Top 1200 High Taxes Quotes & Sayings - Page 6

Explore popular High Taxes quotes.

Last updated on December 18, 2024.

Where taxes are concerned, there are two clear-cut points of view. There are those who think they're too high and those who think they should be even higher because, after all, politicians spend our money far more wisely than we do. The obvious solution I'd propose is that the people in the first group would pay less and those in the second group would pay more. Lots more.

He [Donald Trump] said in the debate - he said, gosh, I'm being audited for two years. Then he said three years. Then he said maybe five years. Listen, if there's a problem in his taxes, the voters have a right to know, because come September, October, the general election, folks in the media are going to make a heyday about any problems in his taxes.

This is what class warfare looks like: The Business Roundtable - representing Goldman Sachs, Bank of America, JP Morgan Chase and others - has called on Congress to raise the eligibility age of Social Security and Medicare to 70, cut Social Security and veterans' COLAs, raise taxes on working families and cut taxes for the largest corporations in America.

In every major war we have fought in the 19th and 20th centuries. Americans have been asked to pay higher taxes - and nonessential programs have been cut - to support the military effort. Yet during this Iraq war, taxes have been lowered and domestic spending has climbed. In contrast to World War I, World War II, the Korean War and Vietnam, for most Americans this conflict has entailed no economic sacrifice. The only people really sacrificing for this war are the troops and their families.

Think, for a moment, about our educational ladder.

We've strengthened the steps lifting students from elementary school to junior high, and those from junior high to high school.

But, that critical step taking students from high school into adulthood is badly broken. And it can no longer support the weight it must bear.

The current U.S. and Eurozone depression isn't because of China. It's because of domestic debt deflation. Commodity prices and consumer spending are falling, mainly because consumers have to pay most of their wages to the FIRE sector for rent or mortgage payments, student loans, bank and credit card debt, plus over 15 percent FICA wage withholding for Social Security and Medicare actually, to enable the government to cut taxes on the higher income brackets, as well income and sales taxes.

The government in business may waste time and money without rendering service. In the end the public pays in taxes. The corporation cannot waste or it will fall. It cannot make unfair rulings or give high-handed, expensive service, for there are not enough people willing to accept inferior service to make a volume of business that will pay dividends.

I've said repeatedly publicly, and other members have, that until you adjust the eligibility for entitlements, do things like raising the age for Medicare for future beneficiaries. Not for those currently receiving or those about to receive. Have serious means testing for high income people. You know Warren Buffett's always complaining about not paying enough taxes. And what I'm complaining about is we're paying for his Medicare. We ought not to be providing these kinds of benefits for millionaires and billionaires.

They have passed the big inheritance tax, and that gets you when you are gone. You used to could die and be able to beat taxes, but not now. The undertaker don't go over your body as carefully as the assessor does your accumilated assets, and he gets his before the undertaker. They have it on these big fortunes now where they pay as high as 60 to 70 percent of what they leave. That's mighty expensive dying when it runs into money like that, and you won't see 'em dropping off as casually as they have been.

Donald Trump has broken his first promise [to release taxes]. Second he stood on this stage last week and when Hillary said you haven't been paying taxes, he said, that makes me smart. So it's smart not to pay for our military. It's smart not to pay for veterans, it's smart not to pay for teachers and I guess all of us who do pay for those things I guess we're stupid.

If the tea party folks would go out there and get angry because they think their taxes are too high, for God's sake, a lot of citizens ought to get angry about the fact that they're being killed and our planet's being injured by what's happening on a daily basis by the way we provide our power and our fuel and the old practices that we have. That's something worth getting angry about.

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business and invest it in tax-exempt securities or to find other lawful methods of avoiding the realization of taxable income. The result is that the sources of taxation are drying up; wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people.

Lower taxes will stimulate your own personal economy by leaving more money in your pocket to do what you want - invest, save, spend, buy a bigger house, a nicer car, and give to charity. And lower taxes also lead to more money for the government to use on those things they've promised you. It's a win-win for everyone.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

Your average person in Illinois doesn't really even know what workers' comp is. The average person doesn't know really what's going on in the pension system. They know their taxes are too high; they know we've got a deficit. But getting that message out and helping the people of Illinois really understand what's going on, that's hard.

High fidelity is a rich experience, and you'll put up with terrible convenience to get it - maybe it's high cost, waiting in line, jumping through hoops. High convenience is the opposite - it's a commodity, but it's cheap and easy and ubiquitous. A great exclusive boutique shop is high fidelity; Wal-Mart is high convenience. Both are hard to establish in their own way. The thing to remember about sustaining either is that you can't sit still. Some other entity will always find a way to challenge your fidelity position or your convenience position.

No matter what anyone may say about making the rich and the corporations pay the taxes, in the end they come out of the people who toil. It is your fellow workers who are ordered to work for the Government, every time an appropriation bill is passed. The people pay the expense of government, often many times over, in the increased cost of living. I want taxes to be less, that the people may have more.

The state of New York's got this group of people called smokers, and they know they're addicted, and despite all the efforts to make 'em quit, they know they can't. So they just see a pile of money when they see these people. And they think because they're addicted, they can't not buy the product, so they just keep raising taxes and raising taxes, and they expect people just to come up with the money from somewhere and pay it.

It was an easy thing to tax for a young country. And then gradually we moved to property taxes, manufacturing taxes, and the income tax was the answer to a populist demand: Let's go after the rich guys. We got into World War I, and they raised the rates and started taxing the rich. Then we got into World War II, and that's when they taxed everybody, because they just needed more revenue.

The most pernicious of his [Obama] proposals will be the massive Make Work Pay refundable tax credit. Dressed up as a tax cut, it will be a national welfare program, guaranteeing a majority of American households an annual check to 'refund' taxes they never paid. And it will eliminate the need for about 20% of American households to pay income taxes, lifting the proportion that need not do so to a majority of the voting population.

Taxes will eventually become a voluntary process, with the possible exception of real estate - the one physical thing that does not move easily and has computable value. The US has a jump-start on the practice, in that 65 percent of local school funds come from real estate taxes - a practice Europeans consider odd and ill advised. But wait until that's all there is left to tax, when the rest of the things we buy and sell come from everywhere, anywhere, and nowhere.

The median family of four ... paid $4,722 in federal taxes last year. That's enough to pay for a new curtain for the secretary of commerce's office, to bribe a farmer not to plant 38 acres with corn ... seven weeks of salary for a Customs man assigned to save us from the terror of high-quality, low priced foreign TV sets, or the subsidy on 6,000 bushels of wheat to prop up the Soviet regime. Surely civilization would collapse without such essential services.

The federal government, state governments will not do without that tax revenue from tobacco no matter what. I've always thought it was one of the most contradictory setups that we have, because everything said publicly about the product is intended to besmirch it, impugn it, and do the same thing to the people that use it. And yet here's the government scoring, I mean, you want to talk about obscene profits, the government doesn't do a damn thing but stick its hand in. The government taxes tobacco at every stage. It taxes tobacco when the farmer's thinking about planting it.

Say did you read in the papers about a bunch of Women up in British Columbia as a protest against high taxes, sit out in the open naked, and they wouldent put their clothes on? The authorities finally turned a Sprayer that you use on trees, on 'em. That may lead into quite a thing. Woman comes into the tax office nude, saying I won't pay. Well they can't search her and get anything. It sounds great. How far is it to British Columbia?

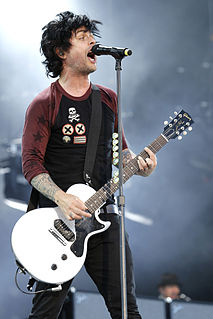

I'm making a lot of money. I should be paying a lot more taxes. I'm not paying taxes at a rate that is even close to what people were paying under Eisenhower. Do people think America wasn't ascendant and wasn't an upwardly mobile society under Eisenhower in the '50s? Nobody was looking at the country then and thinking to themselves, "We're taxing ourselves into oblivion." Yet there isn't a politician with balls enough to tell that truth because the whole system has been muddied by the rich. It's been purchased.

Ronald Reagan cut taxes to raise the deficit to stop liberals in future years from increasing spending. Obama will raise spending to raise the deficit to stop conservatives in future years from cutting taxes. As he funds every liberal dream - from alternative energy production to infrastructure renovation to more federal revenue sharing - he will force a massive expansion in the size of government for a decade to come.

...in terms of business mistakes that I've seen over a long lifetime, I would say that trying to minimize taxes too much is one of the great standard causes of really dumb mistakes. I see terrible mistakes from people being overly motivated by tax considerations. Warren and I personally don't drill oil wells. We pay our taxes. And we've done pretty well, so far. Anytime somebody offers you a tax shelter from here on in life, my advice would be don't buy it.

As more and more Americans own shares of stock, more and more Americans understand that taxing businesses is taxing them. Regulating businesses is taxing them. They ought to be thinking long-term about their ownership, not just their income, and that they should pay taxes on capital, as well as taxes on labor.

Here's another way of putting it. Roosevelt wants recovery to start at the bottom. In other words, by a system of high taxes, he wants business to help the little fellow to get started and get some work, and then pay business back by buying things when he's at work. Business says, 'Let everybody alone. Let business alone, and quit monkeying with us, and we'll get everything going for you, and if we prosper, naturally the worker will prosper.'