Top 268 Hedge Quotes & Sayings - Page 3

Explore popular Hedge quotes.

Last updated on April 21, 2025.

Hume's doctrine was that the circumstances vary, the amount of happiness does not; that the beggar cracking fleas in the sunshine under a hedge, and the duke rolling by in his chariot, the girl equipped for her first ball, and the orator returning triumphant from the debate, had different means, but the same quantity of pleasant excitement.

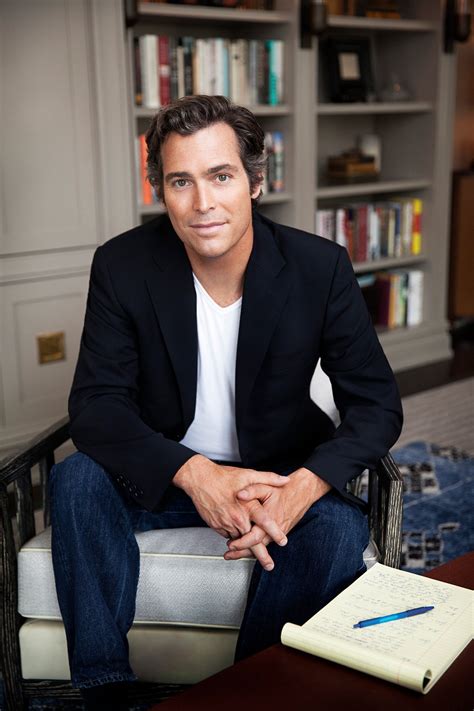

I found the hedge-fund guys I met all to be very, very concentrated listeners - watchful and articulate and quick to defend, if needed. They all seemed to have this contained sitting posture. The legs, if they weren't crossed at right angles, tended to be close over the knee, their hands put together.