Top 1200 High Taxes Quotes & Sayings - Page 2

Explore popular High Taxes quotes.

Last updated on December 18, 2024.

The British use a system where the profits a corporation reports to shareholders is what they pay taxes on. Whereas in America we require corporations to keep two sets of books, one for shareholders and one for the IRS, and the IRS records are secret. For publicly-traded companies, the British system would tend to align the interests of the government with the interests of the company because the company wants to report the biggest possible profit. Though, all wealthy countries have high taxes as wealth requires lots of common goods, from clean water to public education to a justice system.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

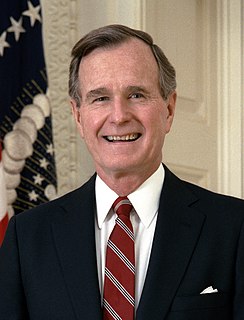

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

When a party can't think of anything else they always fall back on Lower Taxes. It has a magic sound to a voter, just like Fairyland is spoken of and dreamed of by all children. But no child has ever seen it; neither has any voter ever lived to see the day when his taxes were lowered. Presidents have been promising lower taxes since Washington crossed the Delaware by hand in a row boat. But our taxes have gotten bigger and their boats have gotten larger until now the President crosses the Delaware in his private yacht.

You could not possibly maintain the current level of government taxation without the taxes being hidden, and they are hidden in two very different ways. They are hidden through withholding, but they are also hidden by being imposed on business, supposedly on business, when really, of course, business can't pay taxes, only people can pay taxes.