Top 1200 Flat Tax Quotes & Sayings

Explore popular Flat Tax quotes.

Last updated on April 19, 2025.

From 2008 to 2016 all the growth in the American economy, all the growth in national income, was earned just by the wealthiest 5% of the population. So they got all the growth. 95% of the population didn't grow. If you can get a flat tax or other lower tax, as Trump is suggesting, then this richest 5% will be able to keep even more money. That means that the 95% will be even poorer than they were before, relative to the very top.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

If Congress were to pass a 'flat' tax, you'd simply pay a fixed percentage of your income, and you wouldn't have to fill out any complicated forms, and there would be no loopholes for politically connected groups, and normal people would actually understand the tax laws, and giant talking broccoli stalks would come around and mow your lawn for free, because Congress is NOT going to pass a flat tax, you pathetic fool.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

I'll give you a simple formula for straightening out the problems of the United States. First, you tax the churches. You take the tax off of capital gains and the tax off of savings. You decriminalize all and tax them same way as you do alcohol. You decriminalize . You make gambling legal. That will put the budget back on the road to recovery, and you'll have plenty of tax revenue coming in for all of your social programs, and to run the army.

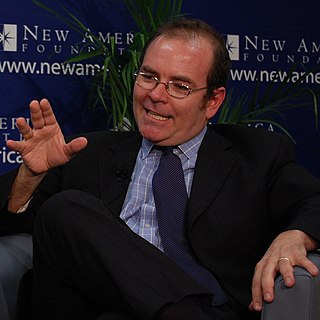

I guess it's like trying to put through the flat tax, which is probably my favorite one of all.... if we did pass it, all of a sudden, what do you have? You have the whole tax system run by a little old lady on a home computer, doing the work of all these thousands of bureaucrats and accountants. Passing that would be amazing, wouldn't it?

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

Having a background in doing printmaking and letterpress, I think that I became very interested in images that were flat and graphic. And my painting still today is very flat...American craft is like that too - the painting is very flat. And also the painting that you see on the storefronts, handmade signs, tend to be very flat. That's probably my biggest influence.

In 1994, Estonia became the first European country to adopt a flat tax, and its 26 percent flat tax dramatically energized what had been a faltering economy. Before adopting the flat tax, the Estonian economy was literally shrinking. In the eight years after 1994, Estonia experienced real economic growth - averaging 5.2 percent per year.

We also need to encourage Americans to become more fiscally responsible themselves. We can do this by redesigning our tax system into an expenditure tax with a single flat rate. ... We have to substantially reduce the size and scope of the federal government, fundamentally increase the role of the states in choosing their own practices, and bring decision-making closer to the people, not to unelected administrators. These steps are crucial to getting our nation on a path of fiscal, political and constitutional responsibility.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.