Top 1200 High Taxes Quotes & Sayings - Page 3

Explore popular High Taxes quotes.

Last updated on April 19, 2025.

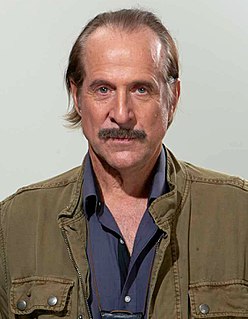

I thought you liberals cared about people, but here you're perfectly content to get them addicted to tobacco and make them pay taxes through the nose and continue to pay taxes through the nose and raise their taxes. And then you try to make 'em think you care about 'em by running PSAs telling them how they shouldn't smoke and how they should quit. You're exactly right. If they really cared, they would ban the product, but they can't, because the revenue from tobacco taxes - I'm not kidding you - funds children's health care programs, and a number of other things as well.

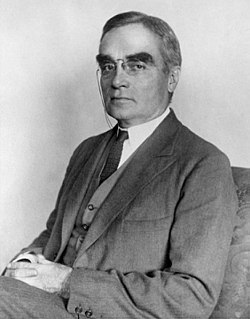

If duties are too high, they lessen the consumption; the collection is eluded; and the product to the treasury is not so great as when they are confined within proper and moderate bounds. This forms a complete barrier against any material oppression of the citizens by taxes of this class, and is itself a natural limitation of the power of imposing them.

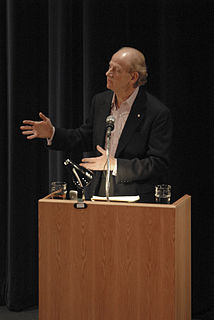

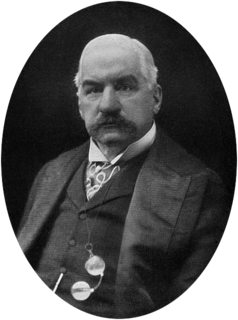

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.