Top 1200 High Taxes Quotes & Sayings - Page 4

Explore popular High Taxes quotes.

Last updated on December 18, 2024.

Escrow accounts are an important tool for homeowners to the reduce the risk of mortgage default on high-priced loans. Millions of Americans, including my wife and I, utilize these accounts to make monthly payments towards the annual financial obligations that come with homeownership like taxes and insurance.

One man should not be afraid of improving his posessions, lest they be taken away from him, or another deterred by high taxes from starting a new business. Rather, the Prince should be ready to reward men who want to do these things and those who endeavour in any way to increase the prosperity of their city or their state.

Your taxes are due a week from today. You can make out your check directly to Halliburton. Or you can do what I'm going to do. I'm filing my first joint return. No, I'm not getting married, I'm sending the IRS an actual joint with a note that says, 'If you think I'm paying for this war, you must be high.'

I came into politics partly because I want to be able to reduce taxes so that individuals have more of their money to spend, so that businesses have more of their money to create jobs, but I believe that lower taxes are sustainable when you get the public finances in order, so I will only make promises I can keep on taxation.

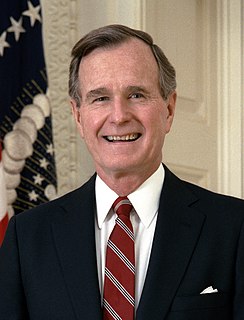

President Lyndon Johnson's administration was known for his War on Poverty. President Obama's will become notable for his War on Prosperity. We're speaking, of course, of Obama's plans to hike income taxes on the most wealthy 2 or 3 percent of the nation. He's not just raising the top rate to 39.6 percent; he's also disallowing about one-third of top earner's deductions, whether for state and local taxes, charitable contributions or mortgage interest. This is an effective hike in their taxes by an average of about 20 percent.

Would your reply possibly be this? Well, it all depends on what my tax rate will be on the gain you're saying we're going to make. If the taxes are too high, I would rather leave the money in my savings account, earning a quarter of 1 percent. Only in Grover Norquist's imagination does such a response exist.

'Green' cannot be allowed to become an excuse for stealth taxes. And nor should 'green taxes' be about punishment. Instead, they should represent a switch of emphasis. So if domestic flights are taxed, it should be on the absolute condition that the money is ploughed into improving the alternatives, such as trains.

A lot of people in the western world don't realize how much taxes limit their options. You can end up paying almost half your income in taxes, which basically means you're working for the government for 180 days a year. I think I can find better ways to use the money I make for the benefit of society.

It soared, a bird, it held its flight, a swift pure cry, soar silver orb it leaped serene, speeding, sustained, to come, don't spin it out too long long breath he breath long life, soaring high, high resplendent, aflame, crowned, high in the effulgence symbolistic, high, of the ethereal bosom, high, of the high vast irradiation everywhere all soaring all around about the all, the endlessnessnessness.

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.

We may be assured by past experience, that such a practice [as some states charging high taxes on goods from other states] would be introduced by future contrivances; and both by that and a common knowledge of human affairs, that it would nourish unceasing animosities, and not improbably terminate in serious interruptions of the public tranquility.

The continual whine of lamenting the burden of taxes, however successfully it may be practiced in mixed governments, is inconsistent with the sense and spirit of a republic. If taxes are necessary, they are of course advantageous, but if they require an apology, the apology itself implies an impeachment. Why, then, is man imposed upon, or why does he impose upon himself?

We owe more money than any Nation in the World, and we are LOWERING TAXES. When is the time to pay off a debt if it is not when you are doing well? You let a Politician return home from Washington and announce, 'Boys we lowered your taxes. We had to borrow the money to do it, but we did it.' Say, they would elect him for life.

Governments should end the extreme concentration of wealth in order to end poverty. This means tackling tax dodging but also increasing taxes on wealth and high incomes to ensure a more level playing field and generate the billions of dollars needed to invest in healthcare, education, and job creation.

The rich people are apparently leaving America. They're giving up their citizenship. These great lovers of America who made their money in this country-when you ask them to pay their fair share of taxes they run abroad. We have 19-year old kids who lost their lives in Iraq and Afghanistan defending this country. They went abroad. Not to escape taxes. They're working class kids who died in wars and now billionaires want to run abroad to avoid paying their fair share of taxes. What patriotism! What love of country!