Top 39 Foreclosure Quotes & Sayings

Explore popular Foreclosure quotes.

Last updated on April 20, 2025.

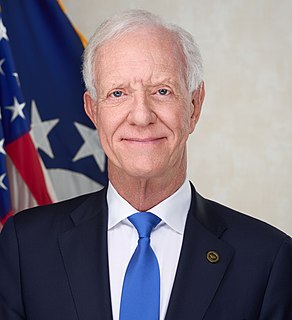

Having a plan enabled us to keep our hope alive. Perhaps in a similar fashion, people who are in their own personal crises - a pink slip, a foreclosure - can be reminded that no matter how dire the circumstance, or how little time you have to deal with it, further action is always possible. There's always a way out of even the tightest spot.

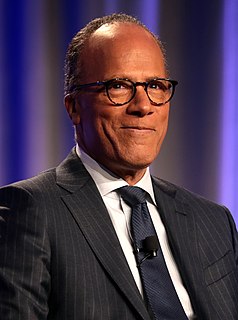

Poverty became something one could see and experience firsthand, no matter where one was on the economic ladder; it became something you could viscerally experience through the lives of friends, family, neighbors, colleagues. I'd venture to say it's a rare person in 2013 America who knows nobody who lost a job in the recession, or knows nobody whose home went underwater or who went into foreclosure.

UC Merced is the University of California's newest campus and lies among farm fields in the San Joaquin Valley, 2 1/2 hours east of San Francisco and not far from where I spent most of my childhood. It's a part of California that has suffered deeply from the recession with high unemployment and a skyrocketing home foreclosure rate.

Whether low-income people are dealing with access to veteran's benefits, or a protective order to guard against domestic violence, or a way to guard against the loss of their home due to foreclosure and unscrupulous behavior by mortgage providers, there's no way they can afford a lawyer. And that's a serious problem. Because that erodes respect for law, it erodes the prospects for justice.

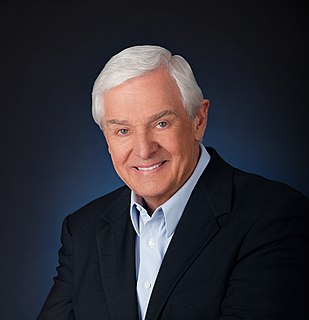

Many politicians and pundits claim that the credit crunch and high mortgage foreclosure rate is an example of market failure and want government to step in to bail out creditors and borrowers at the expense of taxpayers who prudently managed their affairs. These financial problems are not market failures but government failure. ... The credit crunch and foreclosure problems are failures of government policy.

It's time to pull the bandage off America's foreclosure problem. The economy is ready to emerge from its recent dark period, but to make it happen soon we need to speed the resolution of millions of troubled home loans. Six years have passed since the crisis began, yet instead of accelerating, foreclosures have slowed.

African Americans, in particular, saw their cumulative wealth crash. They used to have 10 cents on the dollar of the average white family. That 10 cents on the dollar that the African American family used to have crashed down to 5 cents on the dollar, given the focus of predatory lending on the African American community and the degree to which they were really devastated by the foreclosure crisis. So yeah, I think there is a lot of disappointment out there.