth among the top 5 percent has been among the top 1 percent, and most of the growth among that group has been among the top one-tenth of one percent.

It is said if an organization listens to the complaint of a customer and the problem is fixed, the customer remains a loyal customer and tells approximately seven others about the experience. Conversely, if a person is ignored and the problem not fixed, that customer will not deal with that organization anymore and will tell approximately twenty other people about the negative experience.

Lies About Love We are all liars, because The truth of yesterday becomes a lie tomorrow, Whereas letters are fixed, and we live by the letter of truth. The love I feel for my friend, this year, is different from the love I felt last year. If it were not so, it would be a lie. Yet we reiterate love! love! love! as if it were a coin with fixed value instead of a flower that dies, and opens a different bud.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Most of the productivity gains appear to go to the top 1 percent. Most people don't have enough income and as a result, they borrow additional money by using their credit card and they fall into high debt. The result of the growing income gap is a slower growing GDP (too few people with money to spend) and a rising tide of indebtedness.

The solution for rising up kids in the income distributionlies is in creating better childhood environments for kids growing up, especially in low income families. And so what means such things like schools, the quality of neighborhoods. If you think about what's gone on in Baltimore, it's a place of tremendous concentrated poverty. People aren't really seeing a path forward and I think revitalizing places like that can have a huge impact, even in the face of globalization and changes in technology.

I doubt that Donald Trump would be happier... if he was a different person. But Trump is always telling people how great his life is and about all the great things that he's done, and that's also all about his income. And that's also what we found. If you ask people how their lives are going, as a whole, it seems they tend to point to income.

The final and best means of strengthening demand among consumers and business is to reduce the burden on private income and the deterrence to private initiative which are imposed by our present tax system, and this administration pledged itself last summer to an across-the-board, top-to-bottom cut in personal and corporate income taxes to be enacted and become effective in 1963.

The best tool today is longevity insurance - they call it income insurance. Most people know the value of life insurance. But what if you live? So instead of trying to guess one or the other, you plan for those 20 years and you get this income insurance. If you live beyond 85, you have money that's guaranteed for as long as you live in the form of an annuity.

To the engineer, all matter in the universe can be placed into one of two categories: (1) things that need to be fixed, and (2) things that will need to be fixed after you've had a few minutes to play with them. If there are no problems handily available, they will create their own problems. Normal people don't understand this concept; they believe that if it ain't broke, don't fix it. Engineers believe that if it ain't broke, it doesn't have enough features yet.

Donald Trump is a - the owner of a lot of real estate that he manages, he may well pay no income taxes. We know for a fact that he didn't pay any income taxes in 1978, 1979, 1984, 1992 and 1994. We know because of the reports of the New Jersey Casino Control Commission. We don't know about any year after that.

I promised to bring change to Washington. The underlying reason for the economic mess we're in has been building for years. It's a fundamental imbalance in which the top 1 percent now gets almost a quarter of all national income. We haven't seen income and wealth this concentrated since the late nineteen twenties, and we all know what happened then - the Great Depression. We'll never really get out of the gravitational pull of the Great Recession until we fix this basic problem.

The Foreign Office is a very important arm of the British state and I think Britain has a fantastic diplomatic service. We are the only country in the world spending 2% of our national income on defence and 0.7% of our national income on aid. We are the only country in the world doing both of those things.

Meeting writers is always so disappointing. I got over wanting to meet live writers quite a long time ago. There is this terrific book that has changed your life, and then you meet the author, and he has shifty eyes and funny shoes and he won't talk about anything except the injustice of the United States income tax structure toward people with fluctuating income, or how to breed Black Angus cows, or something.

By the standards of honest, if unorthodox, accounting, government workers don't pay taxes, but are paid out of taxes. In other words, they pay taxes out of money confiscated from taxpayers, who, in turn, pay taxes twice: on their own income and on the income of members of the bureaucracy. At the very least, this should disqualify state workers from voting.

One of the great mysteries of our current state of consciousness is how we can live in a world where absolutely nothing is fixed, and yet perceive a world of 'fixedness.' But once we start to see reality more as it is, we realize that nothing is permanent, so how could the future be fixed? How could we live in anything but a world of continual possibility? The realization allows us to feel more alive.

If the juices of the body were more chymically examined, especially by a naturalist, that knows the ways of making fixed bodies volatile, and volatile fixed, and knows the power of the open air in promoting the former of those operations; it is not improbable, that both many things relating to the nature of the humours, and to the ways of sweetening, actuating, and otherwise altering them, may be detected, and the importance of such discoveries may be discerned.

In those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States. Many American investors properly made use of this deferral in the conduct of their foreign investment.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.