Top 1200 Home Equity Quotes & Sayings

Explore popular Home Equity quotes.

Last updated on April 14, 2025.

One of the wonderful things about the information highway is that virtual equity is far easier to achieve than real-world equity...We are all created equal in the virtual world and we can use this equality to help address some of the sociological problems that society has yet to solve in the physical world.

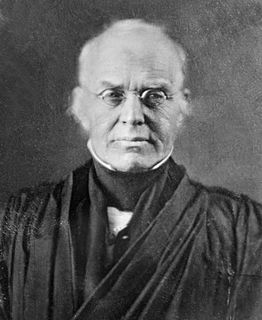

Equity is a roguish thing. For Law we have a measure, know what to trust to; Equity is according to the conscience of him that is Chancellor, and as that is larger or narrower, so is Equity. 'T is all one as if they should make the standard for the measure we call a "foot" a Chancellor's foot; what an uncertain measure would this be! One Chancellor has a long foot, another a short foot, a third an indifferent foot. 'T is the same thing in the Chancellor's conscience.

Even though some down payments are borrowed, it would take a large, and historically most unusual, fall in home prices to wipe out a significant part of home equity. Many of those who purchased their residence more than a year ago have equity buffers in their homes adequate to withstand any price decline other than a very deep one.

If you have money draining out of the public equity markets, that inevitably affects the private equity market. They cannot exist going in different directions because somehow that will rent the fabric of the universe. It's just not permitted that that happens. Obviously there can be anomalies for brief periods of time but it just can't happen forever.

We [US government] have used our taxpayer dollars not only to subsidize these banks but also to subsidize the creditors of those banks and the equity holders in those banks. We could have talked about forcing those investors to take some serious hits on their risky dealings. The idea that taxpayer dollars go in first rather than last - after the equity has been used up - is shocking.

Education makes us the human beings we are. It has major impacts on economic development, on social equity, gender equity. In all kinds of ways, our lives are transformed by education and security. Even if it had not one iota of effect [on] security, it would still remain in my judgment the biggest priority in the world.

Nobody in my generation ever started out in private equity. We got there by accident. There was no private equity business - actually, the word didn't even exist - when I started. I got there out of the purest of happenstance and so I think many people find what they really enjoy doing just in that way. So another piece of advice for you is: don't worry too much about what you're going to be doing when you get out of business school - life will come your way.

Home is a blueprint of memory...Finding home is crucial to the act of writing. Begin here. With what you know. With the tales you've told dozens of times...with the map you've already made in your heart. That's where the real home is: inside. If we carry that home with us all the time, we'll be able to take more risks. We can leave on wild excursions, knowing we'll return home.

Now, suppose that a homeowner puts down only 3% of their own money or 3.5% for the FHA. That means if prices go down by only 3%, the house will be in negative equity and it would pay the homeowner just to walk away and say, "The house now is worth less than the mortgage I owe. I think I'm just going to move out and buy a cheaper house." So it's very risky when you have only a 3% or 3.5% equity for the loan. The bank really isn't left with much cushion as collateral.

We weren't getting a fair deal on the budget and I wasn't going to have it. There's a great strand of equity and fairness in the British people - this is our characteristic. There's not a strand of equity and fairness in Europe - they're out to get as much as they can. That's one of those enormous differences. So I tackled it on that basis.

Most startup entrepreneurs unnecessarily spend half their time and give up half their equity in search of funding from angel investors and venture capitalists. Tens of millions of dollars are available to them for free from partners who not only don't want their equity, they don't even want to be paid back.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

I'm struck by the fact that by and large equity capital doesn't play a big role in new financing; it's either bonds or internal financing but not really equity. And therefore, it's not clear that anything which improves the equity markets has really much to do with the productivity of the economy as a whole.

I was doing this children's theater play, and it was non-Equity. We were out of town to do it at the Kennedy Center, and it was always kind of, 'Well, the producers may have to turn this into Equity,' and that's what happened. It was kind of a silly children's theater play, but that's how I got my card.

Being a good private equity investor is more complicated than it seems. I would say that there are a few characteristics that are important. If you look at the skill set that you need to ultimately be a successful private equity investor, at least at the senior level, you have to be, in this business, a good investor. You have to be able to help companies perform and you have to have judgment around exiting investments. If you look at the skill sets there, they include some things you can teach and some that you can't.

We judged that a sudden, disorderly failure of Bear would have brought with it unpredictable but severe consequences for the functioning of the broader financial system and the broader economy, with lower equity prices, further downward pressure on home values, and less access to credit for companies and households.