Top 1200 High Prices Quotes & Sayings - Page 3

Explore popular High Prices quotes.

Last updated on December 22, 2024.

Exporting oil would not drive up prices at the pump. American drivers buy refined products, which the U.S. already exports. Many studies - from a range of institutions and government agencies, including the Congressional Budget Office and the Energy Information Administration - have shown that lifting the export ban could actually lower gas prices.

In the richest country in the history of the world, this Obama economy has crushed the middle class. Family income has fallen by $4,000, but health insurance premiums are higher, food prices are higher, utility bills are higher, and gasoline prices have doubled. Today more Americans wake up in poverty than ever before.

The mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful, it is an important element of the free-market system. The opportunity to charge monopoly prices - at least for a short period - is what attracts 'business acumen' in the first place; it induces risk taking that produces innovation and economic growth.

We've done price elasticity studies, and the answer is always that we should raise prices. We don't do that, because we believe -- and we have to take this as an article of faith -- that by keeping our prices very, very low, we earn trust with customers over time, and that that actually does maximize free cash flow over the long term.

The Reichswirtschaftsministerium ('Reich Ministry of Economic Affairs') tells the shop managers what and how to produce, at what prices and from whom to buy, at what prices and to whom to sell. It assigns every worker to his job and fixes his wages. It decrees to whom and on what terms the capitalists must entrust their funds. Market exchange is merely a sham.

Who can complain about the price that Google is charging you? Or who can complain about Amazon's prices; they are simply lower than the competition's. And that's why I think we need to shift back to a more Brandeisian conception of antitrust, where we consider values other than simply efficiency and low prices.

It's estimated that about 30 percent of the increase in grain prices could be attributed to the decision to embrace biofuels, particularly corn-based ethanol. It has done nothing for climate change and the business is in real trouble now with the collapse of oil prices. It's completely dependent on a dollar subsidy and tariff from the government.

Regulation has gone astray. . . . Either because they have become captives of regulated industries or captains of outmoded administrative agencies, regulators all too often encourage or approve unreasonably high prices, inadequate service, and anticompetitive behavior. The cost of this regulation is always passed on to the consumer. And that cost is astronomical.

The food shortages and high prices have certainly sparked the world media's attention, particularly since they're coming in such diverse places, being everywhere from Haiti, to Senegal, to Bangladesh, to Egypt - a range of countries. That sort of caught the media off guard, and serves the media's prurient interests insofar as "it bleeds, and so it leads".

Some argue that now isn't the time to push the green agenda - that all efforts should be on preventing a serious recession. That is a false choice. It fails to recognise that climate change and our carbon reliance is part of problem - high fuel prices and food shortages due to poor crop yields compound today's financial difficulties.

People are, by and large, quite poor at judging correct absolute values but are astute about determining relative values. Psychologists call this coherent arbitrariness, which suggests that individuals are coherent when they compare prices on a relative basis but arbitrary when those prices are considered versus fundamental value.

Women oftentimes are the ones making those economic decisions, sitting around the kitchen table and trying to figure out how to pay for rising gas prices or food prices or the health insurance costs. And I think that they see where they expect their leaders in Congress to also make those tough decisions.

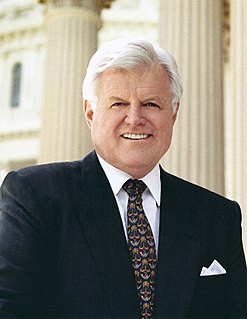

To tackle the prescription drug affordability crisis, we need to understand how high costs are directly impacting the people in our communities and in our neighborhoods - and we need to redouble our resolve to pass meaningful legislation that can lower prices and stimulate competition across the industry.

There is no doubt that the Fed's large-scale asset purchases have caused major increases in a number of asset prices in the economy. This is especially true of mortgage backed securities and corporate bonds, and quite possibly of equities as well. For those people and institutions holding those things, the run up in prices has been a wealth bonanza.